Editor’s note: Welcome to So That Happened, our editors’ takes on things going on in the manufacturing world that deserve some extra attention. This will appear regularly in the Member’s Only section of the site.

Don’t Call It the Rust Belt

Ohio’s governor, senators and representatives were, understandably, delighted by Intel’s January announcement that it plans to invest $20 billion in semiconductor manufacturing in the state—and go up from there if all goes well. While Ohio has always had a robust network of specialized, often small- and medium-sized manufacturers, in recent memory it has not been the place where big-name, high-tech manufacturers invest hundreds of millions, let alone many billions, of dollars.

But amid the speeches and handshakes at the big press conference to celebrate the investment (fanfare highlights: the president of Ohio State, Kristina Johnson, talking of her past life as a chip designer for Nvidia and Samsung—cool!—and Gov. Mike Dewine’s still-stunned-at-the-big-news, gleeful countenance throughout the day) one refrain rang off-key: that Intel was bringing a slew of good-paying jobs to the Rust Belt.

“We Are Finally Burying the Term Rust Belt” proclaimed the headline of a press release from Ohio Sen. Sherrod Brown, which announced the Intel investment. “Goodbye to the Days of the Rust Belt” a Wall Street Journal article declared.

The Intel jobs are certainly good-paying: $135,000 for production workers is enough in this region for a family of four to buy a house, go somewhere on vacation each year and solidly save for college and retirement. But New Albany, Ohio, is not the Rust Belt. New Albany, and the Columbus metropolitan area that it is a part of, are not among the smokestack cities decimated by the outmigration of manufacturing jobs to the southern U.S. and overseas in the 1980s. Youngstown/the Mahoning Valley, Cleveland, Akron, Toledo—those are the factory towns that lost most of their population in the past 40 years, and none is within 100 miles of New Albany.

Cleveland’s median income in 2019, according to the U.S. Census: $26,150. Columbus’s: $45,659. New Albany, Ohio: $196,030.

Child poverty rate in Cleveland in 2019: 46.1%. Child poverty rate in Columbus: 20.8%.

Cleveland is the Rust Belt. Pittsburgh and Flint, Michigan, are the Rust Belt. You could even argue Cincinnati, which was built on the iron production and meatpacking industries, has endured Rust Belt effects. But Columbus has historically had a more diverse economy that is a mix of banking, insurance, education, government and agriculture—not solidly manufacturing.

The area where Intel will locate is the state capital and home to the Ohio State University, not insignificantly the largest public university in Ohio (at nearly 68,000 students, No. 3 in the country) and where most of the state’s high-tech research dollars pour in.

Although here in Cleveland where IndustryWeek is based, we’re happy that jobs will soon be rolling into our state, we’re still hoping and laboring to bury the Rust Belt mantle, and feeling that familiar feeling that, once again, we weren’t chosen.

There are bright spots for the manufacturing economy in Rust Belt Ohio cities—like the new Ultium lithium-ion battery plant under construction near Youngstown, a partnership between GM and LG—but we are not there yet.

Who Needs to Spend $450 million?

A lot of manufacturing executives, investors and—well, just about everyone else, really—are keeping close tabs on the comings and goings in the booming electric-vehicle sector. Tesla is looking to crank up production by more than 50% this year and other industry upstarts are increasingly finding their feet in what looks to be a years-long race to grab market share. But could eVTOLs—electric vertical take-off and landing aircraft or, more colloquially, air taxis—become a similarly competitive big industrial battlefield?

We’re always here for a zinger such as this – and think we’ll be paying a good bit more attention to eVTOLs going forward.

Component Manufacturers Rarely Contribute—That’s Good News

The U.S. Government Accountability Office recently shared its conclusion regarding the contribution of certain manufacturing defects to accidents along the nearly 350,000 miles of interstate gas and hazardous liquid transmission pipelines that crisscross the United States.

While any defect is one too many, particularly when it leads to an accident, the GAO findings showed that component manufacturers of fittings, flanges or valves rarely contribute to such calamities, big or small. That’s positive news.

The congressional watchdog review was conducted at the behest of several congressional representatives who had expressed concern about the manufacturing process for pipeline components.

According to the GAO, of the 1,529 accidents that occurred between 2016 and 2020 along this important pipeline network, fewer than 2% were due to manufacturing defects in fittings, flanges or valves. The agency analyzed data from the Pipeline and Hazardous Materials Safety Administration and interviewed PHMSA officials and industry stakeholders to develop this report.

The GAO findings were released at the end of January.

Specifically, the report noted that 23 accidents included manufacturing defects in fittings, flanges or valves as a contributing factor. None of those accidents resulted in injuries or fatalities, and the amount of product released during the accidents was less than the average for all accidents.

“Many selected stakeholders said that manufacturing defects in pipeline components rarely contribute to accidents,” according to the GAO. “For example, NTSB officials who investigate pipeline accidents said they rarely see manufacturing defects in pipeline components lead to accidents.”

More detail can be found in the full report.

Campbell Soup Named to Gender-Equality Index

First, I must admit I have a sweet spot for the Campbell Soup company. While it might be left over from fond childhood memories, it was further strengthened two years ago when I interviewed its former CEO Doug Conant, who now runs a leadership company. It was one of the best interviews I have had in my 18 years with IndustryWeek.

So when I saw at the end of last month that the company was named to the 2022 Bloomberg Gender-Equality Index (GEI), for the fourth consecutive year, I was quite pleased. The GEI is comprised of 60 questions, based on optional disclosure in metrics related to these categories:

- Female leadership & talent pipeline

- Gender pay & equal pay parity

- Inclusive culture

- Anti-sexual harassment policies

- Pro-women brand

The 2022 index is comprised of 418 companies with a combined market capitalization of $15 trillion, located in 45 countries and regions and across 11 sectors.

