Several enormous, almost outrageous U.S. manufacturing expansion plans erupted in 2021.

In March, Intel Corp. announced that it would construct two new computer chip factories at an investment of $20 billion. Six months later, the manufacturer broke ground on that promise.

In April, Nacero Inc. said it would build a lower carbon gasoline manufacturing facility in Penwell, Texas: $6.5 billion to $7 billion in estimated spending.

And one of biggest announcements occurred in September, when Ford Motor Co. announced BlueOval City and BlueOval SK Battery Park, two mega complexes planned for Tennessee and Kentucky to support the automaker’s electric vehicle growth plans. In partnership with SK Innovation, the $11.4 billion investment is estimated to eventually create some 11,000 new jobs. That’s big. If plans remain on schedule, production will begin in 2025.

These announcements build on several known challenges facing the manufacturing industry: the growth of EVs, the lack of semiconductor supply (as well as the geographic imbalance of chip factory locations) and the focus on low-carbon living. Nevertheless, as big as these announcements are, they represent just a fraction of the new manufacturing facilities, revamped existing facilities and expansions that were reported or are underway in 2021 across the United States.

See Also: Manufacturing Expansion Across the US in 2021

As has become a year-end tradition at IndustryWeek, it is time again for review of manufacturing expansion across the United States. We looked at some numbers, dropped in on two manufacturers that recently have broken ground—fitness company Peloton Interactive Inc. and solar module maker First Solar Inc.—and shared a short menu of manufacturers who in 2021 reported plans to build new sites (plus one recent opening). Our takeaway: There’s a lot to be excited about when it comes to U.S. manufacturing, even as the industry battles against significant headwinds.

The Data Say

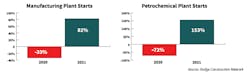

First, let’s discuss a few numbers to help define the manufacturing construction landscape. Construction starts took a big hit in 2020, according to data shared by the Dodge Construction Network, which tracks the commercial construction industry. The decline likely is not surprising, given the devastating collapse of the manufacturing industry in the second half of the year due to COVID. Petrochemical plant starts were down 72% in dollar value compared with the previous year, and manufacturing retreated by 33%.

This year’s data tells a different story, with manufacturing plant starts up by 82% year over year, and petrochemical plant starts up by 153%.

“Manufacturing construction is advancing in 2021 on the back of several notable projects, including petrochemical plants. Outside of petro activity, manufacturing construction related to motor vehicles and parts (such as battery plants for EVs), food-related production and chip fabrication plants are moving forward,” says Richard Branch, chief economist for Dodge Construction Network.

See Also: Growing a Manufacturing Plant on a Greenfield

The manufacturing construction advance is marching in step with industry’s improving fortunes. Manufacturing activity has been growing for 17 consecutive months as of October, according to the Institute for Supply Management data, rebounding robustly. Despite the bounce back, however, manufacturers continue to struggle finding people and getting materials to build product.

Branch noted the challenge—and opportunity: “The supply chain issues that the economy is facing will continue to exert positive pressure on manufacturing construction in the years to come in the sense that domestic producers will want more control over their supply chain and more options for supply other than international sources. That, of course, is a huge positive for manufacturing construction starts. This potential, however, is not without its challenges. The manufacturing sector is facing a severe shortage of skilled labor that will inhibit growth.”

It’s in this landscape that many manufacturers are putting down U.S. roots. Two such manufacturers shared their progress.

Peloton Output Park

On a hot August day in Troy Township, Peloton broke ground on its first dedicated U.S. factory. The new facility represents a $400 million investment and will occupy more than 1 million square feet. When completed, Peloton Output Park, as it’s called, will be one of the largest connected fitness manufacturing plants in the world, the company says. By early November, walls were going up, and Peloton’s Brad St. Louis said the company expects to have an enclosed building by February.

St. Louis, senior manager for automation and controls, recently took time away from new plant preparations to discuss the company’s vision for the site. “If I were to show you a layout, I like to describe it as a small pre-planned city,” he says. And it’s a city where flexibility is a key characteristic, purposefully integrated to help the company quickly address changes in demand.

