On April 2, the U.S. Environmental Protection Agency (EPA) published a mid-term notice evaluating automotive greenhouse gas emissions standards for model years 2022 to 2025, indicating intent to place it on the Federal Register.

This long-awaited document has broad and critical implications for all automotive industry stakeholders, and, in many ways, it is another chapter in the long and challenging story of the U.S. approach to regulating fuel economy and emissions.

According to the notice,

1. The EPA administrator determined that the EPA based its current standards on information that is now outdated, and that more recent data suggests the current standards may be too stringent.

2. The EPA is withdrawing the previous final determination that was issued by the agency on January 12, 2017 (eight days before President Donald Trump took office).

3. The agency will initiate a notice and comment rulemaking to further consider appropriate standards for model years 2022-2025.

That last point means the EPA has, in effect, initiated a rulemaking process to adopt new standards for model years 2022-2025.

While the Obama Administration’s EPA aggressively pursued an overall reduction in greenhouse gases, the April notice makes clear that the Trump administration has very different intentions.

Many think the EPA will substantially reduce the targets for greenhouse gas regulation for light-duty vehicles (and by association, the National Highway Traffic Safety Administration (NHTSA) will also lower the Corporate Average Fuel Economy (CAFE) targets).

Manufacturers, states, non-governmental organizations and other stakeholders will have the opportunity to provide input into the rulemaking process in the coming months. This round of rulemaking is sure to be contentious, and there may well be many legal battles before the outcome of fuel economy and emissions standards are determined for 2022 to 2025.

The notice indicated that for the 2016 model year, “many” companies, for the first time, had to rely on banked credits to comply with the U.S. greenhouse gas regulations. The current EPA regulation was designed to enable companies to accumulate credits for exceeding the regulations in the early years and to be able to leverage those credits as the standard became more stringent.

However, companies found themselves below the standard and needing to use credits much sooner than had been anticipated.

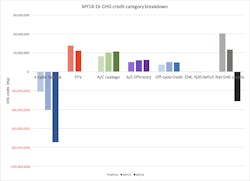

The chart shows that for 2016, the industry missed the two-cycle tailpipe emissions regulation by nearly double the performance gap in the previous year. Auto manufacturers were not able to offset this widening gap with other credits (i.e., flex fuel, air conditioning leakage and efficiency, or other off-cycle credits). For the first time, the industry reported a net loss of greenhouse gas credits in 2016; that is, they used more credits than they earned.

Given current consumer preferences and market segment trends, the rapidly growing deficit between regulatory performance and banked credits suggests that many manufacturers may not comply within a few years.

Suppliers (and automakers) are making substantial investments in fuel efficiency technology, and need to amortize those investments over millions of units at a global scale. Investing in advanced technologies is not only costly but also brings with it considerable risk. Auto suppliers may lose significant returns on these investments if the U.S. weakens its CAFE and greenhouse gas regulations, and many would like to keep the Obama-era regulatory targets in place.

At the same time, suppliers realize that their customers—the vehicle manufacturers—must be able to pass the cost of new technology through to consumers. Getting consumers to pay can be especially challenging in the U.S. market where most consumers do not value fuel efficiency as much as other global regions, and where costly technology may not be needed to meet the relaxed regulatory standards.

The auto industry also operates in many different regulatory environments around the world and must meet many different sets of targets. Even while the EPA and NHTSA are re-examining their regulations, automakers and suppliers are aggressively pursuing fuel efficiency technologies to achieve efficiency and greenhouse emissions reduction standards set across Europe, Asia, and South America.

In North America, Canada and Mexico have signed agreements to align their regulatory frameworks with that of the California Air Resources Board. All of this means that automakers and suppliers—nearly all of which are multi-national companies—must keep pace with the most aggressive regulatory environments if they wish to remain globally competitive. Companies are working to amortize their fuel economy and emissions technology investments across regions, and the impact of the recent U.S. regulatory action is yet to be fully understood.

The One National Program for greenhouse gas and fuel economy was a coordinated effort between the EPA, NHTSA, and the California Air Resources Board in 2010 that aimed to keep regulations similar across the United States. The future of the program is now in considerable doubt. Regardless of the EPA’s actions, California, and many of the Section 177 states that align with California’s standards, continue to express strong intent to go forward with more stringent regulation.

Section 177 states together account for roughly one-third of the U.S. market. On several occasions, the EPA administrator has indicated a willingness to challenge the California waiver that allows that and other states that follow California emissions standards the right to set standards that are different from those set at the federal level. Such a challenge would likely lead to lengthy legal battles.

Without a consistent national program, the industry may find two very different markets within the United States—a possibility that is very unsettling for almost all of the auto manufacturers that sell vehicles in this market.

The Center for Automotive Research has been deeply involved in the fuel efficiency discussion and will continue to actively work with all stakeholders as we move toward a solution that enables consumer choice while effectively minimizing the environmental impact of the motor vehicle.

Brett Smith is co-director, Center for Automotive Research (CAR) Management Briefing Seminars and assistant director, Manufacturing, Engineering and Technology Group. CAR is an independent nonprofit conducting research and analysis on critical issues facing the automotive industry, and the industry’s impact on the U.S. economy and society.

This story was originally published on the CAR website.

About the Author

Brett Smith

Brett Smith is the Assistant Director of the Manufacturing, Engineering, and Technology Group and Co-Director of the CAR Management Briefing Seminars at the Center for Automotive Research (CAR). He joined CAR in 2000 after 12 years at the University of Michigan’s Office for the Study of Automotive Transportation (OSAT).

During his career, Brett’s research has spanned many critical aspects of the automotive industry. He has been deeply involved in research on vehicle and component manufacturing; materials forecasting; product development and analysis; supplier–manufacturer relations; technology development; facility location analysis; and human resource and talent issues. Brett was also active as a labor educator for 15 years.

Brett’s research experience in the area of advanced powertrain technology includes numerous reports and technology forecasts on this subject. He was chair of the NextEnergy-CAR Plug-in Electric Vehicle Working Group (2007-2012), and is currently chair of the Advanced Powertrain Thought Leadership Roundtable, an assemblage of leading powertrain suppliers working with CAR to develop a comprehensive understanding of issues driving this critical industry sector. Brett is an active advisor to the CAR Automotive Communities Partnership (ACP), and leads the Advanced Powertrain Thought Leadership Roundtable at CAR.

Since 2012, Brett has served as Co-Director, CAR Management Briefing Seminars. In that role he has guided tactical planning for the CAR Management Briefing Seminars and other CAR conference activities. He has also chaired the Advanced Powertrain Forum at CAR MBS since 2003, and is also the chair of the Car of Tomorrow session.

Brett received a B.S. in Economics and an M.B.A. from Eastern Michigan University.