Manufacturing Executives Confident But Careful Heading Into Summer [Tales From the Transcript]

In February and March, the country’s largest manufacturing companies believed (maybe hoped?) that the second half of 2024 would bring healthier and more balanced growth. Three months later, that belief is maturing into a confidence about what’s ahead this summer and fall.

From Dow Inc. CEO Jim Fitterling, for instance: “This volume growth right now feels like it’s demand-driven, not restocking-driven.”

Via Applied Industrial Technologies Inc. CEO Neil Schrimsher: “We are encouraged by recent improvements in various industrial macro indicators that correlate with our business.”

And courtesy of Beacon Roofing Supply Inc. President and CEO Julian Francis: “The overall market sentiment is probably better than we anticipated coming into the year.”

Each quarter, we analyze statements made in earnings calls from leading companies in each sector of the IndustryWeek 500 list of the largest public manufacturing companies, looking at the language executives use to describe various aspects of the economy. The above language—“seeing signs,” “encouraged” and “probably better”—doesn’t scream all-in bullishness. But it does convey the tone running through the industry.

Instead of loud optimism, we found a sense of careful calm when it comes to several topics that have in recent years been very volatile at times. And we saw the closest balance between positive and negative commentary since we started tracking these companies in this way in the summer of 2022.

The past year’s other Tales From The Transcript

Q4 – Industrial Leaders Expect Growth Eventually But Are Still Playing Waiting Game

Q3 – Leaders See 'Stickier' Inflation, Look to Offset Wage Growth

As we have with past Tales From The Transcript (see the sidebar for some previous editions), we scoured the transcripts of the five largest companies in 10 sectors of the IW500 to tally executives’ forward-looking commentary on inflation, the labor market, supply chains and demand. (A quick composition note: With U.S. Steel Corp. suspending conference calls because of its planned sale to Nippon Steel Corp., we’ve replaced it with Steel Dynamics Inc.) We rated those sentiments on a five-notch scale from fully positive to fully negative and then calculated composite scores.

Here’s what bubbled up from calls that took place between late March and late May. Our categories—following the theme of balance, two improved slightly from early this year while two slipped—are listed from least optimistic to most.

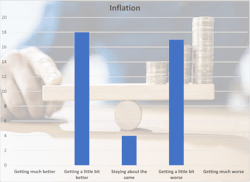

Inflation: 0.01 (0.06 in Q4 and -0.07 in Q3)

The data point closest to equilibrium now is the one that was by far the most negative six quarters ago. The progress that’s been made on input costs has been remarkable and the commentary we compiled shows that the balance we’re seeing now comes down to two factors.

On the one hand, the leadership teams at Vulcan Materials Co., Parker-Hannifin Corp. and O-I Glass Inc. said energy costs and other inputs are continuing to normalize from their pandemic-era gyrations. On the other hand, several executive teams focused on enduring pressures from labor as well as suppliers starting to flex more muscle in terms of passing on their higher costs.

“There’s going to be continued inflation into the business looking forward. While material inputs may soften or abate to a degree, the labor side of that has not,” Schrimsher at AIT said, echoing the thoughts of Lear Corp. CFO Jason Cardew.

A particularly bright assessment, however, came from CEO Dave Rush at Builders FirstSource Inc.: “We’ve seen some not insignificant cost reductions or pricing reductions in terms of what we’re getting from our vendors and what’s selling into the market.”

We can almost hear the “Must be nice” mutterings from other corner offices.

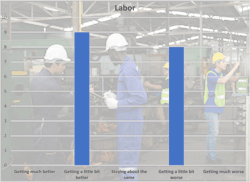

Labor: 0.03 (0.00 in Q4 and -0.07 in Q3)

Executives’ comments about labor during this earnings cycle focused almost entirely on price rather than availability—a big change from a year ago that also has led to a drop in the amount of discussion about workforce issues on conference calls.

