The Affordable Care Act has created heated debates, public and private confusion, and a strong reaction from health insurance providers across the country. There is no debating that this legislation, paired with other changes, has driven health care premiums higher for large businesses. As we look at delays in implementation, we see that the damage to health care costs has already been done. The reaction by insurance companies to dramatically raise rates has happened, and whether the laws are implemented in 2014, 2015, or never, the negative impact is being felt now.

See Also: Manufacturing Workforce Management Best Practices

These higher costs have made it more expensive to maintain a full-time workforce. As costs continue to rise, management teams will realize that incorporating part-time employees and more controls to stay in compliance may be only part of the strategy to control labor costs. Yes, this "evolution" will create the need to measure workforce hours on a more granular level in order to comply with government rules. After all, compliance is something the government does not take lightly, and the IRS is the one managing this new law. The major strategic shift will come from a different place. Leveraging overtime may become the most effective tool in your arsenal.

A Brief Look at the Affordable Care Act

The ACA has some very real implications for employers with more than 50 full-time equivalent employees. With that number of equivalent employees, you are categorized as a mandatory participant in the new health care requirements.

Health insurance companies fear that their cost of doing business will rise quickly due to the new rules regarding coverage. They have been raising insurance premiums as fast as they can ever since the ACA surfaced as potentially viable legislation. This means that the cost of benefits for full-time employees has risen significantly, and there appears to be no end to this trend.

With mandated insurance requirements for all Americans, the cost of care in many cases will shift from government assistance to private insurance companies. Those with expensive health problems cannot be denied coverage, and because of this, the overall burden on the insurer will rise, even as younger, healthier people are forced to join as well. The good news for the taxpayer is it may lower their burden as government assistance is relied on less.

To manage the dramatic rise in insurance rates, the federal government has enacted new rules stating that if an insurer is going to raise rates by more than 10%, they must submit their intended numbers to regulatory officials for approval. This may thwart some of the larger increases, but an 8% or 9% increase in health care costs may be enough to dramatically change how many hours your employees work.

Example Labor Costs for Company 'X'

It is important to understand current baseline costs for one employee working one hour. For each hour of straight time and overtime worked, one needs to calculate all benefits paid and the total cost to the company. To do this, we break out costs into three categories and determine what is paid only during straight-time hours -- fixed costs like health care premiums, vacations and holidays -- and what is included over both straight time and overtime -- things like taxes and 401(k) benefits.

Average Wage = $15.00

Burden = 1.35 – The burden represents all paid benefits including medical and dental, but not things like paid time off.

Pay Ratio = 1.15 – This represents the total hours paid to an employee over the hours they actually work. Essentially, it accounts for paid time off including but not limited to vacations and holidays.

Straight Time Cost:

$15.00 x 1.35 x 1.15 = $23.29

Overtime Cost:

$15.00 x 1.5 x 1.1 (this number includes taxes and 401(k) only) = $24.75

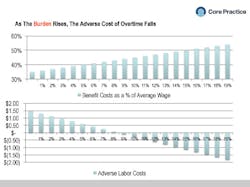

Overtime may become the most affordable tool for companies as they try to keep costs in check. The fixed-cost benefits currently paid during an employee's first 40 hours include things like vacations, holidays and medical insurance. If additional hours are worked, these costs have already been absorbed in the first 40 hours and are not included in overtime hours. Even with the time-and-a-half penalty, overtime may look more attractive as the benefits paid during your straight-time hours continue to rise. With many companies paying fixed employee benefits at levels well over 50% of the cost of the employee base wage, overtime may already be the same cost as straight time or less expensive. Typically, the benefits paid on overtime are only taxes like FICA and potentially some amount of 401(k) matching. Those numbers typically add up to approximately 10%. This means that when employee benefits are near 60%, overtime may end up being cheaper than straight time.

See the chart above to understand where the adverse cost of overtime becomes negative when using the above numbers. We are just examining a rise in the burden costs and assuming all other numbers stay the same.

