California Unseats Texas as Top IW US 500 Manufacturing State

Tied with 61 IW U.S. 500 companies each last year, California surged ahead of Texas, 64 companies to 55. By revenue, the biggest manufacturers in California together contributed $881 billion to the state's coffers, while the biggest in Texas contributed $847 billion.

As with all the top states, the two states' fate in the ranking is closely tied to the health of its dominant primary industry and the size of its largest manufacturers. California hosts 34 computer & electronics products companies, contributing $588 billion, which is up by three companies and $48 billion over the previous year. Meanwhile, Texas is home to 33 petroleum and coal products companies, contributing $706.4 billion, which is down by five companies and $398.1 billion.

To get a sense of how dominant each of these industries is in the two states, the No. 2 industry by number of companies in California, medical instruments & equipment, adds only six companies and $12.2 billion to the totals. As well, two oil companies add $140.8 billion, largely because Chevron Corp., the 5th largest company on the list with $138.5 billion in revenue, is headquartered in the state. Three pharmaceutical companies add $56.8 billion.

In the Lone Star State, two industries tie for No. 2 by number of companies. Five chemical companies post $14.2 billion, and five machinery companies add $50.2 billion.

At position No. 3 in the state ranking by number of companies, New York landed 36 companies on the list, tallying $503.1 billion in revenue. With eight chemical companies ($45.9 billion) and six publishing and printing companies ($41.8 billion), the Empire State edged out 4th place Illinois, which has 34 companies with combined revenues of $442.5 billion. New York also got a boost from two beverage companies, with $69.6 billion in revenue, and three pharmaceutical companies, with $69.5 billion in revenue.

A bit more diverse than the top three states, Illinois' biggest manufacturers include five from the Machinery industry ($88.5 billion) and four each from food ($106.2 billion) and fabricated metals industries ($21.4 billion). As well, three pharmaceutical companies contribute $49.4 billion in revenue.

Of course, the land of Lincoln also boasts the headquarters of one big aerospace & defense company, Boeing Co., which, with $96.1 billion in revenue, alone contributes more than all other industries in the state except the four food companies combined.

Rounding out the top states with 20 or more companies on the IW U.S. 500 list are Ohio, with 30; Pennsylvania, with 24; and Michigan with 22. Ohio's six chemical companies booked $101.8 billion in revenue, while four machinery companies added $18.1 billion. Also contributing is the nice-sized No. 15 company on the list, Marathon Petroleum Corp. ($72.3 billion).

Pennsylvania combines five chemical companies, with $31.9 billion in revenue, and three companies in the fabricated metal products industry, which contribute $22 billion.

Finally, Michigan rides the success of the state's two top-five ranked auto companies, General Motors Co. (No. 3) and Ford Motor Co. (No. 4), which combine for revenue of $301.9 billion. That's more than the state's nine motor vehicle parts makers, which clock in at $46.8 billion. Dow Chemical Co., the state's only chemical company, contributes $48.8 billion.

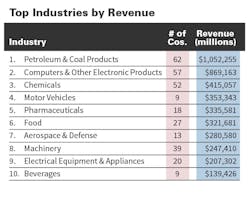

Once again big oil, computer/electronics, and chemicals industries finish far ahead of the other industries, with 62, 57 and 52 companies making the IW U.S. 500 list. Machinery finished fourth, with 39 companies, and food industries, fifth, with 27 companies.

Aerospace & defense companies and beverage companies also generate more revenue per company: the former, ranked 15th by number of companies with 13, ranks 7th by revenue ($280.6); the latter jumps from 18th with nine companies, to 10th by revenue ($139.5 billion).

The math works the opposite way as well, with the 19 fabricated metal products companies combining to contribute only $84.8 billion in revenue, and perhaps surprisingly, the 18 medical instruments companies tallying even less, only $74.5 billion.

About the Author

Patricia Panchak

Patricia Panchak, Former Editor-in-Chief

Focus: Competitiveness & Public Policy

Call: 216-931-9252

Follow on Twitter: @PPanchakIW

In her commentary and reporting for IndustryWeek, Editor-in-Chief Patricia Panchak covers world-class manufacturing industry strategies, best practices and public policy issues that affect manufacturers’ competitiveness. She delivers news and analysis—and reports the trends--in tax, trade and labor policy; federal, state and local government agencies and programs; and judicial, executive and legislative actions. As well, she shares case studies about how manufacturing executives can capitalize on the latest best practices to cut costs, boost productivity and increase profits.

As editor, she directs the strategic development of all IW editorial products, including the magazine, IndustryWeek.com, research and information products, and executive conferences.

An award-winning editor, Panchak received the 2004 Jesse H. Neal Business Journalism Award for Signed Commentary and helped her staff earn the 2004 Neal Award for Subject-Related Series. She also has earned the American Business Media’s Midwest Award for Editorial Courage and Integrity.

Patricia holds bachelor’s degrees in Journalism and English from Bowling Green State University and a master’s degree in Journalism from Ohio University’s E.W. Scripps School of Journalism. She lives in Cleveland Hts., Ohio, with her family.