The CARES Act, which was signed into law in March 2020, was an early federal legislative response to the COVID-19 pandemic. Among other initiatives, it created an “employee retention tax credit” that allowed eligible employers to earn a refundable tax credit for wages paid to employees during periods that the employer’s business was subject to a suspension, a shutdown, or a significant decline in revenues.

Despite its good intentions, the tax credit was not widely used by employers with fewer than 500 employees. Why? Put simply, employers that borrowed funds under the Paycheck Protection Program (PPP) loans could not take advantage of the credit.

In late 2020, Congress passed new legislation to close this gap. Included in the Consolidated Appropriations Act (CAA) that was signed into law on December 27, 2020, are several key provisions that allow employers with PPP loans to take advantage of the credit, increased the amount of the available tax credit, and allowed employers to obtain the credit for qualifying wages paid from March 2020 through June 2021.

Does my company qualify?

Under the CAA, employers are eligible for the retention tax credit under either of two scenarios:

1. The employer’s business was “fully or partially suspended” due to a government order.

2. The employer experienced a significant decline in gross receipts.

A suspension of business means that an employer’s operations has been, or continues to be, limited wholly or in part because of a government order that affects commerce or travel. Such an order might include limits on the number of people who are permitted to gather in one place or the number of hours that a business can stay open. An important caveat: Employers that were or are able to continue business operations on a completely remote basis through teleworking are not considered to have experienced a qualifying suspension of operations.

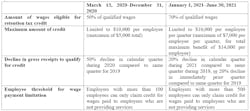

A significant decline in gross receipts means that an employer experienced a decline of at least 20% in gross receipts during a calendar quarter in 2021, compared to the same calendar quarter in 2019. Alternatively, for calendar quarters in 2021, an employer may elect to use the immediately preceding calendar quarter and compare gross receipts to the same quarter during 2019 to determine whether the employer qualifies. For example, to determine eligibility for the tax credit during Q1 of 2021, an employer could compare Q4 of 2020 to Q4 of 2019.

For wages paid during 2020, the decline in gross receipts must be 50% or more for a calendar quarter in 2020 compared to the same quarter in 2019. Employers that previously could not claim the credit due to having PPP funds may now retroactively take a tax credit for calendar quarters during 2020 if they meet this decline in gross receipts standard.

How much is the tax credit worth?

For periods on or after January 1, 2021, the amount of the tax credit available is 70% of “qualified wages” (cash compensation plus qualified health plan expenses) paid through June 30, 2021, up to a limit of $10,000 for each employee (in other words, a maximum tax credit of up to $7,000 per employee per quarter, or $14,000 per employee in total). This figure is more generous than the tax credit available during 2020, which was 50% of qualified wages paid per employee for all quarters (in other words, up to $5,000 per employee).

What additional specifics should I know about the credit?

How do I claim the credit?

Employers claim the credit by offsetting applicable employment tax withholdings to the IRS. In connection with the direct offset, an employer reports total qualified wages on its federal employment tax returns (IRS Form 941), which has been amended to include reporting of employee retention tax credits.

Alex H. Glaser is a partner in the Tax Practice Group at Jones Walker LLP and Curt R. Hearn has been co-lead of the firm’s Corporate Practice Group for the last 20 years.

About the Author

Alex H. Glaser

Partner, Jones Walker LLP

Alex H. Glaser is a partner in the Tax Practice Group at Jones Walker LLP.