“We certainly don’t feel like we have a macro unsolvable problem,” Scott Donnelly, the chairman, president and CEO of Textron Corp., told analysts. “It’s improved significantly.”

Also encouraging is that the above comment from AIT’s Schrimsher was something of an outlier. At Illinois Tool Works Inc., CFO Michael Larsen said higher compensation and benefit costs are hurting margins by half as much as they were a few quarters ago.

Ditto Sherwin-Williams Co. CFO Allen Mistysyn: “Wage inflation for 2024 is more typical to prior years. So think about a low-single-digit impact.”

Supply chain: 0.07 (0.11 in Q4 and 0.21 in Q3)

Chatter about the health of supply chains also has faded in recent quarters. Much as with labor discussions, those with negative outlooks are focused more on costs—some from the Red Sea shipping flare-up early this year, others because of suppliers hiking prices—while positive commentary focused more on performance.

“We are seeing notable improvements across the board in the supply chain,” said Jeff Leonard, president and CEO of infrastructure and agriculture equipment maker Alamo Group Inc. “It’s not just truck chassis. It’s things like hydraulic components and cylinders; all kinds of things that we consume.”

Textron’s Donnelly was singing from the same song sheet and neatly encapsulating the theme of calm we outlined earlier.

“We are starting to see some of the benefits that we expect to see in a more stable production environment,” he said. “Less supplier disruption, fewer onboarding, less impact on training. There’s a lot of things the business is doing to try to address some of those issues.”

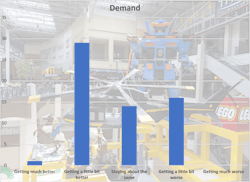

Demand: 0.13 (0.09 in Q4 and 0.07 in Q3)

Back to where we started this piece: Most optimistic among our categories is CEOs’ and CFOs’ take on the demand picture. Our composite score rose for the second consecutive quarter and nearly reached the level of 2023’s Q2 earnings season. (Want to get really optimistic? That round of conference calls last summer wrapped up halfway through a quarter that would produce annualized GDP growth of 4.9%.)

The pretty upbeat outlook came disparate corners of the industrial economy:

- LyondellBasell Industries NV CEO Peter Vanacker echoed his chemicals peers at Dow by saying that “we continue to see early indications that durable goods demand is going up.”

- “We are encouraged by pro architectural sentiment in April and customers in several end markets are optimistic about an improving demand environment as the year progresses,” Sherwin-Williams Senior Vice President James Jaye said.

- Antonio Carrillo, president and CEO of Arcosa Inc.—which makes gear for the infrastructure, structures and transportation sectors—said his team’s tank barge customers have changed their tone of late: “A year ago, [they] were saying, ‘Well, I don’t need anything.’ All of them are coming and saying, “Look, we see all this replacement coming in the near future.’”

Still, let’s finish on a balanced note of our own: More than a few C-suites still spoke cautiously this spring about what lies ahead. Caterpillar Inc. Chairman and CEO Jim Umpleby said customers are being more disciplined with their spending—“Not surprising, just given what's happened [with] economic conditions around the world”—while O-I Glass CFO John Haudrich said consumers’ buying patterns have lagged his team’s expectations.

“We are shifting some of our capital spend a little bit less on growth right now, because of the softness in the market,” Haudrich said. “A little bit more towards cost-related projects, automation and things like that.”

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has been in business journalism since the mid-1990s and writes about public companies, markets and economic trends for Endeavor Business Media publications, focusing on IndustryWeek, FleetOwner, Oil & Gas Journal, T&D World and Healthcare Innovation. He also curates the twice-monthly Market Moves Strategy newsletter that showcases Endeavor stories on strategy, leadership and investment and contributes to other Market Moves newsletters.

With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati in 1997, initially covering retail and the courts before shifting to banking, insurance and investing. He later was managing editor and editor of the Nashville Business Journal before being named editor of the Nashville Post in early 2008. He led a team that helped grow the Post's online traffic more than fivefold before joining Endeavor in September 2021.