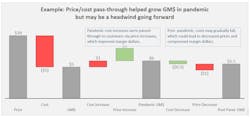

In December 2023, the Producer Price monthly index fell slightly, continuing the trend of modest and historically typical price fluctuations observed since mid-2022. This stands in stark contrast to the frequent and substantial increases experienced from May 2020 to March 2022, a period marked by high inflation that allowed many manufacturers and distributors to push through frequent, large price hikes during the pandemic.

As inflation subsides, will the need for price reductions emerge? Could lower inflation translate to diminished gross margin dollars (GM$)?

Customers who endured double-digit price hikes or went without essential goods and services may now expect price reductions from suppliers. As inflation decreases, should you be poised to slash prices, beginning a dreaded cycle of margin compression? Instead of speculating, let's analyze the data to see where we stand and chart a path forward.

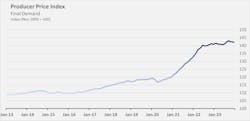

Producer Price Index

The PPI monthly chart shows whether prices are going up or down. If a month is above the 0% line, prices increased. If it is below, then prices decreased. Since December of 2022, there have been five months where the PPI was negative, indicating that goods and services became a bit cheaper. This can signal the end of the period of big inflation that started in the early days of the pandemic.

Let’s pull back and consider the broader context. From 2013 onwards, in 69.7% of months, prices went up from the previous month, while 24.2% saw a decrease, and 6.1% stayed the same. In simpler terms, prices have generally gone up slowly over time, which aligns with the Federal Reserve's goal of maintaining low and steady inflation. In this time frame, there were 10 occasions with consecutive monthly price drops compared to 21 instances of consecutive monthly increases. This suggests that it's more probable for overall prices to keep rising rather than go down.

Historical data indicates that inflation is most likely to see a mix of monthly increases and decreases rather than a freefall in price, so I recommend taking a wait-and-see approach before acting unless your hand is forced. Going forward, the PPI might hover near zero, suggesting minimal changes in price. If inflation is flat, why preemptively write down your prices and crush your margins?

Given the volatility of month-to-month data, it’s helpful to review the data 12-month percent change (i.e. year-over-year price change) because the volatility is smoothed, and trends are easier to detect.

Prices jumped significantly beginning in early 2020, with the YoY increase reaching its peak in March 2022 (+11.7%). Since the peak, the rate of price increase has slowed. To be clear, prices are still increasing overall (+1.0% in December 2023 vs. December 2022), but at a slower rate.

When taken together, we have not yet seen true deflation on an aggregate level, although this 12-month view is inherently a lagging indicator and could eventually catch up with the one-month view presented earlier. Time will tell if deflation happens, so companies must maintain line-of-sight to changes in input costs, the PPI and the overall market so they can react accordingly.

To avoid any rash decisions, it's crucial to recognize that inflation-led price increases are already baked in and won't quickly reverse, if they ever do. Since 2020, prices have risen by approximately 19.3% on an overall scale. Achieving pre-pandemic price levels would require a sustained series of price decreases. For a clearer perspective, I've provided an index view of the PPI Final Demand data.

Now we can revisit the two questions asked at the outset: Is it time for manufacturers and distributors to slash prices? Is the long-awaited margin compression reckoning upon us?

After examining the data, it appears that manufacturers and distributors are not in immediate danger but should tread carefully. Overall inflation has slowed but is not yet deflationary. Deflation would require margin-crushing price decreases, which are not yet necessary. There is no need to panic, but it’s time to begin preparations for a quick reversal.

5 Actions to Take If You Need to Lower Prices

Dr. Tim Smith, an instructor at DePaul University Graduate School of Business and a renowned pricing expert, says it best: “I can price only as well as the stupidest competitor.” All the data in the world won’t help you if customers demand price relief and competitors provide it. If it’s time to lower prices, keep the following thoughts in mind to avoid being drawn into a price war.

1. Employ the “rocket and feather” model. Push cost increases through immediately, but delay decreases. On the way up, protect your margins. On the way down, pocket the difference between your higher price and newly lower cost, even if the gap is temporary. While you temporarily delay customer price decrease, seek lower prices from your suppliers. That way, you are ahead of the game and have improved costs in place when price reductions need to be honored.

2. Understand your competitors’ pricing. If you hear rumors that competitors are lowering prices, do your homework to verify. Which SKUs or product groups are being changed? By how much? If the breadth is narrow or the reduction is minimal, then perhaps a response is not needed. However, if the reduction is large enough to warrant a response, then employ targeted decreases rather than across-the-board cuts.

3. Conduct business that can’t be copied. Consider the maturity of the industry and how your competitors may respond. Ideally a price decrease can be positioned as an economic moat that can’t be easily copied. For example, lower prices can be driven by expanded inventory, investment in logistics, or greater efficiency, rather than a simple “cost down, price down” story.

4. Engage in a tactical retreat. Select a handful of non-core but high-visibility products, reduce prices on those items and proactively let your customers know that you are working hard to deliver great products at an improved price. The marketing halo provided by the decrease should more than make up for the revenue and margin lost from the lower prices of non-core SKUs.

5. Don’t compete on price. Finally, attempt to compete on anything other than price. What other value can you bring to the table? Can you offer faster shipping, a competitive bundle or a new service that will further differentiate you from the competition and take the emphasis off price?

Ultimately, businesses must adapt to market pressures, which can quickly shift. Forward-thinking companies must be proactive. Have a plan for how to respond to competitor price decreases, and act decisively when the time is right. Otherwise, risk being left in the dust by a market that is evolving faster than you are.

Dan Cakora is a Pricing Economist and Business Consultant with Vendavo, a SaaS market leader in B2B pricing, selling and rebate solutions.

About the Author

Dan Cakora

Pricing Economist, Vendavo

Dan Cakora is a pricing economist and business consultant with vendavo, a SaaS market leader in B2B pricing, selling and rebate solutions. Dan has worked in various aspects of pricing for over 15 years. He started his career as a field economist, responsible for helping to measure inflation for the federal government. Before joining the Vendavo team, Dan was a customer at a large, international B2B distributor. He has led pricing teams, developed pricing and sales enablement products, and has a passion for data visualization. Dan has an MBA from DePaul University and a BS in economics from Purdue University.