Special Report: Manufacturing in China: Taming the Dragon

The first thing you need to know about Chinese manufacturers is the first thing they want you to know -- they take product quality very seriously. Any hint or suggestion that the "Made in China" label is synonymous with inferior products is met with a prompt, and sometimes extreme, response.

When U.S. toy company Mattel Inc. recalled 21 million of its toys and dolls, the immediate culprit appeared to be one of its Chinese suppliers that sprayed excessive amounts of lead paint on some toys (See "How to Avoid a Costly Recall"). The executive of that company ended up committing suicide, an act that apparently is not uncommon among disgraced Chinese officials. U.S. consumers were understandably outraged to think that their children could have been exposed to hazardous levels of lead paint. It seemed possible, at least for a moment, that the U.S. government might insist that Mattel move its factories back stateside, where it would be easier to monitor their production.

| See Also |

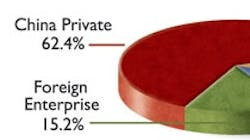

According to a recent study conducted by the Deloitte Global Manufacturing Industry Group, 59% of the U.S. companies surveyed have operations in China, but as we've learned from the Mattel example, those "operations" are being managed under quite different conditions, with much different goals, than are typical in the United States. To get a better idea of exactly what manufacturing processes are like in China, IndustryWeek partnered with the Manufacturing Performance Institute (MPI) to develop a study that reveals the current state of manufacturing in China.

As the charts on the following pages illustrate, Chinese manufacturers have set themselves the objective of achieving high quality with their products, but it's a fact that China's "low-cost" reputation is one that'll probably stick for quite some time, with hourly wages for production workers well under a dollar (while typical U.S. workers earn over $15 an hour).

In line with China's push toward high quality, the country's predominant improvement methodology is total quality management, with more than 80% of respondents saying they use TQM to measure their performance. Lean manufacturing, on the other hand, is more of a rumor than a fact of life throughout Chinese plants, with just 25% of respondents pursuing lean initiatives. In terms of strategic practices, the Chinese focus above all else on customer satisfaction surveys (nearly 60%), whereas U.S. manufacturers most typically pursue continuous improvement practices (nearly 77%).

The relative youth of most Chinese manufacturing facilities (56.8% of China's plants are less than 10 years old, compared with 9.4% for U.S. factories) is perhaps also borne out in the overall lack of progress toward world-class manufacturing status. According to the study, 53.8% of China's manufacturers have made "no progress" at all toward world-class, compared with only 12.8% for U.S. companies. As the core strategy of many U.S. manufacturers is to ensure that their products adhere to international quality standards, while still enjoying the benefits of China's low-cost labor force, it becomes a matter of considerable importance to ensure that productivity goes hand in hand with solid management practices (see "Five Practical Strategies for Building a Chinese Workforce").

How to Get It Right in China

Taking all the above into consideration, then, what should U.S. companies be doing in order to "tame the dragon" so to speak, and become globally competitive with -- rather than merely reliant on -- Chinese manufacturers? Jimmy Hexter and Jonathan Woetzel, two China-based directors of McKinsey & Company and authors of Operation China (Harvard Business School Press, 2007), suggest that successful companies focus on getting four things done very well:

- "They systematically identify all the relevant stakeholders, at various levels of government, who may have a role to play (by influencing regulation or making decisions) in the company's various business areas in China."

- They closely monitor and study the agendas of these individual leaders and governmental bodies.

- Then, "best-practice multinational companies in China take a good hard look at how they can adjust plans to align with these multiple agendas in order to create a balanced approach across parties."

- As the final step, "they develop systematic processes and clear organizational structures (with accountability baked-in) to get all this done and to manage critical relationships on an ongoing basis -- a capability for learning and for continuing to improve upon what has been built."

While China is often pointed to as emblematic of everything that's gone wrong with U.S. manufacturing, there's no escaping the reality that the sheer size of the Chinese market makes it an almost irresistible opportunity for growth. In fact, China bought more than $55 billion worth of U.S. goods in 2006. Product quality issues and intellectual property protection are two very real concerns for U.S. manufacturers, but by closely studying both China's culture and its manufacturing initiatives, U.S. companies are finding that the rewards can be worth the risks.

