NAM/IndustryWeek 2013 Q3 Survey: Manufacturing Picking Up Steam

There is a growing sense that manufacturing activity is accelerating in the second half of 2013. The August Institute for Supply Management’s Purchasing Managers’ Index showed strong growth in new orders and production for the month, building on healthy numbers for July. The latest National Association of Manufacturers (NAM)/IndustryWeek Survey of Manufacturers is largely consistent with this pickup—a welcome change given the frustratingly slow pace over much of the past year. Yet, even with the improvements, demand and production growth has been mostly modest at best, with increases in hiring still lagging behind. Manufacturing production has risen just 1.3% year-over-year, and the sector has added just 20,000 net new workers during the past 12 months.

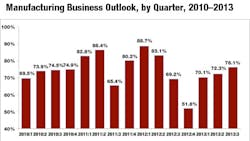

The NAM/IndustryWeek Survey of Manufacturers has closely tracked these trends. After declining to 51.8% at the end of 2012, the percentage of respondents saying that they were positive about their business outlook rose to 70.1% in March and 72.3% in June. In this latest survey, that percentage edged slightly higher to 76.1%. Yet, the average in the first three quarters of 2013 (72.8%) was well below the average in the same time period last year (80.3%).

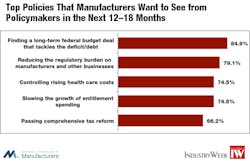

At the same time, manufacturing leaders are concerned about a number of possible challenges on the policy front, many of which will culminate this fall. First and foremost, almost two-thirds of respondents said it is extremely important for their business that the President and Congress make progress on funding the governmentfor the next fiscal year and in extending the nation’s debt ceiling. Part of this conversation could involve ways to avert the across-the-board federal budget cuts (sequestration). In a special question on this topic, roughly 85% of manufacturers said that finding a long-term federal budget deal that tackles the deficit and debt was the top challenge they want to see policymakers address, with reducing the regulatory burden on manufacturers and other businesses (79.1%, controlling rising health care costs (74.5%), slowing the growth of entitlement spending (74.5%) and passing comprehensive tax reform (66.2%) also top priorities.

Moreover, more than 90% of respondents said that addressing the nation’s fiscal challenges was either moderately or very important for their company. Roughly 80% felt that comprehensive tax reform was important for their firm. This was true even though the wording of the question made it clear that comprehensive tax reform—in which marginal tax rates might be lowered and the income tax base broadened—might result in some businesses seeing their tax burden increase, even in a “revenue-neutral” plan.

See also:

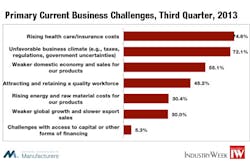

We regularly ask about manufacturers’ primary business challenges. For the third quarter in a row, the top challenge was rising health care and insurance costs, cited this time by 74.6% of respondents. Many respondents noted uncertainties in the implementation of the Affordable Care Act as a major concern. Many are still unaware of their premium costs for next year, and as we noted in the last survey’s report, there is a perception that these costs will rise significantly, particularly at the small and medium-sized level.

The second-most pressing challenge was once again the unfavorable business climate. Many of the sample comments specifically cited frustrations with several regulatory agencies. (See a partial list of sample comments at the end of the report.) Other comments focused on difficulties in attracting talent, credit availability challenges and domestic and global economic concerns.

Anecdotally, we continue to hear more concerns about the long-term impacts of monetary policy. The Federal Reserve has increased the size of its balance sheet from less than $1 trillion before the financial crisis to more than $3.6 trillion today, and it is purchasing $85 billion in short- and long-term securities each month. While the Federal Reserve plans to “taper” (or reduce) its asset purchases as soon as this fall, some have questioned the long-term risks associated with its so-called “exit strategy.” This necessitated the addition of some special questions on the topic. Several respondents expressed their worries about inflationary concerns or negative economic consequences of such actions.

