The Covid-19 Effect: The 2020 IndustryWeek Technology Survey

In recent years, manufacturing technology has been on a somewhat steady trajectory toward building significantly smarter operations. All along, manufacturers have clearly understood the future is increasingly digital. Having seamless connectivity, automation and robotics—and the ability to effectively collect, analyze and leverage mountains of data in near real-time—has become a necessity rather than a luxury. However, many of these same manufacturers were only begrudgingly moving toward what has been coined as “digital transformation.”

Then COVID-19 happened.

The pandemic has become a defining moment for digital transformation, separating the haves from the have nots. Manufacturers suddenly find themselves dependent upon their tech investments. For some, strategic technology investments mean they can rapidly pivot to create desperately needed products. Remote access has also become an integral part of the new normal, enabling experts working from home to form meaningful connections with skeleton crews still on the shop floor. And as manufacturers venture into the restart mode, the strategic use of wearables and robot technology makes social distancing feasible.

Simply put, business as usual is not going to work. Uncertain times mean manufacturers need to be ready to navigate unknown territory. Fortunately, having the right technology in place can help manufacturers add clarity and consistency to crucial operations. And that is exactly the story we see playing out in in this year's IndustryWeek technology survey.

Which Technology Matters Most?

Let’s get to the results.

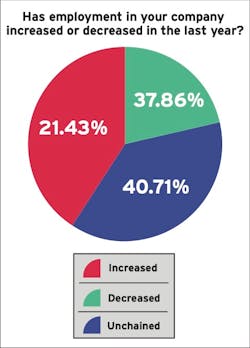

One caveat before diving in: Since this year’s survey of manufacturing leaders (57% of whom identified as C-level) occurred in the heat of the COVID-19 pandemic, it yielded some results that may ultimately prove to be little more than deviations. Perhaps the least surprising of those centers on employment trends. Last year, roughly 55% saw increased employment, compared to 21% in 2020. However, it’s encouraging that not all of the previous year’s growth gave way to decreases, with approximately 41% of respondents saying their employment numbers remain unchanged.

When asked which current technologies respondents see as most important to their company’s future success, automation and AI continue to rise to the top, followed by additive and data analytics. The biggest differences year over year? Although automation and AI received bumps from previous-year results, respondents also placed more emphasis on additive manufacturing.

The love for additive should not come as a surprise, especially considering the role the technology played in addressing supply chain inadequacies—as well as enabling manufacturers across the entire array of industries to take part in providing much needed personal protective equipment and COVID-19 test swabs. The key point to watch here will be whether additive has the staying power to viably serve as another important tool in the toolbox as today’s manufacturers work to navigate the new normal.

In terms of the continued upward trajectory for automation and AI, the ongoing move toward digital environments undoubtedly plays a key role. However, the changed reality of maintaining production environments post COVID-19 is likely enhancing the trend. After all, as manufacturers shift to the new normal, the strategic utilization of automation could prove pivotal in helping manufacturers follow social distancing requirements.

Many manufacturers are focusing on the core of their business and know that digitalization is a key to future success, explains Ryan Martin, Industrial & Manufacturing principal analyst at global tech market advisory firm ABI Research. “No surprise that automation/robotics, AI and additive saw a meaningful bump compared to 2019 due to the maturity of the technologies and recognition of their role in improving operational efficiency,” he says. “Automation and robotics help minimize error, reduce waste and protect margins. AI improves automation as well as the way manufacturers respond to fluctuating supply and demand. Additive manufacturing, once relegated to rapid prototyping, is now being explored for broader production applications.” In recent research, ABI also found that deploying dedicated cellular-enabled Industry 4.0 solutions can generate an operational cost savings ROI of 10x to 20x over five years.

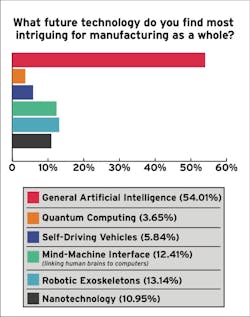

Looking ahead, advances in artificial intelligence garner the bulk of respondent interest at 54%. The next three future technologies piquing interest include: robotic exoskeletons (13%), mind/machine interfaces (12%) and nanotechnologies (11%).

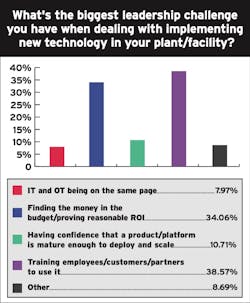

Of course, there are always challenges when investing in new technology. And the biggest challenge facing manufacturers has remained consistent year over year: Simply put, finding the money to make investments (34%) in the type of technology needed to realize a meaningful difference in how they produce and innovate. Training was a solid second at just under 32%. The only surprise here? Money was not a more significant challenge, considering the uncertainty operating in a post COVID-19 environment.Wear Is the Love?

If you have ever attended a tradeshow, wearables are the one technology sector that always garners significant interest because of their coolness factor, whether it’s the futuristic looking smart glasses, AR/VR headsets or exoskeletons.

The Sarcos Guardian XO, for instance, is a full-body, powered exoskeleton built to enhance human productivity while reducing the risk of strain or injury–a key pain point considering that U.S. employers and employees spend over $100 billion annually on back pain related on-the-job injuries.

