Breakthrough or Expensive Dud? What Product-Centric Design Can Teach Us

A manufacturer of handheld scanners and mobile computers—hungry to make its mark against bigger, more established competitors—hit upon a strategy: Design a new device that delights customers in ways no competitor can. To guide this quest, the company’s leaders and sales team sought out the voice of the customer, asking: “What could we bring you that no one else does?”

Customers responded with a wish list (for example, a much larger display, similar to an iPhone Pro) which the company leaders, trusting the gospel of customer-centricity, embraced as their road map to business success. Their excitement grew as they conceived and designed a device they thought would transform their industry by providing everything customers say they want, but currently could not have.

As you’ve probably guessed by now, that is not how this story ends.

Building the complex, game-changing device required costly custom components and specialized capabilities that the company’s existing supply network could not deliver. Undeterred, it sought out new suppliers with (literally and figuratively) the right stuff. The company soon found, however, that qualified suppliers were not particularly interested in working for a relatively small player from an industry outside their target market. As such, essential new suppliers demanded premium pricing. Additional costly investment was needed to augment the company’s manufacturing capabilities.

The company soldiered its way through these and other obstacles to successfully initiate production, only to learn that customers were not pleased by some of the features they had said they wanted. The large display, for example, made the device too large and awkward to operate. Three years of sustained, impassioned effort left the company at a dead end. No meaningful revenue was realized from the “breakthrough” product.

Product-Centric Is Not a Dirty Word

The moral of this cautionary tale? Balance. After decades of management oracles touting the virtues of being customer-focused, customer centricity is now so deeply ingrained in the corporate ethos, any other perspective may be viewed as heresy. We absolutely believe companies should be customer-focused, but that does not make product-centric a dirty word. In fact, to fulfill your true business potential, your passion for serving customers must be balanced with reasoned considerations of what is best for both your customers and your company, particularly over the long term. After all, if you allow crucial decisions to be overly blinded by passion, you may soon not be around to serve customers at all.

Product-centricity is a form of realism. Your company makes money by selling products, and product experiences are how most customers realize value from all your efforts. Further, the products you make shape your operations, which in turn largely determines how prepared you are to cope with today’s chronic supply shortages, shipping disruptions, sudden spikes in demand, and other logistical challenges.

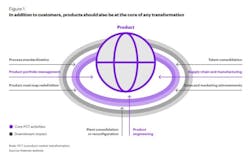

For all these reasons and more, we believe products should join customers at the center of your efforts to optimize every aspect of your company (see figure 1).

This product-centric perspective arose from our work in the Product Excellence and Renewal Lab (PERLab), where we often conduct teardowns with clients to uncover hidden value potential in their products. These back-end explorations open fresh insights that extend far beyond the product itself, helping clients to reimagine how and where products are made, sourced and shipped, as well as how each of those variables might positively impact the performance of the company’s overall portfolio. Even when starting with a single product, one may soon envision the transformation of an entire business.

The Value Stick: What Drives Your Margin?

The basic principles underlying product-centric transformation (PCT) are captured in an elegantly simple model created by two Harvard Business School professors to convey what drives a company’s margin. Our adaptation of this “value stick” is shared in figure 2.

This streamlined rendering offers a reminder that your margin is largely determined by the difference between your customers’ willingness to pay (which impacts price) and your suppliers’ willingness to sell (which shapes your cost). Margin is driven by lowering costs while increasing price.

Granted, this is hardly revelatory, yet there is now such a strong tendency to focus on customers’ willingness to pay, one can easily forget to carefully consider (as in the brief vignette that opened this article) suppliers’ willingness to sell. We believe failure to keep the full value stick front of mind has played into today’s chronic shortages of critical supplies—an environment where motivated suppliers can make a big difference.

In sum, PCT allows a multitude of levers to work seamlessly together, globally and across a portfolio, to optimize margin while making operations more resilient in the face of unanticipated disruptions.

Product-centric transformation begins with the premise that it is better to create a product that is 80 to 90% perfect for the customer, and thus still highly competitive, while ensuring it will also be profitable for the company and relatively simple to manufacture, launc, and support. By maintaining your focus on both ends of the value stick, you also design products that drive demand for other parts of your portfolio, help optimize your operations, reduce your manufacturing and procurement costs, and grow your product margins.