Methodology

The IW/MPI China Manufacturing Study 2007 was designed to collect operational and business metrics and practices at manufacturing facilities within China. In July 2007 at the direction of MPI, BNC Resources Co. Ltd. contacted approximately 950 plants throughout China and across major industries, requesting their participation in the study, which consisted of a four-page questionnaire with more than 100 questions. BNC Resources is based in Beijing and conducts industrial research, including supplier audits. There were 402 facilities that confidentially responded by fax, mail or via an in-person interview; facilities were ISO 9001 certified or in the process of certification or recertification to ISO 9001:2000. Details on how to obtain a complete summary of survey results are available from the Manufacturing Performance Institute (MPI) at www.mpi-group.net.

Charts and Tables

How Low Can They Go?

The perception that China is a low-cost source of labor is in fact a reality, with median hourly wages of production workers still well under a dollar.

| China | U.S. | |

| Median Hourly Wage ($US) | $0.53 | $15 |

| Median Starting Hourly Wage ($US) | $0.43 | $11 |

When asked to name the top three objectives describing their market strategy, both Chinese and U.S. manufacturers ranked "high quality" the highest. However, the similarities end there. Not surprisingly, "low cost" is No. 2 for the Chinese, while U.S. companies see "service and support" as their second-most important objective.

| Chinese Manufacturers | |

| High Quality | 83.3% |

| Low Cost | 56.6% |

| Innovation | 53.9% |

| Service and Support | 28.2% |

| Fast Delivery | 23.9% |

| U.S. Manufacturers | |

| High Quality | 73.7% |

| Service and Support | 55.8% |

| Total Value | 41.2% |

| Fast Delivery | 32.0% |

| Customization | 26.6% |

| (multiple responses allowed) | |

While lean manufacturing is the predominant improvement methodology of choice in the U.S., Chinese manufacturers are focused primarily on TQM, with lean coming in a distant second.

| Total Quality Management | 81.7% |

| Lean Manufacturing | 25.1% |

| Agile Manufacturing | 19.3% |

| Theory of Constraints | 7.8% |

| Toyota Production System | 6.3% |

| Six Sigma | 3.0% |

| Other | 3.5% |

| None | 11.0% |

| (multiple responses allowed) | |

| Age | China | U.S. |

| Less than 5 years | 21.9% | 4.0% |

| 5 to 10 years | 34.9% | 5.4% |

| 11 to 20 years | 25.4% | 19.1% |

| More than 20 years | 17.8% | 71.6% |

| China | U.S. | |

| Customer Satisfaction Surveys | 59.6% | 51.4% |

| Quality Certifications (e.g., ISO) | 54.6% | 55.9% |

| Continuous Improvement | 47.4% | 76.9% |

| Total Productive Maintenance | 40.2% | 34.2% |

| Environmental Management | 33.9% | 43.6% |

| Open-Book Management | 24.9% | 16.0% |

| Kaizen Events/Blitzes | 19.5% | 45.5% |

| Recycling/Reuse Programs | 16.5% | 56.1% |

| Value Stream Mapping | 9.2% | 45.5% |

| (multiple responses allowed) | ||

| China | U.S. | |

| No Progress | 53.8% | 12.8% |

| Some Progress | 37.3% | 61.1% |

| Significant Progress | 7.0% | 24.2% |

| Fully Achieved | 2.0% | 1.9% |

See Also

About the Author

Dave Blanchard

Senior Director of Content

Focus: Supply Chain

Call: (941) 208-4370

Follow on Twitter @SupplyChainDave

During his career Dave Blanchard has led the editorial management of many of Endeavor Business Media's best-known brands, including IndustryWeek, EHS Today, Material Handling & Logistics, Logistics Today, Supply Chain Technology News, and Business Finance. He also serves as senior content director of the annual Safety Leadership Conference. With over 30 years of B2B media experience, Dave literally wrote the book on supply chain management, Supply Chain Management Best Practices (John Wiley & Sons, 2010), which has been translated into several languages and is currently in its second edition. He is a frequent speaker and moderator at major trade shows and conferences, and has won numerous awards for writing and editing. He is a voting member of the jury of the Logistics Hall of Fame, and is a graduate of Northern Illinois University.