Labor and Supply Chain Worries Resurface Among Manufacturing CEOs [Tales From the Transcript]

Vigilance and discipline remain watchwords in the industrial sector, our latest analysis of the earnings call transcripts of 50 prominent U.S.-based manufacturers shows.

With demand not broadly strong or consistent enough to reward big bets—the Institute for Supply Management’s benchmark manufacturing index has been in contractionary territory since April—and cost pressures enduring enough to warrant ongoing action, many executive teams are reaching again for the cost-shaving playbook they used to profitable effect during and shortly after the depths of the COVID-19 pandemic.

“The fitter we get, the more optionality we have to play as we go forward […] Any place we can’t get a return, we will not be warehousing capacity.” Gordon Hardie, CEO of O-I Glass Inc. said Oct. 30, succinctly putting into words the approach many of his peers also are continuing to take.

Hardie and other leaders of Ohio-based O-I are looking to generate at least $100 million in annualized savings from the closure of at least 7% of the company’s production capacity. They’re also looking to restructure the company’s organizational chart to generate tens of millions of dollars more in savings.

Ditto at Builders FirstSource Inc., where CEO-Designate Peter Jackson said his team remains “disciplined stewards of discretionary spending” while “continuing to maximize operational flexibility”—and that’s after consolidating 11 facilities in the first 10 months of this year. Executives at Textron Inc. as well as various agricultural equipment manufacturers and auto parts suppliers made similar statements. In short, the belt will remain tight.

Three months ago, Tales From The Transcript—our deep dive into the quarterly earnings calls from leading names in 10 sectors of the IndustryWeek U.S. 500 list of the largest public manufacturing companies—focused on the level of uncertainty many leadership teams discussed heading into fall. (See the sidebar here for that recap and others from 2024.) This time around, our scores tracking forward-looking statements about demand, the supply chain, inflation and the labor market again came in far closer to neutral than in 2022 and 2023, suggesting the uncertainty—and the focus on discipline it is spurring—will endure even if there are new signs of optimism about 2025.

The scores and summaries below reflect calls held from late September to the third week of November. As always, we’ve arranged them from most negative to most positive.

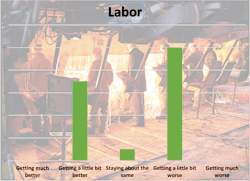

Labor: -0.08 (-0.03 in Q2 and 0.03 in Q1)

Did you get frustrated during your latest trip through the health benefits open enrollment process? It sounds like UFP Industries Chairman and CEO Matt Missad was, too. Talking to analysts Oct. 29, Missad was broadly critical of several states’ “new mandated benefits and regulatory burdens” hurting UFP’s margins but also homed in on higher healthcare benefit costs “driven in part by mandatory coverage requirements and unnecessarily expensive pharmaceuticals.”

Missad’s comments nicely reflect how workforce-related comments from the leaders we follow for this feature have shifted over the past year. Given the secularly tight labor market, there are still concerns about where to find talent to grow—to that point, the skills availability measure in the Richmond Fed’s survey of manufacturing activity has steadily deteriorated this year—but more of the commentary we’re fishing out of transcripts focuses on cost and the expectation that wages and benefits will continue to be a pesky nuisance at best and a chronic pain point at worst.

To wit, Sherwin-Williams Co. CFO Al Mistysyn: “We have wage inflation—which is more of a typical increase that we’re expecting in 2025—but also healthcare [will] be significantly higher year over year.”

Which leads us back to the plans from OI and others outlined above. At auto parts supplier Lear Corp., President and CEO Ray Scott said wage inflation is leading his team to “aggressively” seek out lower-cost manufacturing sites. In North America, he said, that means moving more wire operations to Honduras.

Supply chain: -0.03 (0.26 in Q2 and 0.07 in Q1)

Blame Boeing? We kid—although maybe only a little bit, since TransDigm Group Inc. Co-COO Mike Lisman pointed to this fall’s strike by machinists at the industry giant as a reason the aerospace supply chain’s situation will get worse before it gets better.

Angsty commentary from big aerospace and defense companies is the primary reason the broad optimism of our supply-chain reading from three months ago has evaporated. At Lockheed Martin Corp., CFO Jay Malave said executives’ upbeat growth outlook “remains tempered by our current assessment of the pace at which the value chain can meet the demand.” And the commentary from Northrop Grumman Chair and CEO Kathy Warden was even more somber.

