Demand-Driven Supply Chains Are In Demand

Analysts and supply chain practitioners have been discussing the concepts of a demand-driven supply chain (DDSC) for a decade. We have been working with our customers across many different industries, to help them realize these concepts. What is fascinating and revealing is how the core concepts are manifested in different ways depending on industry characteristics.

A Basic Definition

First, let’s get to a common definition of DDSC. The original impetus for DDSC was to understand the impact of latency and aggregation as information propagates up the supply chain from the source of demand to the suppliers, i.e., the bullwhip effect. Given typical supply lead times, suppliers generally produce enough to meet the demand forecast, which is only marginally accurate at the granular level at which inventory decisions (SKU/week) are made. However, as soon as it is known that the actual demand differs from the forecast, the supply levels need to be adjusted accordingly at each step of the supply chain. But due to the lag time between when the demand changes and when it is detected at various points along the supply chain, its effect is often amplified, leading to inventory shortages or excesses.

Companies tend to overcompensate by slowing down or speeding up production, which can cause inventory levels to fluctuate. This whipsaw effect is costly and inefficient for all participants.

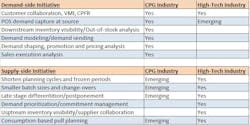

Several important supply chain concepts have emerged in order to mitigate the bullwhip effect. These concepts are collectively referred to as “demand driven supply chain” and can be organized in terms of “demand side” and supply side” initiatives.

Demand-side initiatives focus on better ways to capture the demand signal closer to the source, analyze the demand to sense the latest and most accurate demand signal, and shape the demand by executing and tracking promotional and pricing strategies to steer demand in line with business objectives.

Supply-side initiatives generally have to do with lessening reliance on the forecast, by becoming more agile with faster response, when actual demand is known.

All of these strategies are aspects of being demand-driven, but it is rare to see a company pursue all of them. In fact, we have come to understand that, depending on the characteristics of the market and industry, companies will emphasize different elements. In this article we will look at the consumer packaged goods (CPG) and high-technology industries to illustrate this point.

DDSC in Consumer Packaged Goods

CPG companies strive to achieve very high service levels—consumers typically do not wait if their preferred product is not on the shelf; they instead go elsewhere or choose a competitor’s product. Furthermore, CPG companies are typically not supply constrained—they determine what inventory levels they need, and they set capacity and/or prebuild stocks in order to have the required inventory. Therefore, it is not surprising that we see an emphasis in CPG on demand-side strategies, although this is starting to change.

Traditionally, CPG companies have forecast demand based on distribution center (DC) shipments to retailers/wholesalers. These processes mask actual consumer behavior, and add days if not weeks of latency to the information flow. There have been a number of initiatives that have been adopted by the industry to remedy this:

• The most common demand-side initiative, which has been in use for over two decades, is a customer collaboration replenishment strategy. This includes techniques such as vendor-managed inventory (VMI) and collaborative planning, forecasting and replenishment (CPFR). Such techniques allow CPG manufacturers to get closer to the demand signal by gaining visibility to retailer inventory, forecasts and shipments from DCs to stores. Such initiatives have and continue to deliver significant value in terms of reducing inventory and enhancing service.

• Over the past 10-20 years, CPG companies have started to go a step further. By tapping into point-of-sale (POS) data directly from the retailer, CPG companies can get clear visibility into actual demand, rather than using distribution center shipments as a proxy. Such clear visibility allows CPG manufacturers to see what consumers are actually buying, with minimum latency, allowing them to adjust their supply plans quickly and accurately.

• Furthermore, by modeling demand characteristics such as order volume over time, and correlations of what products sell together, CPG companies are able to understand demand patterns to enhance short term forecasts (demand sensing). In these demand sensing applications, the emphasis is on separating and analyzing both the normal demand flow, as well as any incremental promotional lift. Demand modeling also allows CPG manufacturers to work with retailers to optimize merchandising strategies

• Access to POS data is also used by CPG marketing teams to better understand the correlation between promotional strategies they deployed and resulting change in sales volume. These activities provide them the insights they need to increase the effectiveness of their promotions and pricing actions. Armed with actual impact on sales from promotional pricing, CPG companies are better equipped to deploy demand shaping strategies that work.

• Point-of-sale information capture also allows CPG companies to gain better visibility into where the downstream inventory is: at the retailer’s DC, in the store back room, or on the shelf, and allows them to infer out-of-stock conditions. Such information is not only useful as a real-time alert to trigger replenishment, but also allows them to collaborate with retailers in measuring and improving sales execution.

In CPG, on the supply side, the emphasis has been historically on fast and frequent replenishment processes, either based on VMI or using deployment algorithms leveraging the enhanced demand signals described above. Fast replenishment is especially critical during promotional periods, when out-of-stock situations not only result in lost sales, but in potential impact to customer loyalty.

Trends are now emerging which are putting further pressure on CPG manufacturers to adopt more advanced supply-side initiatives. In many markets, retailers are also optimizing their own supply networks and expecting more from CPG manufacturers. Penalties are imposed on manufacturers who do not meet fulfillment targets and these penalties have grown substantially across the industry. In many markets, CPG companies are receiving ever growing percentages of orders (via EDI) that require same-day shipment. Lastly, in certain CPG segments (such as cosmetics), high-margin products with short lifecycles are becoming more common.