However, this is not an urgent source of worry for most respondents. Roughly one-third ranked ending expansionary monetary actions as one of the top policy priorities for the next 12 to 18 months. We also asked manufacturers to rank their level of worry about the Federal Reserve’s exit strategy on a scale of 1 to 10, with 1 being not worried at all and 10 being extremely worried. The average of all respondents was 6.0, with 57.2% scoring their worry between 5 and 8. To be fair, this question has never been asked before, so it is hard to ascertain whether an average score of 6.0 is better or worse than it might have been in the past. Nonetheless, it does indicate a moderate amount of concern. For those who were most concerned, 16.0% ranked their worry as a 9 or 10, which was roughly the same percentage who said that the prospect of “tapering” was impacting their business.

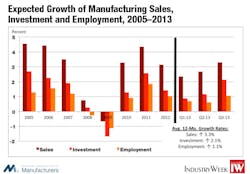

Looking specifically at the third-quarter data, the increase in manufacturers’ outlook carried through to other variables. For instance, sales are expected to grow 3.3% over the next 12 months, up from 2.3% in March and 2.7% in June. While it continues to be below the 4.7% observed at the beginning of 2012, the pace is the fastest in five quarters. Almost two-thirds of respondents said they expect their sales to increase. However, small manufacturers (e.g., those with fewer than 50 employees) were less optimistic than their medium-sized (50–499 employees) or larger (500 or more employees) counterparts. Smaller firms had sales expectations of 2.6%, or at least 0.7% less than the other two class sizes.

Capital spending has risen from 0.9% in March to 1.2% in June to 2.1% in the third quarter. The percentage of manufacturers planning to increase investments by 5% or more rose from 8.0% in June to 27.5% in this survey, helping to lift the overall average. Still, 45.6% anticipate no changes in capital spending over the next year, a sizable number. Larger manufacturers were more bullish on capital investments than small or medium-sized businesses, with their growth rates being 1.7% to 2.0% to 3.0% in order of size. However, each class size saw improvements during the quarter.

Even as other activity measures have accelerated in recent months, hiring plans have lagged. This survey suggests that employment should experience modest gains, but roughly 60% of respondents do not plan to change their employment levels over the next 12 months. Employment is expected to increase by 1.1% in the next year, up from 0.6% in the last survey. The percentage of manufacturers planning to decrease employment fell from 15.9% three months ago to 10.2% this time. Similar to the capital investment figures, small manufacturers anticipate slower growth in hiring over the next year (0.7%) than their medium-sized (1.2%) or large (1.1%) manufacturing peers.

Manufacturers expect inventory levels to be essentially unchanged over the next 12 months, with the average down 0.03%. This is up somewhat from the expectation of a 0.33% decline last time. Nonetheless, while it was close to neutral, it has now been negative for five straight quarters. Reduced inventories do provide a silver lining. With reduced stockpiles, production will need to pick up significantly if and when new orders start to take off. Slower growth for prices will also help nudge additional demand. The average price increase anticipated for a company’s product line was 1.1% in this survey, unchanged from June’s survey but lower than the 1.5% predicted in March.

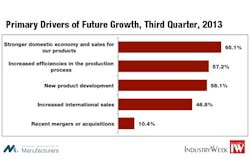

Manufacturers are looking for sales growth both domestically and overseas. When asked about the primary drivers of future growth, 65.1% said that a stronger domestic economy was the key to their strategic plans. At the same time, increasing international sales was also very important, cited by nearly 47% of respondents. That is the highest percentage on the trade figure since this question was added in mid-2011. Over the next 12 months, more than 42% of manufacturers expect higher exports in their firms, with an average increase of 1.4%. As with past surveys, those manufacturers that were more optimistic about their international orders were also more positive about their business outlook.

We use the NAM/IndustryWeek output data in a regression model to help predict manufacturing production two quarters ahead. Other variables include housing permits, the interest rate spread, real personal consumption and the S&P 500. This model explains roughly 89% of the variation since the data began in the fourth quarter of 1997. Note that the regression model was re-run this quarter to reflect revisions mainly to personal consumption data.

