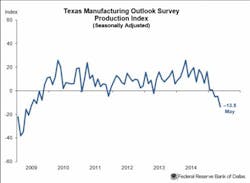

Texas factory activity continued a downward trend in May, the Federal Reserve Bank of Dallas reported Tuesday, with the production index falling to -13.5, the lowest reading in 6 years.

The decline in oil prices continues to have negative effects in the state. One manufacturer commented:

“The oil and gas exploration and production industry continues to worsen since last year’s peak. While the degradation is leveling, the related business impact remains. With some recovery of the price per barrel of oil, the general feeling is that our business impact has leveled.”

The employment index dipped from 1.8 in April to -8.2 in May. Hours worked fell from -5.0 to -11.6. Wages and benefits stayed in positive territory but weakened from 16.5 in April to 14.7 in May.

Manufacturing leaders took a more sour view of current business conditions. The index for company outlook fell from -7.8 in April to -10.5 in May, the lowest reading since June 2009. As for business activity in general, respondents’ views worsened from -16.0 to -20.8.

But in a signal that manufacturing leaders think the worst is behind them, their outlook for six months from now improved for production, capacity utilization, new orders and employment. As one machinery manufacturing commented:

"We've maintained the position that we need to give the oil market time to settle, so our goal has been to survive until the third quarter. At that point, production and inventories will have stabilized and maybe our customers will be more comfortable entering the market. We have numerous customers who have delayed purchasing product, and we are optimistic that they will begin ordering again in the third quarter."

About the Author

Steve Minter

Steve Minter, Executive Editor

Focus: Leadership, Global Economy, Energy

Call: 216-931-9281

Follow on Twitter: @SgMinterIW

An award-winning editor, Executive Editor Steve Minter covers leadership, global economic and trade issues and energy, tackling subject matter ranging from CEO profiles and leadership theories to economic trends and energy policy. As well, he supervises content development for editorial products including the magazine, IndustryWeek.com, research and information products, and conferences.

Before joining the IW staff, Steve was publisher and editorial director of Penton Media’s EHS Today, where he was instrumental in the development of the Champions of Safety and America’s Safest Companies recognition programs.

Steve received his B.A. in English from Oberlin College. He is married and has two adult children.