Proposed 'Book Tax' Puts Burden on Manufacturers

The proposed “book tax” in the Senate’s reconciliation bill “would overwhelmingly hit U.S. manufacturers,” according to a new analysis by the Joint Committee on Taxation, Congress’s non-partisan tax scorekeeper.

What’s Going On

The reconciliation bill, the outline of which was released Wednesday by Senate Majority Leader Chuck Schumer (D-NY) and Sen. Joe Manchin (D-WVA), proposes a 15% minimum corporate levy, or “book tax,” on certain companies.

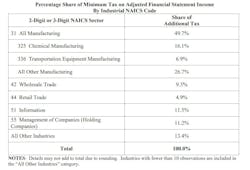

The provision is estimated to raise $313 billion, and JCT finds that manufacturers would be responsible for paying nearly half of it. (Table: Joint Committee on Taxation analysis)

What It Means

The impact would be swift and devastating to manufacturers and the economy as a whole, according to my own analysis of the bill’s effects on the manufacturing sector.

Including direct, indirect and induced effects, in 2023 alone the impact would include:

- A real GDP reduction of $68.45 billion

- 218,108 fewer workers in the overall economy

- A labor-income decrease of $17.11 billion

Targeting Manufacturers

“‘This is a domestic manufacturing tax, plain and simple,’” Senate Finance Committee Ranking Member Mike Crapo (R-ID), who asked for the JCT analysis, said in a statement.

- “Despite Democrats’ claims, the book minimum tax does not close tax loopholes. Treatment of capital investments, like those made by American manufacturers, differ for book and tax purposes—for good reason,” according to a press release from Senate Finance Republicans.

- “Congress intentionally designed tax depreciation rules to support domestic investment. Democrats’ tax on U.S. manufacturing would eliminate that benefit."

Chad Moutray is chief economist, National Association of Manufacturers. This article originally appeared on the NAM website. It is used with permission.