Tales From the Transcript: Enduring Inflation, Smoother Supply Chains

Market and economy watchers surprised by the recent data showing that inflation is persisting really shouldn’t have been: Many leaders of IndustryWeek U.S. 500 companies told us as much in the first few weeks of 2023—and they often added that they are raising prices further, perhaps helping extend those inflationary pressures into the second half of the year.

From Carrier Global Corp. Chairman and CEO David Gitlin: “We’ve realized that inflation is not over. And we’ve had to announce further price increases in January that perhaps even a couple of months ago we might not have anticipated.”

Added Andre Schulten, CFO of Procter & Gamble Co., who neatly summarized what many of his peers also discussed: “Our suppliers are still in the process of passing through their own inflation. So while their input costs [are] certainly easing, they also haven’t fully caught up to the cost structure hits that they have experienced over the past few quarters.”

And so, three years after COVID-19 began disrupting businesses in earnest, higher prices continue to flow into and through this economy. That’s the most definitive takeaway from our latest quarterly dive into the conference call transcripts of the five largest companies in 10 sectors of the IndustryWeek U.S. 500 list of publicly traded companies. As we did in November, we scoured executives’ comments for forward-looking statements about price increases, the labor market, the state of supply chains and overall demand and rated them on a five-notch spectrum from fully positive to fully negative.

That exercise produced 149 data points across the four categories. We weighted each “fully positive” or “fully negative” response at 100% and each “slightly” comment at 50%, then calculated the average. That methodology means that every single company responding “fully positive” would produce a score of 1, while 50 ‘slightly negative’ responses would result in a -0.5 score. A perfectly evenly distributed set of responses ends up with score of zero.

Here’s how the fourth-quarter commentary—which was given to analysts and investors from late December until the last week of February—translated into broad sentiment barometers ranked from most negative to most upbeat. We’ve also added representative quotes for context.

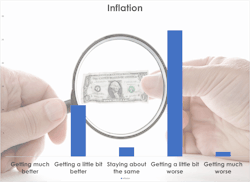

Inflation: -0.22 (versus -0.42 in Q3)

“The industry broadly is pushing back on accepting long-term fixed-price contracts right now,” Warden, Northrop’s chair, president and CEO, told analysts. “They're asking for reopeners for inflation. We expect that to continue. And as our suppliers ask us for that, we, of course, are passing that on.”

A number of executives also noted that price increases will be key to maintaining or even growing margins in a macro environment marked by weakening demand in several sectors.

“Our expectation is we’re going to maintain the majority of our price,” said CFO Al Mistysyn of Sherwin-Williams Co. “We think we’ve gotten past the margin contraction portion of the cycle.”

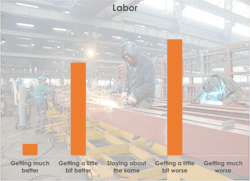

Labor: 0.00 (versus -0.14)

Two things stuck out to us from Q4 commentary on labor: There was notably less of that commentary (19 mentions from our 50 companies versus 29 in the fall), which is another way of saying worker availability is gradually getting better, and executive teams across manufacturing are leaning ever more on automation.

“We’re accelerating our investments in our manufacturing capability, buying new machine tools, getting more automation and more robotics because we recognize we're going to be in this labor constraint for some time to come,” Jeffrey Leonard, president and CEO of Alamo Group Inc., said on his team’s call. “In fact, none of us can really yet see an answer to that, to be candid.”

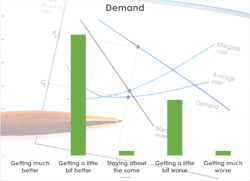

Demand: 0.04 (versus 0.29)

There is more overall caution, however: Last quarter, we logged 37 positive comments about the demand outlook, but that number slid to 25 this go around. Negative comments rose to 21 from 15.

Perhaps most illustrative of the state of much of the U.S. economy in March was P&G Chairman, President and CEO Jon Moeller’s take on how many customers are easing off the gas pedal.

“We’ve been through a period where inventories have been a little bit higher than normal in some of our retail channels,” Moeller said. “Supply assurance is increasing, demand volatility is decreasing. So those inventories are understandably being brought down.”

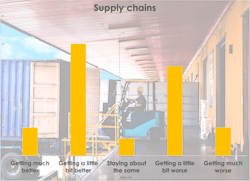

Supply chains: 0.15 (versus -0.17)

There are still pockets of trouble, some executives said, but they’re becoming both easier to identify early on and to help address.

The predictability of material leaving factories “is more reliable and aligned with historical performance,” Matt Puckett, CFO at VF Corp., said. “This is an important data point that will better position us to more fully service the business in fall of 2023 and beyond.”

Still, certitude is in short supply elsewhere and it’s worth bringing the topic back to the headline issue of price pressures, courtesy of Summit Materials Inc. CFO Brian Harris.

“Overall, the supply chain issues have not gone away,” Harris told analysts. “We still see those as providing a source of inflation and uncertainty as we go through the balance of the year.”

With every one of our four indicators closer to equilibrium in early 2023 than they were late last fall, uncertainty looks to be the watchword for another year.

Methodology

Analyzing 149 executive statements in four economic categories, we scored each comment as either:

- Fully positive: 1

- Slightly positive: 0.5

- Neutral: 0

- Slightly negative: -0.5

- Fully negative: -1

We then averaged the scores to assign a general corporate sentiment to each portion of the economy.

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has been in business journalism since the mid-1990s and writes about public companies, markets and economic trends for Endeavor Business Media publications, focusing on IndustryWeek, FleetOwner, Oil & Gas Journal, T&D World and Healthcare Innovation. He also curates the twice-monthly Market Moves Strategy newsletter that showcases Endeavor stories on strategy, leadership and investment and contributes to other Market Moves newsletters.

With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati in 1997, initially covering retail and the courts before shifting to banking, insurance and investing. He later was managing editor and editor of the Nashville Business Journal before being named editor of the Nashville Post in early 2008. He led a team that helped grow the Post's online traffic more than fivefold before joining Endeavor in September 2021.