Supply Chains Are Headed Back Into Choppy Waters

Global trade had started showing signs of an uptick in the fourth quarter of 2023 after an extended period of declining demand. But a fresh wave of disruption to major trading routes, first in Panama and now in the Red Sea, threatens to snuff out any faint hopes of a resurgence in trade before it has had time to take root. As global supply chains face another wave of disruption, how feasible is long-term resilience to these risks?

Economists, business leaders and governments worldwide have had their fair share of change to manage and decisions to make over the past 18 months. Rampant inflation, rising interest rates and ratcheting geopolitical tension have all contributed to the overriding sense of uncertainty that has weighed heavily on global trade.

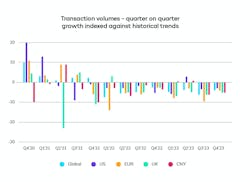

Amidst this backdrop, the last quarter of 2023 brought a glimmer of hope as Tradeshift's Q4 Index of Global Trade Health indicated a slight rebound in trade activity, fueled by a surprise surge in order volumes, which rose at their fastest rate in nearly two years.

Turning a Corner?

The apparent resurgence in orders, though admittedly from a relatively low base, played out consistently in major economic hubs, including the US, Eurozone, and, to a lesser extent, the UK. We should be cautious about drawing firm conclusions from a single quarter’s data. Still, the near-uniformity with which activity seemed to be increasing across key markets offered some hope that the pattern of dwindling demand in recent quarters may finally have hit bottom. After a difficult 18 months, could global trade be about to turn a corner?

Red Sea Curveball

The beginning of a new year threw up another curveball as an escalating spate of missile attacks on ships in the Red Sea brought supply chains back into the public discourse. Maersk CEO Vincent Clerc has said that he believes disruption to global shipping caused by the attacks on Red Sea vessels will last at least a few months. The surge in orders in Q4 now looks less like the first signs of recovery and more like yet another headache for businesses facing a return to delays and bottlenecks in their supply chain.

This disruption is not merely a stroke of bad luck. The volatility that has characterized the past two years transcends cyclical fluctuations. What’s happening in the Red Sea typifies a systemic shift with enduring consequences for global trade. Despite lessons learned from the pandemic, vulnerabilities in existing supply chain models persist, leaving us susceptible to a frustrating cycle of “two steps forward, one step back.”

Resilience, Agility, Sustainability

Strategic priorities for the supply chain before the pandemic were built around three pillars: service, quality and cost and capital. Navigating the “next normal” requires three additional pillars: resilience, agility and sustainability. This new model is underpinned by four basic principles: visibility across the supply chain, strong collaboration with trusted suppliers, sourcing diversification and the ability to react quickly to fast-changing conditions.

Many of today's supply chains remain excessively lengthy and shrouded in opacity, making them ill-equipped to adapt to an increasingly turbulent world. We’re already seeing strong evidence of a shift away from this model, with Mexico and Canada among the beneficiaries of a focus on shorter, more localized supply chains. Rather than simply shifting single-sourcing models to locations closer to home, linear supply chains are also giving way to a much more networked ecosystem with redundancies built in to prevent a single point of failure. Such reconfiguration requires quick identification, vetting and onboarding of new suppliers, emphasizing the need for efficient systems and processes.

Automation and artificial intelligence have emerged as crucial tools in this transformative journey. To build supply chains capable of weathering periods of volatility, supply chain operators need to be able to spot problems early. That requires visibility into the status and health of suppliers, often numbering in the tens of thousands. Which suppliers and processor facilities present potential single points of failure in the supply chain? Which critical inputs are at risk from shortages or disruption? Gathering, sorting and presenting that kind of information is only possible with automation.

Spotting potential issues is one thing; the ability to take action is another. AI can help supply chain operators stay agile. Imagine a scenario where emerging risks or long-term vulnerabilities would automatically trigger an interactive dashboard to flash up alternative sourcing options in different geographies. Selected suppliers would have been pre-vetted according to pre-set criteria using data collected by the AI from various sources. Organizations involved in complex manufacturing might set controls around product quality or design specifications. Given the increased scrutiny businesses face over sustainability in their supply chains, many may also choose to select vendors based on verified ESG credentials.

The Limits of AI

We've seen AI-guided sourcing thrive in highly digitalized environments like B2B marketplaces, where there's ample clean, structured data on factors like cost, quality, reliability, and carbon footprint. However, it's crucial to note that humans still must handle the vetting of suppliers in these curated ecosystems.

Outside these environments, generative AI might be able to advise on sourcing options in fairly commoditized categories, but a lot of the information these systems draw on is likely to be self-reported, or unverified. There are also huge gaps due to the lack of digitization across trading relationships. As much as AI’s potential is phenomenal and growing, we need to fix the rails before we start looking at how fast the train can go. The focus in the next two to three years will be on helping organizations clean, consolidate, and digitize existing data sets so that they’re building from a single source of truth.

Businesses must also consider other strategic factors, like embracing automation to reduce their exposure to labor shortages wherever production is based in the world. Governments must be bold in incentivizing businesses to nearshore production facilities. This action must go hand-in-hand with a forward-looking policy around immigration and the reskilling of existing workers.

Businesses must act promptly in implementing long-term strategies to mitigate risks. The longer the delay, the less likely the prospect of a sustained global trade recovery becomes. While supply chains will find a way to navigate the current storm, the next storm is already brewing on the horizon.

James Stirk is CEO, Tradeshift.

About the Author

James Stirk

CEO, Tradeshift

James is an accomplished leader with 25+ years of experience building strategy, sales growth and business development for established Multinationals (Fortune 500) and smaller (PE backed) organizations across finance, ERP, business intelligence and cyber. Based in the UK, James joined Tradeshift in 2020.