Get to Know All Your Supply Chains

Do you understand all your customer value propositions, and the risks to each of them in your supply chain? Companies that perform better than their competitors—financially and operationally—know they have not one but many supply chains. In a diverse global market, each supply chain serves a different group of customers, and that’s why it’s necessary to identify, segment and manage risks accordingly. Companies that do this can prioritize their resources to protect the value they offer to their most profitable customers. As a result, they not only survive supply chain disruptions, but stand out from their competitors—even in the harshest of storms.

The Value of Knowing Your Value

This strategy works across industries. Take a technology company that sells high-end smartphones. The value proposition in this case is innovation and the ability to bring out new products before copycat ones appear. It’s difficult to predict what will hook customers, so the forecast risk is high. Price risk is also high, since there’s a great deal of competition in this market—another company might price its innovative new product lower. And finally, supply risk can be high, because overall demand on the supply base may exceed capacity. This creates risk throughout the supply chain; for example, the company’s suppliers could face demand swings and unanticipated competition for essential raw materials.

To protect its value proposition to customers, this company will do well by using flexible risk-sharing contracts with suppliers. If, however, the same company also sells standardized networking equipment to another group of customers, its value proposition to them would be based on cost. With lower forecast risk and price risk, it could manage its supply chain better by focusing on its inventory strategy.

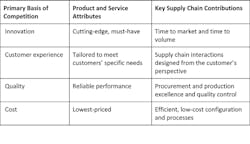

Different Types of Value Proposition

What do your customers value most from you? This table shows different customer value propositions and their link to the supply chain.

Today’s companies have multiple brands and operate in several segments. That means, in effect, you have several different value propositions—and several supply chains. For each proposition, you need to look at the risks in its supply chain that could adversely affect your ability to deliver the value your customers expect.

Many companies, even those with relatively mature supply chain capabilities (for example, more collaborative relationships with their suppliers and flexibility to respond to changes in the value chain), haven’t taken the next steps in assessing the risks to their different value propositions.

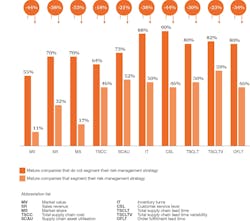

Our recent PwC-MIT survey found that more than 40% of companies with mature supply chain capabilities don’t take a risk-segmentation approach. Those that do, however, are rewarded. After a disruption to their supply chain, only 32% of risk-segmenters had a significant fall in sales revenue, compared with 70% of non-segmenters.

The Payoff from Risk Segmentation

Your Supply Chain is a Strategic Asset

No company can avoid disruptions. In the same survey, 70% of global companies had suffered three or more disruptions in the last year. What matters is whether you emerge from disruptions advantaged or disadvantaged compared with your competitors. And, more than any other factor, it’s your supply chain that determines this.

Most supply chains today are designed to minimize cost. As a result, your supply chain has probably expanded geographically, extending to more countries in order to take advantage of lower labor costs away from your home markets. But this pursuit of efficiency has also increased your risk—which brings new costs, albeit hidden ones.

For example, many companies reward purchasing agents solely on the basis of unit purchase price. A standard way to minimize this price is by using a single supplier who can keep costs down by doing long production runs. But if this supplier is hit by a strike or goes bankrupt, your own company’s viability could be threatened. Thus, inadvertently, you have taken on a great deal of risk in exchange for short-term cost savings.

Ask yourself these questions:

- Is your supply chain segmented to offer multiple customer value propositions?

- Have you mapped your supply chain to understand all the associated risk profiles?

- What’s the risk-adjusted cost of supplying each product you offer?

- Are you developing capabilities tailored to mitigate risks in every segment?

Map All of Your Supply Chains

So, how do you begin to segment your supply chain, relate it to your customer value propositions, and find the risks in it? A good place to start is mapping your entire supply chain. Begin with the customer, and work backwards. Look at how the product reaches them, where it enters the country, how it’s shipped, where it’s assembled and where the raw materials come from. Collecting and understanding these details shines a light on the real risks in your supply chain.

