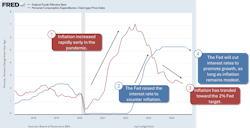

This week’s interest rate cut by the Federal Reserve signals a closing chapter of higher interest rates put in place to curb hot pandemic-era inflation. The 50 basis points (bps) drop means rates went from a range 5.25% to 5.5% down to a target range of 4.75%-5%—a cut larger than some anticipated. With the inflation rate now trending toward the Fed’s 2% target, there is more wiggle room to allow interest rates to fall even further.

Why Cut Rates Now?

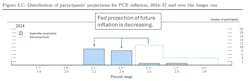

The rate cut comes at a precarious time for the U.S. economy. The Fed’s dual mandate is to promote maximum employment and stable prices. The rate of inflation is trending toward the Fed’s 2% target as internal projections of future inflation show a further decrease.

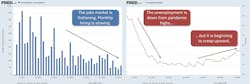

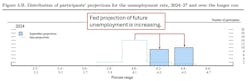

But on the other side of the ledger, jobs have softened. Hiring has slowed, and the unemployment rate is creeping up.

More concerning, the Fed expects unemployment to increase further.

Interestingly, rate cuts frequently correlate with recessions. The chart below shows the seven most recent recessions correlated with rate cuts. To be clear, rate cuts do not cause recessions. But they are best identified in the rear-view mirror. The intuition is that the Fed is always behind the market, and a rate cut is a “rearguard action” to stave off recession. As prospects for economic growth weaken, the Fed reacts with a rate cut to reverse the tide.

More Rate Cuts to Come

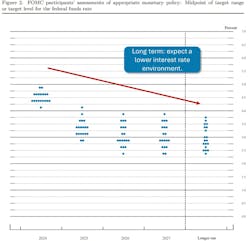

The cooling of inflation and rising unemployment caused the Fed to cut by 50 bps instead of the 25 bps that the market expected. Despite employment concerns, there is reason to be optimistic. The Fed’s long-term target for the federal funds rate shows a gradual decline toward a modest 3%. This return to normalcy will allow manufacturers a modicum of certainty when planning for capital projects that drive long-term growth.

There may be more help on the way. Given the long-term projection above, the Fed cutting cycle will likely stretch through the end of 2024 and beyond. The CME’s FedWatch tool projects additional 50-75 bps worth of cutting by the end of 2024.

Even in the best of times, there is a lag between interest rate reductions and an impact on demand. Conventional wisdom is that lower interest rates make borrowing less expensive, which improves demand. Customer project ROI becomes more attractive, borrowing gets cheaper and debt refinancing can improve cash flow.

While the conventional wisdom of increased demand is true, what we don’t know is when it will play out. Don’t expect across-the-board jumps in orders to materialize overnight. Companies may sit on the sidelines until the cutting cycle is complete before jumping back into the fray.

Seven Opportunities to Adapt and Capitalize on Decreasing Interest Rates

Changes in interest rates are always a double-edged sword. Lower interest rates typically support conditions for market growth, but they can also bring about unwanted side effects. A well-thought-out response to the rate cuts will include some offense and some defense.

1. Tighten the belt on borrowing – In a vacuum, lower interest rates mean cheaper borrowing, but many manufacturers borrowed heavily during the pandemic when rates were near zero. According to The Economist, over $2.5 trillion in corporate loans are due to be refinanced by 2027, with $700 billion due in 2025 and over $1 trillion in 2026. If your loans are coming due with higher interest rates, consider reducing debt or delaying refinancing until rates fully drop, likely by 2025. In the meantime, you may need short-term solutions like bridge loans or temporary credit to manage the gap.

2. Reassess incremental opportunities – Deals that were already a definite “yes” or “no” probably won’t change because of lower interest rates. Savvy companies will focus on the “maybe” deals that need a little push to become a “yes.” Lower interest rates can make projects more appealing by improving ROI and financial performance, which might be enough to close those undecided deals.

3. Look to foreign markets – When interest rates drop, the U.S. dollar becomes cheaper, making exports more affordable. Companies with international reach should seize this chance to boost their competitiveness overseas. However, this advantage may be fleeting. Other countries can lower the value of their currency to support their own exports, so it's important to act quickly to take advantage of the opportunity.

4. Work the job market – A weaker job market could benefit employers by allowing them to hire superior talent at better rates. With potential growth on the horizon due to higher demand and coupled with advantageous hiring, companies should consider expanding the workforce or upgrading talent while keeping headcount stable.

5. Watch for inflation, redux – Rate cuts make borrowing cheaper, which increases demand and can push prices up, causing “demand-pull inflation.” If this happens, companies may have to increase prices for their customers again, which could be a tough pill to swallow after the past three to four years of price pressure. Be aware of your customers’ willingness-to-pay thresholds. If inflation rises quickly, the Federal Reserve is likely to raise interest rates to control it.

6. Manage input costs – The same demand growth that could drive customer prices to increase will also impact your input costs. Vendors will be on the hunt for increases, so instruct procurement teams to proactively lock in supply with forward buys before prices go up. They should also solicit bids to create competition among suppliers to keep costs low.

7. Act with caution – Rate cuts are not the time to get overly optimistic. As illustrated earlier, initial cuts tend to correspond with recession as the Fed tries to stave off market softness. Smart companies will remain disciplined and act deliberately to capture new opportunities without overextending.

Agility is the key. Adapting to market change first requires an understanding of what is happening and then charting a path forward. The good news is there are plenty of opportunities to position yourself for smart growth at the end of 2024 and beyond.

About the Author

Dan Cakora

Pricing Economist, Vendavo

Dan Cakora is a pricing economist and business consultant with vendavo, a SaaS market leader in B2B pricing, selling and rebate solutions. Dan has worked in various aspects of pricing for over 15 years. He started his career as a field economist, responsible for helping to measure inflation for the federal government. Before joining the Vendavo team, Dan was a customer at a large, international B2B distributor. He has led pricing teams, developed pricing and sales enablement products, and has a passion for data visualization. Dan has an MBA from DePaul University and a BS in economics from Purdue University.