Significantly, the PCT approach replaces serial decision-making—in which design and portfolio choices are made without full consideration of their operational implications―with concurrent decision-making involving multiple functions. Before you commit to a product, you know how to make, source, and deliver it, connecting all the dots up front.

The PCT approach is also forward-looking, determining answers to big questions such as “What kinds of technologies do we currently use that could be supplanted in the next five years?” and “Where are our best platforming opportunities, including across multiple regions or business units?” Further, it pursues exponential value gain via global optimization, versus local and single-product optimization that often proves sub-optimal results across the portfolio. As such, product-centric transformation is typically a CEO-sponsored strategic initiative, guided by ambitious objectives and strategic priorities shaped by the C-suite in consultation with the board.

Case Study in Margin Growth

Anything labeled a “transformation” should deliver big results. Product-centered transformation lives up to that billing. Case in point: a PCT program for a $5 billion manufacturer of residential building products improved the company’s margin by 850 basis points.

The company had recently been carved out of a much larger corporation and was still struggling to find its footing. Its stock had declined precipitously, and it had been through some unsettling leadership transitions. We were initially invited by the C-suite and board to help review the product portfolio for low-hanging fruit at the top of the value stick—in other words, “Where is there white space to increase volume?” “Where might we price more aggressively to increase revenue?”

The answers to those questions proved complex, as the company is in a competitive marketplace with changing customer preferences. Further, we found that the product portfolio inherited from the legacy BUs was an ongoing drag on the company’s growth and productivity.

For example, one product line offered more than 50 color choices, many of which were difficult to discern from others (in other words, “50 shades of white”). Similarly, more than 100 different kinds of chips were used, when we could identify a clear need for no more than nine. Most of these inherent inefficiencies stemmed from siloed product development that was locally optimized. That is, a given product might use unique components to save a few cents on a $10 cost, which made perfect sense—until the client viewed those choices from an enterprise perspective. Sourcing so many different components and maintaining them in inventory was quite costly. The multitude of components also complicated engineering, making it difficult to maintain products, adapt quickly to changes triggered by component obsolescence or apply innovations developed for one product in others.

In response, the project evolved into a more comprehensive approach that spanned not only portfolio and pricing, but also engineering, design and supply chain. We worked with client teams to pursue a range of portfolio, pricing, engineering, design and supply chain initiatives, all through the lens of product families. In contrast to top-down data exercises defined in spreadsheets, teams pursued a broad array of improvement opportunities through the lens of individual products. They began, for example, by asking: “How should our portfolio of thermostats be designed to simultaneously meet varied customer needs, keep a competitive edge, be manufactured profitably and be resilient in the face of supply disruptions?”

The result? 850 basis points of gross margin growth by year three of the program. The PCT initiative was highlighted in investor presentations, which helped drive a 300% increase in the company’s share price over two years.

Companies’ efforts to become more customer focused have yielded no shortage of positives, but one glaring negative is that a passion for delighting customers, unbalanced by product perspectives, can create blind spots that lead businesses to leave significant margin on the table. Viewing both ends of the value stick simultaneously inspires various BUs and functions to shed siloed approaches to instead help each other be more successful. This, in turn, yields unprecedented levels of effective coordination, efficiency and process optimization; avoids cannibalization of one’s own portfolio and other costly mistakes; and steadily drives up operating and profit margins.

Alexander Bruns and Kushal Fernandes are Principals in the PERLab division (Product Excellence and Renewal Lab) of Kearney, a global strategy and management consulting firm.. The authors extend thanks to Bharat Kapoor, Kearney partner and Global Lead of PERLab, for his contributions to this article.

About the Author

Alexander Bruns

Prinicpal, Kearney

Alexander Bruns leads the Mechanical Tower of Kearney's Product Excellence and Renewal Lab (PERLab). In 2019, he transferred from Kearney's DACH unit to our US unit to apply his expertise in a new region. He supports his clients on transformational projects targeting margin improvement through Design to Value, platforming, and complexity reduction. Hid extensive project experience spans across various industries from automotive, over high-tech and consumer electronics, to fashion. He earned a Master’s degree in Industrial & Systems Engineering from the University of Rhode Island, USA and a Master’s degree in Industrial Engineering from the Technical University Braunschweig in Germany.