General Motors Co. has made close to $50 billion in adjusted net income over the past five years, while Tesla Inc. has lost close to $5 billion. Yet investors believe Elon Musk’s carmaker is the stock to own on the assumption that he has a nearly unassailable lead on all challengers when it comes to electric cars.

On March 4, GM CEO Mary Barra and the team from her skunk works in GM’s Technical Center north of Detroit made a case that they can catch up to and maybe even pass Tesla in the race to electrification. GM thinks it has a killer app in a battery platform that reduces the use cobalt, one of the more expensive elements needed to store energy, and has a Lego-like structure that can be shrunk down or expanded double as the chassis for anything from a compact Chevrolet Bolt hatchback to a 1,000-horsepower Hummer pickup.

For GM or any other automaker that wants to take on Tesla in the EV race, the battery is vital. Its cost can put the car out of reach for many consumers and undermine its chances of profitability before the vehicle ever reaches a showroom. And by Barra’s admission, if that battery can’t make a car go 300 miles on a single charge—a bragging point that only Tesla has with any model on sale right now—most consumers won’t consider it. But if GM pulls off this battery coup, and consumers are persuaded to come along, the Detroit automaker may have what established carmakers have been seeking for several years—an Android-like antidote to Tesla’s position as the iPhone of electric cars.

“What matters more than anything is battery cost. If you can get cost down, you can get better range. The big automakers like GM have an advantage in scale and global reach,” says Colin McKerracher, head of transport analysis for BloombergNEF. GM has made it clear, he says, that “they aren’t giving up.”

Today, GM sells the electric Chevy Bolt, and newer entries include Audi’s e-Tron and Jaguar’s I-Pace. None of these models have dented Tesla’s global lead, which amounted to 368,000 EVs sold globally last year, more than triple the number of the next challenger, China’s BAIC. But give GM its due. It’s been working on electric cars since the EV1 went on sale in 1996. The carmaker put out the Chevy Volt plug-in hybrid in late 2010; it has deep expertise. But Tesla stole the show with the Model S sedan in 2012, and the rest of the industry has been wondering how to strike back ever since.

Here’s how GM’s new system works and why management says the company can get back in the game:

- Its battery cells are flat pieces about 2 feet long and 9 millimeters thick. Their design enables each cell to dissipate heat more easily than the cylindrical versions Tesla uses, which GM engineers say will boost their batteries’ performance and give them a longer life. The battery chemistry, which was developed jointly with Korea’s LG Chem Ltd., uses 70% less cobalt, the most expensive element in batteries. Reducing cobalt content brings GM’s future EVs close to the cost of a conventional car and should make them profitable.

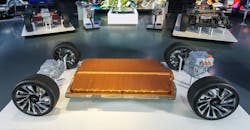

- GM stuffs 20 of these cells into a pouch. It puts 24 pouches into each module, essentially a brick of power storage. GM showed a dozen modules laid into a metal tray that makes up the floor and chassis of the vehicle. It could use fewer or more modules depending on the car model (this also provides the safety structure of the car). Since GM can stack modules side by side or on top of each other like Lego bricks, designers can package more of them into all kinds of vehicles to get more power storage on board. That’s how GM says it can get up to 400 miles on a charge, beating any current Tesla.

- The modular battery pack allows GM to make vehicles of different lengths and widths. That means that the company can host a variety of vehicles, car or truck, by simply adjusting the size of the metal tray and the number of modules laid into it. GM showed off small cars for Chevrolet, mid-size SUVs for Chevy, Buick, and Cadillac, and two different hulking Hummers that will be sold by the GMC truck brand. There’s even an ultra-luxury sedan called the Cadillac Celestiq that targets buyers who like Bentleys.

- The battery pack can be mated to one of three different electric motors. GM said it will be able to make front-drive runabouts such as the Bolt, rear-drive luxury sedans like the Celestiq, or all-wheel-drive Chevy pickups and Hummers. Using three motors for so many models is also far cheaper than producing the dizzying array of gasoline engines GM sells. Combining cheaper battery chemistry, modular battery packs, and the low-cost motor families saves the company enough to sell its EVs at a more affordable price than traditional combustion-engine vehicles.

“Tesla has an advantage in brand value and a bit of a technology edge, but I wouldn’t count GM out,” BloombergNEF’s McKerracher says. “They are making all of the right moves to be competitive.”

By David Welch

About the Author

Bloomberg

Licensed content from Bloomberg, copyright 2016.