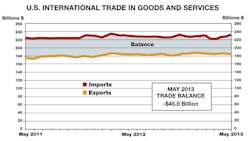

The nation’s trade deficit in goods shot up $5.0 billion in May, largely accounting for an increase in the U.S. trade deficit to $45 billion. Overall exports totaled $187.1 billion while imports were $232.1 billion.

Exports of goods fell $0.9 billion to $130.3 billion while the import of goods increased $4.2 billion to $193.7 billion.

From April to May, exports fell for consumer goods ($1.2 billion), industrial supplies and materials ($0.9 billion) and foods and beverages ($0.1 billion). Increases occurred in capital goods ($0.8 billion), automotive vehicles and parts ($0.3 billion) and other goods ($0.2 billion).

The rise in imports, said Michael Dolega, an economist with TD Economics, is a “function of a healing U.S. economy.” He noted the increase in imports was led by consumers goods and the “substantial pent-up demand” for automobiles.

“New vehicle sales sold at an annualized rate of 15.9 million in June,” Dolega said. “Healthy auto sales will likely sustain import volumes going forward, but will put pressure on the Trans-Pacific Partnership talks in light of Japan recently allowed to join the negotiations.”

Given the weakened global economy, Dolega said, imports would likely outpace exports in the coming months. “This will be somewhat offset by lesser U.S. energy import-dependence,” he said. “As global recovery gathers steam into 2014, we expect exports to regain their footing.

The trade deficit with China increased from $24.1 billion in April to $27.9 billion in May. The U.S. also ran trade deficits with the European Union ($10.8 billion), OPEC ($6.3 billion), Germany ($5.8 billion), Japan ($5.4 billion) and Mexico ($5.3 billion).

The U.S. incurred a deficit of $7.2 billion in advanced technology products, as imports of $34.1 billion exceeded exports of $26.9 billion.

Noting the more than 12% increase in the trade deficit, Alan Tonelson, an economist with the U.S. Business and Industry Council, called U.S. trade policy “badly broken” and urgently in need of a “top-to-bottom overhaul.”

Tonelson recommended suspension of the Trans-Pacific Partnership trade agreement talks. “Because the pervasively protected and heavily subsidized Chinese and Korean economies typify those found in the Asia-Pacific region, U.S. approval of the Trans-Pacific Partnership looms as a disastrous economic mistake that would boost America’s trade deficits even higher, thereby slowing its already feeble recovery and undermining weak job-creation levels,” Tonelson said.

About the Author

Steve Minter

Steve Minter, Executive Editor

Focus: Leadership, Global Economy, Energy

Call: 216-931-9281

Follow on Twitter: @SgMinterIW

An award-winning editor, Executive Editor Steve Minter covers leadership, global economic and trade issues and energy, tackling subject matter ranging from CEO profiles and leadership theories to economic trends and energy policy. As well, he supervises content development for editorial products including the magazine, IndustryWeek.com, research and information products, and conferences.

Before joining the IW staff, Steve was publisher and editorial director of Penton Media’s EHS Today, where he was instrumental in the development of the Champions of Safety and America’s Safest Companies recognition programs.

Steve received his B.A. in English from Oberlin College. He is married and has two adult children.