“We are committed to living our values and creating a culture where all employees feel safe, valued and supported to do their best work,” said Camille Pierce, Campbell’s chief culture officer and head of talent, said.

The company has a number of initiatives supporting this goal, including an employee resource group, called the Women’s Inclusion Network, which offers inclusive mentoring and sponsorship opportunities. A partnership with the Network of Executive Women provides professional development. And the company works with nonprofit Path Forward to offer “returnships” to help midcareer professionals reenter the workforce.

Additionally, all salaried employees have a performance objective related to inclusion and diversity.

Building Racial Equity in Manufacturing

Manufacturing companies have been very active in DE&I over the past few years, and following that lead, on Feb. 1, The Industry and Inclusion Cohort, added 13 community colleges to continue their mission of ensuring inclusivity in manufacturing.

The group notes that while the sector gained much attention due to the pandemic, it also caused record unemployment for people of color at a disproportionate rate, compounding “the effects of systemic racism that make it more difficult to attain well-paying jobs in the first place.”

So, pulling together community colleges in a more concerted effort is a path to more racial equity, according to the group. “Community colleges are uniquely positioned to connect more people, particularly people of color, to well-paying and sustainable jobs, such as those in the manufacturing industry,” says Andrew Stettner, a senior fellow at The Century Foundation, one of the organizers of the coalition along with the Urban Manufacturing Alliance. “Our coalition will work to align credential programs at community colleges with industry needs, and to ensure that a more diverse workforce feels supported and is able to take advantage of such opportunities.”

Community colleges join the Industry and Inclusion 2.0 cohort include:

- Bishop State Community College (Mobile, Alabama)

- Pima Community College (Tucson, Arizona)

- Sierra College (Rocklin, California)

- Norco College (Norco, California)

- Community College of Denver (Denver, Colorado)

- College of Lake County (Grayslake, Illinois)

- Ivy Tech Community College (Indianapolis, Indiana)

- Hawkeye Community College (Waterloo, Iowa)

- Baton Rouge Community College (Baton Rouge, Louisianna)

- Forsyth Tech Community College (Winston-Salem, North Carolina)

- Lorain County Community College (Elyria, Ohio)

- Houston Community College (Houston, Texas)

- Milwaukee Area Technical College (Milwaukee, Wisconsin)

Lee Wellington, executive director of the Urban Manufacturing Alliance, said, “Manufacturing provides much-needed opportunities for equitable economic development in American cities. The past few years have underscored the importance of local production ecosystems, from producing essential personal protective equipment to responding to increased demand for energy efficient materials, and much more. "

Have PTO, Will Travel

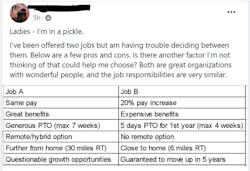

This fascinating and, lately, relatable conundrum was shared in the Cleveland Women’s Networking group on Facebook. Within four hours, the post had collected 325 comments.

The overwhelming choice: Job A.

A smattering of responses:

“I would pick A because what is important to me is a good PTO policy and hybrid work environment with flexibility to work from home and good medical. I think you need to decide what matters the mostly to you. The 20% pay increase you need to consider with the expensive benefits probably won’t math out to be a 20% pay increase.”

“A for hybrid!!! That will be more of a blessing than you realize! Not paying for gas alone is a raise!!”

“If there were no other factors ... A. You get more at home time with a hybrid option and the additional PTO. Who knows if in five years you'd be at that job to be able to see that promotion opportunity come to fruition. Five years is a short time and a long time all at once.”

“I’d go with Job A. Expensive benefits to me is a sign that a company does not overly respect or care about its employees.”

“I have taken a pay cut before to have more PTO and be able to work from home, and I don’t regret it one bit. I would see if you have the ability to negotiate a higher salary or see when you have the ability to get a raise.”

And, finally, a contrarian view: B would be my option but I also don’t have any kids, and the close to home feature is like adult goals for me right now lol.

Food for thought, manufacturing leaders. And note to HR: Best spell out during the interview process how remote, exactly, remote is. Because unless the job is fully remote or the remote option is completely flexible, there’s soooo much room for misunderstanding.

Waving Goodbye to Peloton

The news coming out of fitness company Peloton is nothing but ugly. Riding high one moment, spiraling downward the next. Not only is CEO John Foley, who co-founded the firm, replaced, but approximately 2,800 employees are let go and full-year guidance released February 8 (in the Q2 earnings announcement) is revised sharply downward--to $3.7 billion to $3.8 billion from the $4.4 billion to $4.8 billion forecast in Q1. Rumors of several interested buyers are rampant.

As a native Ohioan, I’d been pleased to see Peloton come into the state. Less industrial, more high-tech, I thought it introduced a new manufacturing vibe to the state. Now, however, it is out just as quickly as it was in.

The Peloton plant appears to have succumbed in part to the very factors it was attempting to address. “We really are going into this with flexibility and agility,” to meet changes in demand, I was told last year. That meant the introduction of smaller, more nimble processes that could quickly adapt to the ebbs and flows of individual product demand. Monuments to a single product were going to be few and far between.

Now, however, it’s overall demand that has brought the company up short.

What’s next for Peloton has yet to play out, but it’s likely more big changes are on the horizon. I’ll miss the promise of a Peloton plant. Welcome, Intel, to Ohio.

About the Author

IW Staff

Find contact information for the IndustryWeek staff: Contact IndustryWeek