Manufacturing is expected to grow over the next few years in the U.S. Even with a recent slowdown, a MAPI foundation report predicts U.S. manufacturing will grow slightly faster than the general economy in 2015 and 2016. Industry growth is a great opportunity, but doesn’t guarantee one’s success.

We believe efficiently meeting growth goals will be a real challenge for most organizations. Uncertain economic conditions and increased capital spending requirements will make committing future capital a greater challenge than it has been historically. The winners will be innovative leaders who can confidently target capacity growth investments by unlocking hidden opportunity in their existing assets and high impact, low cost capital.

Many Demands for Capital

A recent survey of US manufacturing executives showed that 57% believe their current assets are at “near full” capacity. Conversely, only 7% of executives felt their assets had significant unused growth capacity. This “near full” perception is understandable given the investments leaders have made in tools like Lean and Six Sigma which seek to get the most out of their capacity. Because leaders perceive a lack of capacity in their existing assets, they will turn to capital intensive options when large-scale growth is required.

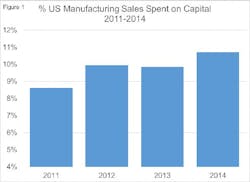

Unfortunately, cash to fund growth may not be as readily available as it has been in the past. Data shows capital spending is already growing faster than sales (figure 1), which means additional capital spending will face higher scrutiny.

Lastly, committing capital to growth will be challenging for leaders because of the uncertainty surrounding future economic conditions. As an example, uncertainty in U.S. dollar fluctuation could quickly alter your capacity strategy. Layer on top of this the worry that more than half of all major capital projects miss their cost, production, and/or schedule targets. Heavy capital investments will be a risky cornerstone for growth given an unknown market future and the typical underperformance of major projects.

Overall, growth opportunities may exist for manufacturers, but capitalizing on them will be more complex than in the past because of limits on the amount of capital available to commit to this growth.

Growing Companies Can Take a Different Approach

A small group of manufacturing leaders are capitalizing on growth in the face of uncertainty by looking at opportunities and investments differently. These leaders are utilizing an approach we are calling Zero Based Growth to create low-cost, low-risk capacity growth. Through this approach they are:

- Realizing more capital-free capacity in their existing assets

- Delivering substantial capacity gains from minor capital investments at a fraction of the cost of major project alternatives

- Reducing capacity growth planning horizons from years to weeks

We call this approach Zero-Based Growth because it builds on Zero-Based Analysis (ZBA), a methodology for finding all of the theoretical opportunity in a process. Zero-Based Growth uses a rigorous technical understanding of asset capabilities to find rapidly deployable, low-cost growth options. Where traditional approaches usually increase investment proportionally to growth goals, Zero-Based Growth-minded leaders achieve higher growth with a lower relative investment (figure 2).

In one example, a leading biological products manufacturer was able to realize an 80% capacity increase in a matter of weeks without capital investment. They initially believed their existing plant was nearing full capacity and were considering a costly capital expansion. There were strict quality and cleanliness standards which limited run times and production, and plant operations believed they had optimized their run time given the biological limitations they faced. The leadership group conducted a ZBA of the facility, which challenged what would be possible if the process fouling and other biological limitations of the process could be overcome. The team learned to approach these biological constraints as opportunities rather than limitations, and was able to prove that the process actually had the capability to increase production by 130%. ZBA made this magnitude of opportunity visible and enabled the team to quickly grow capacity without capital.

In situations where even more capacity is required, Zero-Based Growth-minded leaders are able to identify focused minor investments that unlock significantly more capacity at a fraction of the cost. This offers a much more attractive investment when compared to the traditional approach of building a new line or entire facility.

In another case, a leading food company had a new product with rapidly growing demand and planned to invest in a new production unit that would be expensive and take a year to build. Over the previous 12 months the process had increased performance and was running at its name-plate speed and a benchmark OEE for that product. Traditional analysis showed little opportunity existed to push this unit further.

The leadership team looked for opportunities with a different approach. By isolating each mechanical component of the process and assessing its theoretical maximum capability, the team found that all but one component of the unit actually had excess capacity. The entire unit was only limited by a single mechanical step. Instead of a major capital project, leaders twinned capacity in just that step by repurposing existing assets and increased output 50% in one-tenth of the time and cost of the proposed expansion unit.

Zero-Based Growth-minded leaders shorten their response time to add capacity. This allows them to reduce their planning horizons to a period where forecasts are more accurate. Maximizing growth from quick-to-implement improvements ensures leaders can grow capacity and allocate capital with more certainty while avoiding or deferring major capital investments.

Capital planning and growth investments will become increasingly important as leaders look to capitalize on growth and expansion in the upcoming years. Innovative leaders will use a Zero-Based Growth approach to stretch capital budgets and efficiently meet growth projections with confidence.

At Stroud International Taylor Milner, Mike George and Corey Pappel help businesses in consumer goods, energy, mining, and manufacturing industries uncover and realize untapped potential in their operations and capital project performance. Questions or comments: contact [email protected] or call 781-631-8806.