One thing we observed while working on Driving Ohio’s Prosperity is that successful manufacturing companies simultaneously engage in immediate and longer-term value creation. In other words, to be successful and resilient, every employee performs both today’s job and tomorrow’s job.

Why two jobs? Today’s job is all about getting goods and services out the door. Doing today’s job well pays the bills, keeps operations going by satisfying current customers with production and service delivery, and sets the stage for tomorrow’s jobs. Today’s job creates current value and is a necessary condition for survival. Tomorrow’s job is devoted to continuously improving processes, products, and services. How can the product be better, the process more efficient? What need isn’t being served? Where do untapped opportunities lie? Answering these questions is a requirement for long-term prosperity.

Quite simply, employees and management both have a stake in a two-job value proposition. A two-job value proposition addresses the demands of the most important constituencies of a business: customers and owners. Today’s job centers on customer satisfaction and is tied to continuous improvement. Tomorrow’s job of continuous innovation is required to satisfy investors and ensure the future. Without today’s job, there will be no jobs in the future. Without tomorrow’s products and services, there is no future.

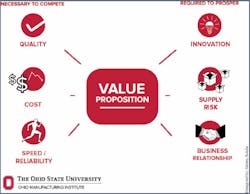

Necessary to Compete; Required to Prosper

So, what is in a two-job value proposition? The following figure details the six key components: Half respond to today’s job and the other to tomorrow’s.

Executing today’s jobs well involves the fundamentals of manufacturing: producing a quality product, at a competitive cost, and delivering it on time. Tomorrow’s job also has three components, but they are broader and less well defined: ensuring that the company is engaged in continuous process and product innovation, minimizing supply risk, and building strong business relationships.

Of course, adding value is central to both jobs. Manufacturing companies that focus production on commodity products will eventually succumb to cheaper production platforms. When bolts or windshield wipers can be made and shipped to an automaker halfway across the world at a price significantly cheaper than domestic suppliers can offer, the domestic manufacturer will lose out. In a competitive global environment, manufacturing jobs that employed generations of Americans are “not coming back, not unless we add some huge high-value-added distinction that creates [justifies] that price for the product,” one Central Ohio automotive parts supplier told the research team.

The traditional way manufacturers have tried to add value to products is to offer better quality, lower cost, and quicker turn-around times while responding to just-in-time delivery demands. These factors are now competitive necessities; they are no longer sources of competitive advantage. Reliable delivery, flawless quality and competitive cost are now expected—they are necessary to compete.

New value-creating opportunities lie in improving the product and the customer’s experience, providing better understanding of usage patterns and product reliability, and reducing downtime. All of these activities require the ability to collect and analyze data about your product. In manufacturing, working with customers to improve the quality and performance of the final product and lowering the cost of the final assembly are other ways to add value. No matter the pathway—process or product—innovation needs to be ongoing and disciplined to keep the company from being commoditized.

The second requirement for long-term prosperity is to minimize supply risk. This is done by creating a very broad perspective on the company’s sustainability. Sources of risk go beyond suppliers and the physical supply chain that is managed by the purchasing department; they also include currency risk, risk of intellectual product theft, risk of damage to the brand’s reputation, and the risk posed by relying on long, thin, supply chains. All of these risks need to be anticipated and managed.

The third part of tomorrow’s job is changing the business relationship whenever possible into more of a partnership, or becoming a trusted and preferred supplier. This means adding value, information and solving problems for your customers. That is the hardest part of tomorrow’s job; the reason it is so hard is that the costs associated with doing tomorrow’s jobs do not generate immediate returns. These are operational investments. Companies with durable products that can turn the members of their salesforces into sales engineers and operational sources of market intelligence will succeed in the long run, but they may not show immediate results. Nonetheless, using customer service as a way to strengthen a business relationship is fundamental to doing tomorrow’s job, particularly if the relationship is data-driven.

For a timely example of the tension between doing today’s job and tomorrow’s job, look to the manufacturing job market.

Manufacturers are scrambling to find skilled and semi-skilled workers who can pass drug tests for current openings; plants are racking up overtime bills because they are short-handed. In one striking case, New York Times economics reporter Nelson Schwartz reports that Columbiana Boiler’s owner asserts that the company is losing work to German competitors “because they have a better labor pool.”

The problem is not limited to drug use. Manufacturers have been firing, not hiring, over the past 20 years, due to changes in demand for workers. Two generations of U.S. manufacturing leaders have not had to train an entry-level workforce, and now the industry as a whole has a labor problem that is sociological, managerial, and economic.

Sociological: because of the negative status associated with working in manufacturing coupled with the popular perception that it is an unstable career. Managerial: because “command and control” management practices will consign a company to the knuckle-dragging class of employers of last resort. And economic: because increasing wages or open gain-sharing plans can decrease turnover and enable workers to understand that they are being rewarded for their work-specific knowledge. (Of course, there are competitive limits to wages that can be paid.)

So there you have today’s problem: hiring and training motivated, drug-free people who can operate the current stock of machines and equipment. There is an undisputable demand for welders, CNC operators, machine operators, and tool and die makers.

At the same time, manufacturers need to address three critical aspects of building tomorrow’s manufacturing workforce. First, transfer the skills and knowledge older workers have about their jobs that are not written down — this is known as tacit knowledge — to new employees. Second, identify and groom new shop-floor leaders and plant managers. Third, either recruit or identify skilled technicians who can design, operate, and maintain a digitally integrated factory. These are engineering technicians who understand production and are broadly trained in the design and management of information technology, electrical and mechanical engineering, materials, and possibly hydraulics. (Europeans call this skill set “mechatronics” for the combination of analog [mechanical] skills and digital [electronic] skills required in an advanced manufacturing operation.)

Today’s job is responding to the immediate problem of hiring a workforce that can sell, produce and ship goods and services immediately. Tomorrow’s job is developing a workforce that can respond to the improvements in productivity, quality, and traceability that are starting to occur with the advent of the digital factory.

About the Author

Ned Hill

Professor of Public Administration and City & Regional Planning

As A One-Handed Economist, Ned Hill provides straight talk on business and markets to industry leaders looking for a new perspective. Dr. Hill is Professor of Public Administration and City & Regional Planning at The Ohio State University's John Glenn College of Public Affairs and a member of the College of Engineering’s Ohio Manufacturing Institute. He came to OSU after serving as Dean of the Maxine Goodman Levin College of Urban Affairs and Professor and Distinguished Scholar of Economic Development at Cleveland State University. He has also been editor of Economic Development Quarterly and Chair of the National Advisory Board of the Manufacturing Extension Partnership. The Ohio Manufacturers Association’s Board of Directors presented Mr. Hill with the Legacy Award in 2005 and again in 2016 for his work on behalf of Ohio’s manufacturers. He earned his Ph.D. in both urban and regional planning and economics from MIT, and now teaches the doctoral seminar in public economics in the Glenn College as well as classes in economic development and state and local public policy at the Glenn College and OSU’s City and Regional Planning program.