By doing this, you’re likely to find that some of the decisions you made to achieve efficiencies don’t factor in the risk they pose to your customer value proposition. For example, you might have a single global sourcing center in Asia to minimize costs, including your tax bill. But that means there’s concentration risk: an earthquake there would bring your whole supply chain to a standstill. Taking that risk into account would mean building in redundancy or shadow technology.

And that’s only the beginning. You also need to know precise details for each element of the supply chain. For example, it’s not enough to know that your products are manufactured in China—where is each factory precisely? You also need to know where your competitors’ factories are located, so you can see potential risks to your industry, too.

Then, there’s transportation. Do you know whom you’re competing with for service providers, such as shipping lines? A spike in customer demand for a large competitor’s products could fill up the ship’s containers, leaving you stranded at the port. Or consider what might happen when your products arrive at their destination port. Could the unionized labor go on strike? You need to have all this information and ask yourself how you would respond to various risks.

Such details about your entire network matter. And when it comes to your suppliers, it would be a mistake to treat them all in the same way. Some supply easily-replaced commodities like packaging materials, while others may contribute to your intellectual property. That’s why it's important to categorize your suppliers as strategic (essential to your future), tactical (difficult but not impossible to replace), or transactional (easy to replace). Note that transactional suppliers are typically around two-thirds of a company’s entire supply base. Costs and terms are especially important here.

Once you’ve mapped out your supply chain, consider a risk-adjusted pricing model, which will give you a reasonable estimate of your total costs, including supply chain risk. The risk-adjusted price reflects not just the aggregate cost of the goods, but also the cost of the relationship with the supplier and of the governance required to monitor that supplier’s risks. This allows you to ensure that the risks you’re assuming are proportionate to the cost of replacing the supplier.

Going a step further, a cutting-edge approach uses sophisticated analytics to model a company’s supply chains and monitor real-time information to spot issues and enable proactive response. Imagine the power of simulating the effects of a natural disaster, labor unrest, or a supplier bankruptcy, and then visualizing optimal adaptations. Technological advances are putting this capability within reach today.

Consider Your Performance Management Systems

Top-down or bottom-up? Companies sometimes struggle with this question. Individual business units’ incentives often encourage them to pursue short-term economic benefits rather than long-term strategic gains. One way to overcome this is to get senior management involved and take a command-and-control approach. The COO could, for example, mandate dual sourcing—buying each product from two suppliers. A more sustainable approach, however, is to take a long, hard look at your performance management systems and adjust incentives accordingly.

One company found that its product divisions were often transporting some products by air and having them reconfigured at regional distribution centers to match customers’ orders. This happened because its standard shipping method was by sea, to keep costs low, which didn’t match the needs of its customers, who valued innovation. The extra cost of transporting by air and reconfiguring weren’t taken into account in the product margins by which the divisions were judged and rewarded. The result was that the company’s focus on minimizing costs, together with its performance management systems, were keeping costs and risks unnecessarily high. Finding this out allowed the company to take action, boosting profits.

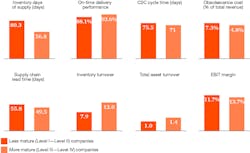

Better Performance on Every Measure

The results of work in this area are felt far beyond the supply chain. Our survey found that companies with mature supply chain and risk management processes have, as you’d expect, a greater proportion of on-time deliveries than other companies (93.6% compared with 88.1%). But they also perform better on every other measure, financially as well as operationally—including a higher total asset turnover ratio (1.4 compared with 1.0) and a higher EBIT margin (13.7% compared with 11.7%).

A segmented risk strategy can have a significant impact on your performance. The first step is to stop thinking that you only have one supply chain. From there, you’re on the path to weathering and thriving, no matter what comes next. A segmented risk approach means you and your suppliers will continue to give your customers what they value most.

Glen Goldbach is a U.S. Advisory director with PwC, focused on complex supply chain issues. Costas Vassiliadis is a senior manager with PwC Advisory Netherlands, focused on supply chain optimization.