The current survey findings suggest that manufacturing production should grow strongly over the next six months, up 3.5% at the annual rate. This is higher than the 2.8% year-over-year pace predicted in the last survey. As such, the data serve as an uplifting way to end this report, indicating that manufacturing activity should continue to pick up in the coming months. Behind the more optimistic production numbers expressed in this particular model were better numbers for consumer spending, manufacturer optimism and the stock market. Housing, which had been a strength in past reports, was less so this time around, and the widening interest rate spread served as one of the larger drags.

Of course, models are only as good as the data that go into them, and a lot of unknowns in the economy remain, which could derail the 3.5% growth rate over the next six months. Possible downward risks include a contentious fiscal spending debate, the next round of across-the-board spending cuts, continued slow growth overseas in export markets, weaknesses associated with implementation of the Affordable Care Act and geopolitical events.

The NAM/IndustryWeek Survey of Manufacturers has been conducted quarterly since 1997. This survey was conducted among NAM membership between August 16 and 30, with 285 manufacturers responding. Responses were from all parts of the country, in a wide variety of manufacturing sectors and in varying size classifications. Aggregated survey responses appear here. The next survey is expected to be released on Monday, December 9.

Sample Comments

- “Completing the current expansion to increase our capacity.”

- “The Department of Labor and the IRS are killing business. Sometimes they refuse to give any sort of guidance on things, so we must figure it out.”

- “Difficulty finding people who want to work.”

- “Global economy is impacting the domestic economy as domestic sales opportunities are tied to global-based corporations, which are struggling.”

- “[The FDA obstructs] all innovation in the diagnostics market and [is] immune to legislation and common decency.”

- “Increased availability of credit for our customers means it is easier for them to finance equipment purchases.”

- “Misguided regulation of the energy industry.”

- “Our country is in grave danger economically. Much of it is caused by the government health care regulations, environmental regulations and high taxes.”

- “We need to restrict EPA and NLRB regulations.”

- “The sequester is hurting our business.”

- “Stronger new housing starts and continued strength in the remodeling sector.”

- “Uncertainty in the future for our customers to make capital expenditures.”

- “We are having difficulty filling blue-collar openings.”

About the Author

Chad Moutray

Chief Economist

Chad Moutray is chief economist for the National Association of Manufacturers (NAM), where he serves as the NAM’s economic forecaster and spokesperson on economic issues. He frequently comments on current economic conditions for manufacturers through professional presentations and media interviews. He has appeared on Bloomberg, CNN, C-SPAN, Fox Business, Fox News, and Reuters television.

Prior to joining the NAM, Dr. Moutray was the chief economist and director of economic research for the Office of Advocacy at the U.S. Small Business Administration (SBA) from 2002 to 2010. In that role, he was responsible for researching the importance of entrepreneurship to the U.S. economy and highlighting various issues of importance to small business owners, policymakers and academics. In addition to discussing economic and policy trends, his personal research focused on the importance of educational attainment to both self-employment and economic growth.

Prior to working at the SBA, Dr. Moutray was the dean of the School of Business Administration at Robert Morris College in Chicago, Ill. (now Robert Morris University of Illinois). Under his leadership, the business school had rapid growth, both adding new programs and new campuses. He began the development of an MBA program that began accepting students after his departure and created a Business Institute for students to work with local businesses on classroom projects and internships.

Dr. Moutray is a former board member of the National Association for Business Economics (NABE). He is also the former president and chairman of the National Economists Club, the local NABE chapter for Washington, D.C. He holds a Ph.D. in economics from Southern Illinois University at Carbondale and bachelor’s and master’s degrees in economics from Eastern Illinois University. In 2007, he was named a distinguished alumnus by Lake Land College in Mattoon, Ill., where he earned his associate’s degree in business administration, and in 2014, he received an Outstanding Graduate Alumni Award from Eastern Illinois University.