CEOs Need a Game Plan as US Elections Approach

2024 was expected to be a year of highly consequential elections globally, and it certainly hasn’t disappointed. Only midway through the year, voter preferences have already been far more volatile and unpredictable than even seasoned political scientists expected, creating uncertainty in both election outcomes and government continuity.

In Europe, the political center held, barely, in the EU parliamentary elections, despite significant far-right gains. In France, President Emmanuel Macron unexpectedly called snap elections, only to see the populist National Rally initially take a large lead in the first round but fall back again to third place in the second round. Similarly, British Prime Minister Rishi Sunak also called a surprise election, which helped put Labour back in government after a lengthy 14-year absence. Meanwhile, in the Netherlands, an unexpected triumph of the far-right was followed by an unstable, EU-skeptic coalition government.

Elsewhere, Indian Prime Minister Narendra Modi won re-election, as expected, but by a far smaller margin than anticipated. South Africa’s ANC wasn’t so fortunate, losing its majority for the first time. And in Taiwan, the surprise for many Western pundits was the measured reaction of the Chinese government to the victory by the independence-leaning DPP candidate, Lai Ching-te.

U.S. Elections in the Wings

Now the focus shifts to the most consequential election of all – the United States presidential race. Here too, volatility and uncertainty reign, as dramatically demonstrated in recent weeks. President Biden’s disastrous debate performance created turmoil and uncertainty, climaxing in his decision to exit the race.

Where Do Union Endorsements Stand in the Race for President?

The United Auto Workers union endorsed President Joe Biden for re-election last February, as state primaries were still wrapping up. Now that Biden, who joined auto workers on the picket line last September, has announced he is no longer running, will the UAW endorse Harris?

That’s not decided yet—although the current UAW leadership stated yesterday it is definitely not endorsing Trump.

“Joe Biden made history by joining us on our picket line last September and has stood shoulder to shoulder with the working class throughout his term in office. Vice President Kamala Harris walked the picket line with us in 2019, and along with President Biden has brought work and jobs back to communities like Lordstown, Ohio, and Belvidere, Illinois,” said the UAW statement. “That’s the legacy President Biden leaves, and that’s the work we will continue to build on as a union. While Donald Trump lies about rebuilding the auto industry, the fact is that while he was in office, autoworkers in Lordstown were left for dead by GM in 2019 while he said and did nothing.

“The path forward is clear: we will defeat Donald Trump and his billionaire agenda and elect a champion for the working class to the highest office in this country.”

The International Brotherhood of Electrical Workers endorsed Harris on Monday. “Vice President Harris has been a proven ally of the IBEW,” IBEW President Kenneth W. Cooper said in a statement. “Working by President Biden’s side, she cast the deciding vote to save our pensions. Their administration created good union jobs through the Bipartisan Infrastructure Law, the American Rescue Act, the Inflation Reduction Act and the CHIPS and Science Act.”

The 1.3-million-member Teamsters union has not yet endorsed a candidate and was considering not backing one last week when Biden was still in the running, according to a Reuters article. Teamsters President Sean O’Brian was a speaker at the Republican National Convention last week.

--Laura Putre

The felony conviction and other legal developments surrounding former President Trump, the selection of J.D. Vance as the Republican VP nominee and, of course, the attempted assassination have generated further turmoil. It is difficult to predict how the election and its aftermath will unfold.

In the face of such uncertainty, it is tempting for C-Suite executives to proceed with current strategies and plans, and merely wait to see what the outcome will be. However, such passiveness would be a significant error, as different election outcomes will have profoundly different effects on most industries and businesses.

Instead, companies should urgently analyze U.S. election scenarios to avoid potentially costly errors and give executives more time to mitigate risks and prepare for opportunities.

Election Scenarios

To avoid getting lost in detail and complexity, the scenarios should focus on plausible election outcomes. Currently, there is dwindling uncertainty about who will be the Democratic candidate, with Kamala Harris the overwhelming favorite, yet the nomination won’t be locked in until the Democratic convention in August. So we will consider the outcomes that the next President could be Kamala Harris, another Democrat, or Trump. Republicans could control none, one, or both of the House and Senate.

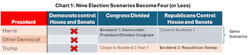

On the surface, there appear to be nine election outcome scenarios to analyze – a daunting level of complexity.

However, two pragmatic assumptions reduce that number to four plausible scenarios (Chart 1):

- While the identity of the Democratic nominee certainly affects the likelihood of the Democrats winning the presidency and Congress, there will be no major differences in policy implications on the Democratic side no matter who the nominee is.

- The likelihood of Democrats controlling both House and Senate, particularly with a “working” majority, seems very small, and so those scenarios can be ignored, at least for now.

Plausible Scenarios

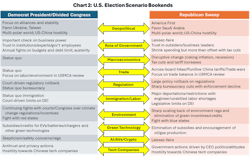

Companies should begin by focusing on the two "bookend" scenarios: a Democratic President with a Divided Congress and a Republican Sweep (Chart 2). Not only are these the two most plausible scenarios, but they also identify the most critical risks and promising opportunities. If the company is prepared for both of these bookends, it will be prepared for all four plausible scenarios.

While the Democratic President/Divided Congress scenario may resemble the current state of play in Washington, there are some important differences. Recent Supreme Court rulings have been quite skeptical about regulatory authority and discretion and racial preferences. Consequently, the next few years are likely to see a significant rollback on regulatory constraints on business and the ability to consider race in hiring and promotions, even under a Democratic administration.