PricewaterhouseCoopers reported that the rise in health care costs should be approximately 7.5% in 2013. This rise will continue in 2014. Large manufacturing companies already incur high burden levels today. It is clear that in the next five years all major manufacturers will have a negative adverse cost of overtime: Overtime will actually be cheaper than straight time. A different way to look at this trend is shown in the table on page 23.

The Death of the 40-Hour Workweek

Why would management teams only work employees 40 hours? With the high cost of benefits, not to mention the investment made in individual skilling, management teams will be tasked with working employees longer hours each week to get the most for their investment. Just looking at this problem from a financial perspective would cause many to reach the conclusion that high levels of overtime would create significant labor savings.

If manufacturing employees work 20% more hours (that is eight hours more if an employee is currently working 40 hours on average), they are essentially accomplishing work that another employee could have done on straight time. This 20% increase could translate into a 20% decrease in jobs in the sector. This will drive higher unemployment, as fewer people will be doing more work.

What About All That Overtime?

The realities of the True Labor Cost calculation often cause the knee-jerk reaction that employees should work all the overtime they want. This is absolutely not the case. Not only must employee preferences be considered, but first and foremost health and safety must be protected.

Various studies have shown that, on average, 52 to 53 hours over an extended period of time (six weeks or longer) will drive down the health of the employee, shop-floor safety statistics and productivity. For all of these reasons, we do not like to see employees working more than 48 hours on a regular basis. (Some exceptions apply based on type of work, etc.) It is never acceptable to work employees past a healthy and safe level.

Many of the arguments made in this article are dependent on one key factor: the employee. We conducted a national survey of shift workers and found a wide range of responses with respect to overtime preferences. We asked employees if they were working too much overtime, too little or the right amount. What we found is that there was no such thing as the "average shift worker" and that preferences ranged wildly even if two facilities made the same product and were located in the same town. In fact, we found that 28.4% of those surveyed were working more overtime than they would like; 37.8% were working less overtime than they would like; and 33.8% were working just about the right amount of overtime. Demographics did show some correlations, but they didn't always hold true. In the end, everyone is different, and the key is to understand what your employees' appetite is for overtime. It may surprise you.

The Good News: ACA May Indirectly Drive Continuous Improvement

Before the eyes start to roll and the disbelief sets in, let me say that I am not trying to tell you how lucky you are to have more government regulation. However, the Affordable Care Act may be a great catalyst to get some operational benefit. The tools you will probably need to measure, monitor and manage employee hours should have more than this purpose. Remember, the Internal Revenue Service is enforcing this law and payroll details will be critical.

So what are you going to need to measure in order to stay compliant? Most of our clients are not concerned about covering their employees because almost all of them are already covered without the new rules. However, the IRS will require more detailed documentation under the shared responsibility assessment for reporting and payment obligations.

For facilities with seasonal and/or variable demand for their products and services, the new laws may become a major compliance headache. Employees need to be classified as full-time or part-time upon being hired, and for those classified as part-time, a period measuring their average hours must be set up. With demand fluctuations come work-hour fluctuations, and employees working 30 hours or more each week, or at least 130 hours each month, will qualify as full-time. This may change month to month, so employers are required to set up "stability and measurement periods" where they can monitor actual employee hours and make the right determination over an extended period of time. This measurement will create a "safe harbor" scenario where even with fluctuations, an employee's status may not have to change.

The same information you gather through your new workforce management system will also tell you what your productivity numbers look like by area and will allow you to identify and isolate these issues. So while you are complying with government regulations, you will also be able to act on your new True Labor Cost-based labor strategy. A system that can target these issues in real time may become the best productivity creation tool you own. While complying with new legislation, productivity improvement may become a byproduct of the new law.

The manufacturing sector faces constant change. The companies that can get ahead of these changes, manage them with the right technology, and turn them into operational opportunities for improvement will win. Although the Affordable Care Act has been met with political resistance, it may provide the impetus for capital investments that will drive out costs. The key is to balance the financial realities with a thoughtful approach to employee health, safety and morale.

John Frehse is managing partner for Core Practice, a New York-based consulting firm, and a frequent speaker and author on labor management topics.