“They aren’t concentrated in any one area of the business,” Warden said Oct. 24 of the supply-chain challenges. “They’re broad-based and they tend now to be more supplier-dependent. And so we are working with individual suppliers to help them address their particular challenges.”

In so many words, there will be no quick fix.

Beyond aerospace, there were similar mutterings in the automotive and diversified industrials segments. Regarding the former, it’s worth noting that the recent news from Dana Inc.—a cutback in engineering spending and a plan to trim $200 million more in costs—as well as the bankruptcy filing from wheel maker Accuride Corp. point to how muted vehicle demand is working its way through the supply chain.

Still, let’s wrap this section on a brighter note for supply chains, courtesy of Owens Corning Chairman and CEO Brian Chambers: Speaking about the need and desire to stay close to customers, Chambers told analysts in early November that that means Toledo-based Owens Corning is “going to invest in manufacturing assets and sourcing to suppliers that are local to our markets and local to our manufacturing facilities.”

That likely sounds like music to the ears of the team making plans to move into the White House next month.

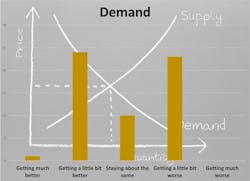

Demand: 0.03 (-0.04 in Q2 and 0.13 in Q1)

After going negative last quarter for the first time since we launched Tales From The Transcript in the fall of 2022, our demand indicator recovered ground but continues to tell a balanced story of various sectors coming and going. Despite their supply-chain pain, aerospace and defense firms remain upbeat while players in the metals and materials industries also are optimistic about what’s ahead.

Said Steel Dynamics CFO Theresa Wagler: “We’re feeling really good with the steady aspect of [pricing] we’ve seen in the last six to nine months. And now we’ll just get through the fourth quarter seasonality and then head towards what we think is going to be a really robust 2025.”

And yet, for every executive excited about next year like Wagler—such as Ball Corp.’s CEO Dan Fisher, who said “customers are pretty darn encouraged” about what’s beyond the uncertainty expected through year’s end—there was a leader (re)setting expectations of an upturn later in 2025 rather than in the spring. Stanley Black & Decker President and CEO Don Allan, for instance, said lower interest rates will take a while to work through “choppy markets.”

Added O-I Hardie: “Rather than the modest U-shaped recovery we expected earlier in the year, actual trends indicate an L-shaped recovery, given a more gradual improvement in consumer demand.”

Inflation: 0.03 (0.02 in Q2 and 0.01 in Q1)

Still, that general vibe often is more reflective of businesses’ abilities to absorb and pass along higher costs than of actual trends. Here, it’s worth reminding ourselves that our analysis looks for forward-looking statements and expectations, not assessments of today’s environment. For instance, Martin Marietta Materials Inc. CFO Jim Nickolas said his team expects the company’s inflation to be in the mid-single digits next year—even if that is trending down from its recent pace. However, that’s a forecast that will still be comfortably below the price hikes Martin Marietta executives expect to push through.

A similar trend is expected at distributor Applied Industrial Technologies Inc., where CFO David Wells said the company plans to pass along “that slow, steady inflationary impact largely coming from labor and other overhead spend from our manufacturers.” Wells said he sees no areas of concern and that price increases are happening at a comfortable pace these days.

However, it’s worth looking out for new pressures possibly entering the pipeline—something Builders FirstSource’s Jackson is doing: “Our sense from what we’ve seen from some vendors is that the era of cuts is ended,” Jackson said nearly a month ago. “What we’re seeing right now is stability in pricing and some modest, maybe low single-digit price increases.”

Jackson made that comment on the morning of Election Day. Since then, tariffs—and the price increases many executives said they’ll pass along if those measures are enacted—have moved center stage. We expect we’ll learn a lot more about Corporate America’s inflation expectations when the time comes to recap fourth-quarter earnings calls.

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has been in business journalism since the mid-1990s and writes about public companies, markets and economic trends for Endeavor Business Media publications, focusing on IndustryWeek, FleetOwner, Oil & Gas Journal, T&D World and Healthcare Innovation. He also curates the twice-monthly Market Moves Strategy newsletter that showcases Endeavor stories on strategy, leadership and investment and contributes to other Market Moves newsletters.

With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati in 1997, initially covering retail and the courts before shifting to banking, insurance and investing. He later was managing editor and editor of the Nashville Business Journal before being named editor of the Nashville Post in early 2008. He led a team that helped grow the Post's online traffic more than fivefold before joining Endeavor in September 2021.