Machine Tool Orders Fall for Second Straight Month

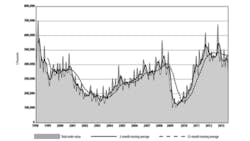

U.S. manufacturers ordered $351.21 million in machine tools and related equipment (“manufacturing technology”) during July, a 23.6% monthly decline from June, as well as a 23.6% year-on-year decline. It was the second consecutive monthly decline in new orders, and brings the total value of 2013 manufacturing technology orders to $2.925 billion, a decline of 7.2% compared to the seven-month total for 2012.

The decline was more decisive for orders of metal forming and fabricating equipment, which fell 82.5% from the June result. Orders for metal cutting equipment, which comprise a much larger component of the results as a whole, fell 15.3% from the previous month.

The data is included in the monthly United States Manufacturing Technology Orders (USMTO) report, compiled by AMT - The Association for Manufacturing Technology, and representing total production and distribution of machine tools and related technology, including nationwide and regional results. The figures are actual data, reported by participating producers and distributors of manufacturing technology.

“This muted order activity is not atypical for summer months, and is concurrent with other monthly readings that indicated a drop in durable goods orders and a flat industrial production index. Despite this seasonal dip, however, the bigger picture for manufacturing remains positive,” according to AMT president Douglas K. Woods.

“It’s important to note that in regional USMTO activity, the Northeast and West regions are at their highest average and year-to-date values in 15 years, thanks to the precision parts and aerospace industries. Meanwhile, the PMI (the Institute for Supply Management’s Purchasing Managers Index) posted its third consecutive monthly gain. We anticipate a continued pattern of modest but sustained growth through the end of 2013.”

Widespread Regional Declines

The regional gains noted by Woods were modest. In the Northeast, the July new orders rose 4.5% to $73.72 million, from $70.56 million in June, and up 9.7% from $67.18 million recorded during July 2012. The Northeast was the only one of six regions to post an improvement over comparable results. The year-to-date total for the Northeast is up 3.6% to $482.22 million versus $465.57 million recorded from January through July 2012.

In the Southeast region, manufacturing technology orders fell 34.7% to $34.95 million during July, from $53.53 million, and dropped 30.9% from $50.58 million posted for July 2012. The region’s year-to-date total is now $272.75 million, down 16.2% from the $272.75 million total for the first seen months of 2012.

New orders in the North Central-East fell 33.5%, from $123.56 million in June to $82.15 million in July. The latter figure is 25.0% less than the July 2012 result, $109.61 million. For the year to date, the NCE region has accumulated orders of $747.12 million, 7.3% less than the comparable period of 2012, $806.25 million.

The North Central-West region posted new orders of $57.30 million during July, down 32.5% from June’s $84.93 million, and down 27.6% from July 2012’s $79.10 million. With a seven-month total of $554.93 million, the region’s current year total is 3.0% less than $571.85 million, the result for January-July 2012.

Results from the South Central region include July orders totaling $58.05 million, which is 12.1% lower than June’s total, $66.04 million, and 14.9% lower than July 2012’s $68.23 million. The regional total for the first seven months of this year is $444.25 million, 21.1% lower than $563.22 million posted for the region during the comparable period of 2012.

Lastly, in the West, new orders fell 26.5% to $45.04 million during July, from $61.27 million during June. The new figure is 46.9% less than $61.27 million posted during July 2012.

This region’s year-to-date total is $423.85 million, which represents a 1.0% increase over the $419.73 million total recorded during the January-July 2012 period.