It’s hard to tell the full story by the numbers.

While 89% of U.S. manufacturers, surveyed by The Workforce Institute at UKG in their report "Is Stability in Sight?" reported year-over-year growth in April 2022 compared to 54% in 2021 and 65% in 2022, there are still factors affecting their bottom line.

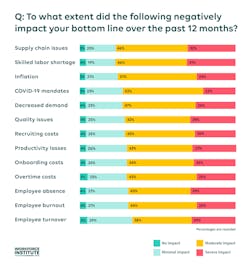

Supply chain and skilled labor shortages continue to be the predominant concerns, as detailed in the graph below.

And another statistic causing concern is that four out of five companies report having trouble hitting production goals. Not surprisingly, a major reason for this is the skilled labor gap, the impact of which is being felt “more than ever” by 87% of those surveyed for the study.

This shortage has led to both under and overstaffing lines 62% of the time, leaving just 11 days per month where facilities have appropriate staffing levels.

Finding the right staff continues to be difficult with at least half of respondents saying employee resignations, manager departures, and retirements all increased compared to 2021.

Another issue called ghosting—e.g., when an employee unexpectedly skips a scheduled shift or suddenly stops coming into work—also gained traction. And attendance was an issue with 68% of companies terminating employees for that reason in April 2022.

Other issues are noted in the graph below.

Pay, of course, is always an issue even as half of the companies reported increasing wages during the past year for existing workers at all levels with 70% raising starting pay for hourly employees and 65% increasing frontline managers' salaries.

To address the myriad of issues companies are offering a variety of options including:

- Remote work (44%)

- Flexible schedules (40%)

- Enhancing workplace culture (90%)

- Support employee wellbeing (89%)

They have also committed to several employee-centric goals among their top five priorities for the year ahead:

- Employee safety and wellbeing

- Strengthening the supply chain

- Diversity, equity, inclusion, and belonging

- Recruitment

- Retention.

About the Author

IW Staff

Find contact information for the IndustryWeek staff: Contact IndustryWeek