US Chemical Export Outlook: Expected to Soar as Shale Strengthens Industry

As Zacks noted in a recent research note, the U.S. chemical industry is “in the process of gradual healing after being badly shaken by the Great Recession.” The healing continued in February, when the most recent Chemical Activity Barometer, published by the American Chemistry Council, showed a 0.4% increase. Year over year, the CAB is 5.0% higher than in February 2016.

Not only was there improvement in all the production indicators but exports of chemicals were also on the increase. Given that the CAB is considered a leading indicator for the U.S. economy, the council said it “continues to hint at gains in U.S. business activity through the third quarter.”

Last fall, Moody’s Investors Service raised its outlook for the North American and EMEA chemicals industry to stable from negative. The agency said earnings are likely to rise through next year as the industry benefits from cost-cutting and acquisitions, as well as from global economic growth.

"The upward outlook revision for the North American and EMEA chemicals industry is based on diminished global macro risks, the still-strong performance of diversified and specialty chemical companies, and the apparent bottoming of several commodity chemicals," says Moody's analyst, Joseph Princiotta. "Diversified and specialty producers should continue to see above-average earnings, while most other chemicals companies will post at least breakeven results over the next few months."

U.S. chemical production was off by 0.4% in 2016, according to the Federal Reserve. The American Chemistry Council expects chemical production, excluding pharmaceuticals, to grow 3.6% this year and 4.8% in 2018. Kevin Swift, ACC’s chief economist, said “affordable and abundant supplies of natural gas” will continue to offset “significant headwinds, including an overall drop in business investment, a rebalancing in the oil and gas sector, soft export markets and a high dollar.”

According to the ACC, output gains in 2016 were led by agricultural chemicals, coatings and other specialties, as well as bulk petrochemicals and organics and plastic resins, all areas aided by renewed competitiveness arising from shale gas. Advances in manufacturing and exports during 2017 and beyond will drive increased demand for basic chemicals and improving manufacturing activity is expected to support growth for most specialty segments.

Of course, the chemical industry is a hugely important sector for the U.S. economy. According to government data, the industry has more than 10,000 firms that produce more than 70,000 products. In 2015, the U.S. chemical industry had sales of nearly $800 billion and directly employed more than 810,000 workers. It also supports more than 2.6 million workers in its supply chain. By 2020, ACC projects, the industry will have sales of more than $1 trillion.

Exports Fueled by Shale Revolution

In 2015, the chemical manufacturing sector had $184 billion in exports, accounting for 14% of all U.S. exports. According to the ACC, chemical industry exports are expected to increase an average of 7% through 2021.

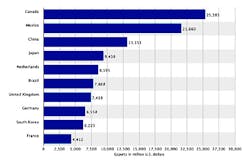

Top Destinations for US Chemical Exports in 2015 ( in millions)

What is driving export growth for the chemicals industry? Among the factors are the energy revolution in the U.S., with shale gas playing a critical role. Exports of chemicals linked to shale gas are projected to reach $123 billion by 2030, notes ACC, more than double the total in 2014. That will drive the trade surplus from these chemicals to increase from $19.5 billion to $48.3 billion by 2030.

Companies are investing in facilities that will add more than 100 million metric tons (MMT) of new capacity to the U.S. chemical industry by 2025, according to research from IHS. “Much of that new capacity will be converted to plastics, significantly increasing the U.S. net export position for these materials,” IHS states.

U.S. facilities will be increasing production of ethylene, propylene, methanol, ammonia and their derivatives, such as plastics and fertilizer, IHS noted. This domestic fertilizer production will replace imports from South America, the Black Sea and the Middle East. The U.S. shale gas impact on liquid bulk chemicals is “less pronounced than for solids but still significant,” the firm states in its report, IHS Chemical U.S. Bulk Chemical Export Expansion Analysis.

Recent production additions have resulted in a 10 million metric ton (MMT) increase in bulk liquid chemicals in the last year, and by 2025, U.S. bulk liquid chemical additions will expand by more than 25 MMT, IHS Chemical said. The most notable bulk liquid chemical additions will be in methanol.

“Chemical producers are clearly looking to take advantage of continued low natural gas prices in the U.S., which is enabling the significant expansion of these methane-based projects,” said Chris Geisler, director, chemical consulting at IHS Chemical and author of the analysis. “With so many projects coming online, this phenomenal growth is changing the global trade landscape. Currently, the U.S. is a major importer of methanol, but by 2018, the U.S. will be a major net exporter of methanol, which is a significant shift for the U.S. industry.”

IHS says the vast majority of new olefin chemical production will be converted to solid plastic resins and exported. With the exceptions of the ammonia and fertilizer production chains, it says, the vast majority of expansion will be centered in Texas and Louisiana.

“Solid fertilizer and plastics trade will change substantially in the U.S., as well as bulk liquids trade for products such as caustic soda, methanol and ethylene glycol,” IHS’s Geisler said. “This capacity expansion means there will be significant uptick in chemical trade activity and logistics considerations for not only producers and traders, but also the key ports, terminals and logistics providers, primarily on the Texas and Louisiana Gulf Coast.”

“As these chemical products expand, we expect to see increased marine, rail and truck traffic, primarily in the U.S. Gulf Coast, but possibly later, that activity will expand to several of the East and West Coast ports and terminals,” said Geisler.

With more than 275 new chemical production projects announced since 2010 with a total value of more than $170 billion, ACC’s Swift says, “The United States remains the place for chemical companies to invest.” Capital spending in the industry surged 21.0% in 2015, reaching nearly $44 billion, and accounting for more than one-half of total construction spending by the manufacturing sector.

By 2021, ACC forecasts, capital spending will reach $70 billion, contributing to four consecutive years of job growth in the industry.

About the Author

Steve Minter

Steve Minter, Executive Editor

Focus: Leadership, Global Economy, Energy

Call: 216-931-9281

Follow on Twitter: @SgMinterIW

An award-winning editor, Executive Editor Steve Minter covers leadership, global economic and trade issues and energy, tackling subject matter ranging from CEO profiles and leadership theories to economic trends and energy policy. As well, he supervises content development for editorial products including the magazine, IndustryWeek.com, research and information products, and conferences.

Before joining the IW staff, Steve was publisher and editorial director of Penton Media’s EHS Today, where he was instrumental in the development of the Champions of Safety and America’s Safest Companies recognition programs.

Steve received his B.A. in English from Oberlin College. He is married and has two adult children.