However, according to survey results, the “coolness factor” for such products has yet to translate to realistic applications, as most wearables have yet to gain favor with the IndustryWeek audience. Specifically, roughly three quarters of respondents fail to see justification for investing in the maturing technology sector.

Misconceptions around where the technology can play a role could be the culprit. According to Kristi Martindale, chief customer officer and executive vice president, product strategy for Sarcos Robotics, the strategic deployment of exoskeletons could be instrumental in ensuring safety during the COVID-19 pandemic. “The pandemic has impacted how we live and work,” she says. “Social distancing at work is especially challenging for those industries where employees must work in teams or in close proximity to one another to help lift, carry, and assemble heavy materials and components.”

Wearables like the XO “can support the existing workforce and better protect employees, enable continuity of work, and maintain productivity by augmenting an individual’s strength and endurance, while also helping prevent heavy-lift related injuries that could further impact workflows and output,” she adds.

They can also augment the existing workforce–even in a distributed workspace environment–by enabling one worker to effectively handle tasks previously handled by two or more team members working together, or in situations where social distancing is not possible due to requirements for the lifting and manipulation of certain objects. “The robotic suit helps increase human strength and endurance by a factor of 20, enabling one worker to lift up to 200 pounds without strain,” says Martindale.The one wearable category with an uptick was location trackers/environmental sensors (13% in 2019 vs. 19% in 2020). The possible culprit for the increase? A growing trend to embrace wearable contact tracing technology, influenced by adherence to regional COVID-19 regulations designed to protect employees from spreading the virus.

According to Stephanie Tomsett, wearables research analyst at ABI Research, ABI forecasts that the wearable devices have the most immediate market potential in healthcare—including devices used in medical settings or in the home to track patients’ vitals, with wearables including blood pressure monitors, continuous glucose monitors, pulse oximeters, ECG monitors, and home monitoring devices. “New devices have also been investigated in recent months due to the Covid-19 pandemic, including contact tracing wearables and healthcare trackers designed specifically to monitor patients with Covid-19,” Tomsett says.

Powering the Digital Factory

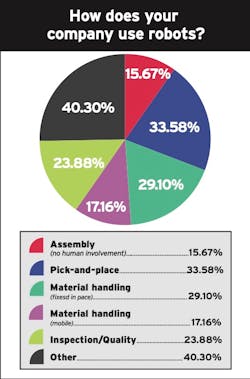

Two technologies at the heart of most digital factory configurations, automation and robotics, are clearly important for survey respondents. When looking at the numbers, almost half (49%) of respondents identified the technologies as either critical or important. Interestingly, 33% say they have yet to embrace any automation. When digging deeper to look at actual applications, pick and place is the most common robotic application, followed by material handling and inspection.

Connectivity is a key component to running a successful digital factory. As such, 5G has understandably garnered significant interest considering the promised benefits, especially within industrial environments. Specifically, as an update designed to enhance heavily automated environments, 5G promises higher levels of capacity, consistency and reliability.

Looking at the stats, a growing number of respondents appreciate the potential, with approximately 29% saying 5G is key to unlocking Industry 4.0, vs. only 19% in 2019. This increase underlines the fact that the more people know about what capabilities 5G will bring for enterprise digitization, the higher they value 5G, explains Leo Gergs, 5G research analyst at ABI Research.

“Since 3GPP’s Release 16 introduces key capabilities for enterprise 5G (such as 99.999% network availability and reliability, sub-10 milliseconds latencies and the support for time sensitive networking), the freeze of this Release in the beginning of July will result in even more industrial players to realize the tremendous value that 5G will bring for enterprise digitization in the context of Industry 4.0,” says Gergs. “Most prominently, these will center around the deployment of private standalone networks in the oil and gas, industrial manufacturing and logistics domains. As these verticals are characterized by particularly hazardous environments and a multitude of concurrently running production processes, the potential quality and efficiency enhancements through further automation is particularly large in these areas. Therefore, we see these verticals at the forefront for 5G deployments.”

When it comes to securing these highly connected environments, although confidence remains surprisingly high, it has slipped slightly when comparing year-over-year results. In 2020, 68% are either extremely or somewhat confident, whereas 72% had the same level of confidence in 2019.

While the level of confidence would suggest that manufacturers are adequately protecting their converged environments from costly and increasingly complex cybersecurity attacks, industry statistics paint a much different picture. According to the most recent Verizon Data Breach Incident Report, manufacturing is steadily becoming an attack target, with financial gain surfacing as the primary motivator. Specifically, external actors are leveraging malware—such as password dumpers, app data capturers and downloaders—to obtain proprietary data for financial gain, accounting for 29% of the breaches.

What really jumps out for manufacturers is web application vulnerabilities, explains Bryan Sartin, executive director of security professional services at Verizon Business. “Manufacturers tend to use a lot of custom developed applications, custom coded, custom created unique productivity apps that link to operational technologies and so forth,” he says. “There are more instances of the exploits of those applications because of weak authentication, particularly at system level and application level accounts that power web services platforms.”

About the Author

Peter Fretty

Technology Editor

As a highly experienced journalist, Peter Fretty regularly covers advances in manufacturing, information technology, and software. He has written thousands of feature articles, cover stories, and white papers for an assortment of trade journals, business publications, and consumer magazines.