Make Your Move: Are You Ready for a Slowdown in Consumer Spending?

Our view is that over the coming year U.S. economic growth will slow, but not break down. The U.S. economy experienced solid growth in 2013, with industrial production increasing 2.9% from the previous year, and real gross domestic production gaining 2.6%. We are unlikely to see that pace during the remainder of 2014 and through the first one to two quarters of next year. The economy will grow, just not at the same pace as last year. IndustryWeek readers should plan accordingly regarding budgets, cash and expectations.

Our advice is to beware of linear projections and be aware of the impact of slowing demand on your inventory levels. Also be mindful of the growth that we expect to develop in the second half of 2015. Make sure your company's goals and compensation plans are aligned with future growth potential. Hire top sales people and seek out new markets for your products.

The consumer will be the driving force behind the economic slowdown. Consumers are facing multiple headwinds including higher housing costs (both in the purchase and rental markets), more expensive and confusing health care, and, more recently, rising food costs. All this while slack in the labor market has led to meager income gains.

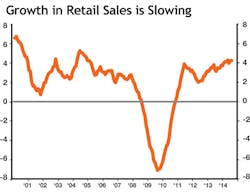

We are starting to see the seeds of this slowdown in consumer spending. Total retail sales adjusted for inflation has been growing at a near 4% year-over-year clip since last autumn (annual basis). However, the rate of change for the most recent three months of data has slowed to 2.5% over last year, a sure sign to us that annual sales are about to enter a phase of slower growth. We expect this slower pace to last through mid-2015, and that healthy acceleration will follow in the second half of next year.

Retail sales of automobiles are increasing, albeit at a moderating rate. Sales in the last 12 months are up 9.6% from last year, while sales in the first quarter increased a milder 5.8% from the first quarter of 2013. Extreme weather across the U.S. undoubtedly contributed to ongoing slower growth through the first three months of the year; however, we also see this as a signal that consumer appetite for light vehicles is easing. We are also seeing auto production slow to match the pace of slowing consumer demand.

Retail sales of building materials and supplies are rising as well, and at an annualized level of $264 billion are 5.4% ahead of last year, having surpassed a five-year high. The housing market and consumer activity are key drivers here. Both housing starts and existing home sales have started to move horizontally for now as a result of higher prices, higher interest rates and tighter mortgage credit. Expect the difficulties in the housing market to increase later this year and extend into 2015. Industry participants should be particularly aware of cash needs as the market slows.

As housing slows further, we will see demand for building supplies fall in the second half of the year. The same pressures impacting the housing industry are, or will be, evident in others sectors as well. Electronic and appliance stores are already seeing sales recede, and furniture and home furnishing sales are likely to follow suit within the next couple of months. Most troubling here is that furniture production is accelerating, up 5.7% from a year ago. The inevitable buildup in inventory could surprise many manufacturers and distributors. That surprise increase in inventory is likely to result in a sharp pullback in activity, as opposed to a more orderly and manageable gradual adjustment process.

With 2014 nearing the halfway point, it will be critical that your team not dwell on the negativity of slackening demand, but it is a good idea to update the spreadsheets and cash flow projections. Companies caught cash-short later this year will find it difficult to ramp up for the increased levels of activity projected for the latter half of 2015.

Contributing Editor Alan Beaulieu is an economist and president of ITR (itreconomics.com). He is co-author, with his brother Brian, of "Make Your Move," a book on spotting business-cycle trends.