Make your Move: Computer and Electronics Production Growth to Ease

The media spent a good portion of early 2014 talking about the weather, and some of it for good reason. Extreme weather during the first two months of the year dropped temperatures well below seasonal normal in wide swaths of the country. Linking the poor weather to tough economic data, while a natural progression, was perhaps reaching too far.

To be sure, consumers are feeling the pinch from higher heating costs, with natural gas prices approaching a four-year high in February; however, they should recede once more temperate weather arrives. Despite this, consumers seemed willing to spend; total retail sales were barely affected. The weather did have an impact on housing starts, but the pace of growth in that sector has been slowing since early 2013 as reduced affordability has hurt demand.

My fear is that the press coverage could lead you to conclude that the business cycle is weakening underneath you and that it is time to hoard cash and say no to new initiatives. The reality is that the economy and your future are looking good through the middle of the year, with only a slower rate of growth likely in the U.S. later this year and into 2015, and this has little to do with the weather. Use the upcoming slowdown to better prepare your business for the bright future we see beyond mid-2015.

Outlook for Computers and Electronics

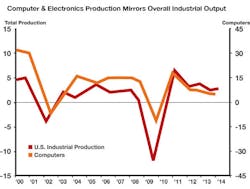

Annualized computers and electronics production is approaching a six-year high, 4.7% above the year-ago level (annual basis), which indicates that demand in this sector is strong. However, production has already shifted into the slower-growth phase of the business cycle, and the rates of change are telling us that this will continue. At this point we do not see production collapsing. New orders for computers and electronics equipment (deflated) are at a record high $1.1 trillion, and, in the expansionary phase of the business cycle, at 7.5% above last year. At this level, new orders will support a reasonably healthy level of production for some time. The computer and electronics production business cycle closely matches that of the overall economy as measured by industrial production (see chart). We expect the pace of growth in industrial production to ease in the latter portion of the year and reaccelerate in the second half of 2015. A similar trend should develop in computer and electronics production.

Production will be further undermined by weakening international demand as many world economies struggle with recovery. Global shipments of personal computers declined 9.8% in 2013, according to the electronics market research firm IDC. The economic slowdown in many emerging markets contributed to the global weakness in shipments. These growing economies are key to the electronics industry as they develop healthier consumer markets.

Communications equipment production is 1.9% higher than last year on an annual basis, with the growth rate accelerating. We expect production to continue rising through midyear in concert with the expected growth trajectory in the overall economy. The pace of growth in new orders for communications equipment (nondefense), while 6.4% higher than last year, is slowing and will contribute to the erosion in production.

Annualized new orders for defense communications equipment is $4.5 billion, which is near a seven-and-a-half-year low and 17.3% below last year. The backlog of unfilled orders is also contracting on an annualized year-over-year basis, which, when combined with the federal government looking to trim spending, does not bode well for this sector.

| Stay up-to-date with economic news and trends on Alan Beaulieu's Make Your Move blog at iw.com/blog/make-your-move. |

There are constant challenges to operating a profitable business, from the ever-changing fluctuations in the business cycle to new and burdensome regulations. We strongly encourage you to look beyond the short term and build a plan to take your business to new levels. Whether it is by adding top-notch salespeople to help you penetrate a new market or an investment in technology that will improve efficiency, spend money now to ensure a profitable future.

Contributing Editor Alan Beaulieu is an economist and president of ITR (itreconomics.com). He is co-author, with his brother Brian, of "Make Your Move," a book on spotting business-cycle trends.