See also: Peloton Cancels Plans for Ohio Plant

Practically speaking, that means big dollars won’t be spent on massive purpose-built assembly lines that may look good in the short term, but which can become monuments of inactivity if demand for that product changes. Instead, think smaller and more nimble processes, with room for growth. That same thinking translates to technologies like the paint system, where changes to product mix shouldn’t require major modifications to the system, but instead may just require tooling changes. Additionally, the space is well thought out to always preserve material flow from raw steel through assembly, St. Louis says.

“We really are going into this with flexibility and agility,” he says. Interestingly, despite his technology title, the senior manager for automation and controls takes a measured approach to technology implementations. “I’ve done projects where it felt like automation for the sake of automation, and those never turn out well. Automation to solve known problems is much more of a win,” he says.

“The philosophy is let’s address problems as they arise; we have a lot of time to grow into this factory, and there’s no reason to do a million things the day we open the doors.”

That said, the new Peloton site, which St. Louis describes as [Industry] 4.0-ready, won’t be lacking in automation. Robots will handle welding duties as well as other tasks where precision is required. And “I’m all for automation… where it could be harmful to humans for ergonomic reasons,” he says. Moreover, “I like to say I empower people through technology.”

Ultimately, Peloton wants employees to embrace this facility for the long term, and such thinking helps guide decision-making around automation and other aspects. “We want this to be a fantastic place to work. I want to see some of the lowest turnover in the area for employment. When we take the time to train somebody, I want them here forever,” St. Louis says.

Production at the site is anticipated to begin in 2023.

(Caption for top photo: In August Peloton broke ground on its first dedicated Peloton factory in the United State.)

A First Solar Boost

Like Peloton, First Solar Inc. broke ground on a new manufacturing plant in August, and also like Peloton, the facility is in northwest Ohio. However, for First Solar, Ohio is a known quantity. This new facility will be its third in northwest Ohio, where it’s had a presence since 2002.

The manufacturing plant, which represents a $680 million investment, will be huge at 1.8 million square feet, and it’s expected to create 700 permanent jobs. Here’s an interesting tidbit: First Solar believes that once this latest facility is fully operational, the company’s footprint in northwest Ohio will make it the largest fully vertically integrated solar manufacturing complex outside of China. If all goes smoothly, operations will begin in 2023.

As First Solar builds out its new site, a focus is on optimization, says Mike Koralewski, chief manufacturing operations officer. “You think about the optimization of the site, the optimization of the building, the optimal optimization of the process,” he says. And don’t forget the optimization of the supply chain that feeds the plant. “And across all of those are kind of how you optimize your people,” he adds.

A key to that optimization will be automation. Koralewski cited Industry 4.0 architecture, machine-to-machine learning, artificial intelligence and Internet of Things connectivity as among technologies that will help the plant succeed.

“Our automation is absolutely going to step up tremendously,” he says. “How the machines react and recover among themselves; how materials are delivered to the line; the interface of a person to an asset, will all be different.”

Koralewski says such technologies are a game-changer for First Solar. Moreover, he adds, they also are going to allow the workforce to upskill, “which allows them to grow and evolve themselves as our factories and processes evolve.”

Asked what excites him most about First Solar’s new plant, the chief manufacturing operations officer looks to the bigger picture. “There are a few things that to me are very exciting. No. 1 is that this is the continued growth of manufacturing in the U.S.”

Continued U.S. growth. Increasing manufacturing competitiveness. A growing domestic supply. What’s not to like?

About the Author

Jill Jusko

Bio: Jill Jusko is executive editor for IndustryWeek. She has been writing about manufacturing operations leadership for more than 20 years. Her coverage spotlights companies that are in pursuit of world-class results in quality, productivity, cost and other benchmarks by implementing the latest continuous improvement and lean/Six-Sigma strategies. Jill also coordinates IndustryWeek’s Best Plants Awards Program, which annually salutes the leading manufacturing facilities in North America.

Have a story idea? Send it to [email protected].