To adapt to these trends, we are seeing CGP companies striving to speed up/postpone their planning and fulfillment processes, shorten lead times, wait longer to capture the same-day demand before pulling the replanning/replenishment trigger.

DDSC in High-Tech

While many high-tech companies (especially in consumer electronics) face some of the demand-side challenges described above, there are significant differences in the supply chain of these companies that leads to very different strategies for becoming demand-driven.

Many high-tech companies operate in a context of high market uncertainties due to short product lifecycles. Given these short lifecycles, such companies must be careful in building finished goods inventories, or face massive write-off costs. Often these supply chains strive to keep as much stock as possible as components or in a semi-finished product stage, and postpone final assembly. In many cases, critical components that go into the product are in short supply, requiring allocations.

Most often these components also have long lead time items from offshore suppliers. Furthermore, for many high-tech companies, demand originates from multiple channels, including retail, corporate/industrial and direct consumer. The combination of these issues makes DDSC dynamics different in the high-tech industry:

• Demand-driven strategies in the high-tech industry start with product design, where companies strive to use a common product platform in their engineering designs, so they can maximize the use of standard components and aggregate capacity. This strategy enables them to delay the final SKU configuration until the demand is better established.

• High-tech companies have made great strides in reducing the planning cycles and increasing planning frequencies to become more responsive. Given the demand volatility due to e-commerce models and continuous competitor leapfrogging, it is not uncommon to see weekly tactical (S&OP) planning cycles with daily and even sub-daily updates.

• With different go-to-market channels, demand-driven is not just about finished goods inventory. In many cases, high-tech companies implement build-to-order or configure-to-order strategies, where they forecast at the level of options or subassemblies that they require. This leads to collaborative planning processes, where the forecast is sent to suppliers and contract manufacturers for their commitment, and then a constrained plan is agreed-to and locked in.

• When the plan is constrained, companies are driven to allocate their supply to various demand channels and priorities in order to protect their strategic goals, and their key accounts. As a result, advanced demand prioritization methods are used to plan what demand will be fulfilled, and to enforce these allocation decisions as orders are received and fulfilled. In such scenarios, it is critical that once supply commitments are made, it is possible to re-plan to capture tomorrow’s demand, while still protecting the prior commitments for strategically important accounts. Such rules-based advanced commitment management processes are a central element of a high-tech demand-driven supply chain.

• Even though the supply chain plan is “locked in,” it must respond to demand changes. This is a key challenge in engineering the high-tech segment’s demand-driven supply chain. Hence, companies are implementing collaboration processes to achieve upstream visibility to material and capacity situations, and developing simulation-based what-if replanning scenarios (often called “shadow planning”) to be able to quickly determine if a plan change is feasible and desirable.

• Lastly, we are seeing some companies adopt the ultimate demand-driven supply initiative—consumption-based pull planning. In this scenario, inventory buffers are placed at critical points in the supply chain to decouple processes and minimize lead times, and supply actions (deployment, production and procurement) are triggered by consumption-based replenishment. This affords protection against demand uncertainty by only building to a replenishment signal, not to a forecast.

The chart below offers a summary of how CPG and high-tech companies are adopting demand-side and supply-side strategies for becoming demand-driven.

Key Technology and Operational Capabilities

In order to deploy the mechanisms listed above, whether demand-side or supply side initiatives, there are some key capabilities manufacturers need to implement to become more demand-driven:

Multi-tier connectivity and collaboration:Information is integral to implementing a DDSC, either downstream to distributors and retailers, and/or upstream to contract manufacturers and suppliers. Organizations need to coordinate the design, manufacturing and supply of complex and long lead-time end products within their supply chain network. Visibility into and collaboration with the extended supply network across multiple tiers is essential. CPG companies use such technology to access POS data from various retail customers, while high-tech companies can use it to share demand and supply plans within the extended supply chain.

Data timeliness and granularity: Most companies, who are trying to become demand-driven, need to collect and share data on demand and supply more frequently and increase the degree of data granularity they analyze. For example, supply-constrained high-tech manufacturers require visibility into finished goods and work-in-process inventory at plants, while CPG companies need visibility into SKU-level detail on items in stores, on warehouse shelves and in distribution centers.

Agility and flexibility:The classic elements of flexible manufacturing—such as short changeover times, access to temporary labor and external capacity, and the ability to produce small batches cost-effectively—make it easier to respond quickly to spikes and dips in demand, a key aspect of DDSC success. Agility is a key capability within the extended value chain.

Fast replanning and what-if analysis:With demand volatility, and more demand requiring same-day fulfillment, fast replanning and simulation are of growing importance in all industries. Increasingly, these models are extending upstream and downstream to trading partners to accomplish multi-tier replanning scenarios.

Alignment of metrics and incentives:The ultimate goal of being demand driven is to ensure the best service at the lowest cost. Hence, the performance metrics and incentives of all supply-chain players must be aligned so that everyone is marching in the same direction. The classic silo’ed supply chain organization, where manufacturing watches production economics, distribution monitors finished goods and service, logistics optimizes transportation costs, and procurement primarily evaluates landed material cost, is unlikely to achieve success. Leading demand-driven companies focus on the end-to-end process, and develop a balanced scorecard of metrics to achieve overall competitive advantage.

While the concept of demand-driven supply chains is relevant to all industries, the methods to get there can be quite different for different industries, with varying degrees of emphasis placed on demand-side and supply-side initiatives. Despite such a variation, there are many commonalities in the core IT and operational capabilities these companies need to develop.