Red states would continue to challenge regulations and other federal policies, provoking court fights. Additionally, Republicans in Congress have moved further to the right and are less willing to compromise. As in 2011 and 2023, there would be bitter fights over budgets and debt limits in this scenario, but these conflicts are less likely to be easily resolved, with higher likelihoods of government shutdowns, defaults and more fiscal austerity.

The differences between the Democratic President/Divided Congress and the Republican Sweep scenarios are stark, with important implications for every business. The chances of a Republican Sweep are substantial. Pre-Harris, Nate Silver estimated the chances of a Trump win at 75%, while Decision Desk HQ estimated the chance of Republicans controlling the House at 65% and the Republicans controlling the Senate at 82%. The three probabilities are highly correlated and the Republican forecast has improved since the debate. Every business should be prepared for a Republican Sweep scenario, as almost every aspect of the U.S. government’s impact on business would differ from the status quo (Chart 2).

Particularly impactful would be changes in trade policy, reinforced by geopolitical shifts. The immediate direct effect would be a reduction in U.S. imports from outside North America, particularly China, as tariff increases go into effect.

Correspondingly, there would be export reductions due to retaliation. The long-term unwinding of global supply chains would continue due to their increased risk and lower profitability, perpetuating the shifts seen in recent years from conflicts, trade wars, industrial policies, and COVID-19. Pricing and market share opportunities would open for domestic producers. These disruptions would heighten the chances of inflation and a global recession.

A Republican Sweep scenario would likely reduce, or even eliminate, subsidies and credits for green technologies—including EVs, batteries, and chargers—as part of a broader effort to remove environmental constraints on businesses and consumers. Additional regulatory rollbacks are anticipated, with proposed deep cuts to the federal bureaucracy, affecting regulatory enforcement.

A Trump Administration would engage in conflicts with blue states over environmental, safety, racial and other policies, including California’s authority to set its own emissions rules. Anti-immigration initiatives are designed to increase wages for low-income Americans and create opportunities for American-born engineers. Emerging technologies such as AI, autonomous vehicles and cryptocurrencies would face fewer regulations, influencing the digital and transportation transformations significantly.

The Democratic President/Republicans Control Congress scenario closely mirrors the Democratic President/Divided Congress scenario in terms of policy implications. Republicans would be unable to override Presidential vetoes, so controversial bills would still face significant obstacles to becoming law. Annual conflicts over the debt limit and budget would become even more challenging to resolve, and courts would continue to influence regulatory outcomes.

The Trump/Divided Congress scenario differs markedly from a Republican Sweep. In a Republican Sweep, legislation, spending, and tax changes would align with the agenda of Trump and his advisers, with a notable chance of Republican overreach leading to a backlash in 2026, similar to the one that affected Democrats in 2010. However, trade, immigration, and many regulatory changes would be under Trump Administration control regardless of Congressional backing. Other aspects of this scenario would likely fall between the Republican Sweep and the Democratic President/Divided Congress scenarios.

Business Implications

What should C-Suite executives do with these election scenarios? Some implications are clear:

- A Republican Sweep would severely disrupt global trade in 2025 and increase costs for imports, particularly from China. Companies should consider increasing inventories of imported goods and parts and might also accelerate exports, even if they end up in warehouses, particularly to China, before any potential retaliation.

- Companies should reexamine their global supply chains in light of heightened risks. While “friend-shoring” is a potential strategy, it comes with its own risks, particularly with the USMCA up for review in July 2026. Contingency plans for potential border disruptions could help mitigate these risks.

- Companies should analyze the impact of tariffs on their competitors to identify opportunities for pricing and market share increases.

- Companies should analyze regulations that adversely affect them and prepare arguments and lobbying strategies to change them in the Republican Sweep scenario.

- Companies should cultivate relationships with influential Republicans and their advisers to prepare for the high possibility of a Republican Sweep.

- Companies should aggressively avoid the political spotlight.

However, the impact of the differences in election scenarios varies not just by industry but also by company, depending on their footprint, products and competitive position. While these generic scenarios provide a useful starting point, companies should develop their own bespoke scenarios by evaluating how each major scenario driver affects their strategic, financial, and operational decisions. Given the short time horizon, the long lead times for some responses and the magnitude of differences between scenarios, careful and custom analysis is urgently needed.

A version of this article orginally appeared in the C-Suite newsletter. It is used with permission

About the Author

John Jullens

AMG Leadership Team Member, Arthur D. Little/Managing Partner, Arbalète LLC

John has more than 30 years of management consulting and industry experience in North America, Europe, and China. He specializes in developing growth strategies for clients in the automotive and industrial manufacturing sectors, including demand-side transformation, new market entry, globalization/emerging markets, brand and customer strategies, organizational redesign, and M&A due diligence and post-merger integration. He has published extensively on these topics for such leading publications as Harvard Business Review, Harvard Business Review China, CEIBS Business Review, and Strategy+Business.

Marc S. Robinson

Principal, MSR Strategy

Marc S. Robinson, Ph.D., managing partner, Arbalète LLC, is an economist and strategist with more than 30 years of experience advising leaders in multi-national companies, governments, and non-profit organizations. He spent most of his career as an internal consultant for General Motors. He also served in the White House on the President’s Council of Economic Advisors and taught at UCLA and Stanford University. He and his colleague John Jullens publish the applied business strategy newsletter C-Suite.