Tales From the Transcript: What Public-Company Leaders Expect From Q4, Early ‘23

Asked late last month about his team’s inventory management, Illinois Tool Works Inc. Chairman and CEO Scott Santi was emphatic.

“We haven’t seen enough stability yet on the supply chain side to make us comfortable that we can start backing off,” Santi said. “Our first priority is to preserve our ability to serve our customers.”

ITW, Santi had said minutes earlier on the company’s third-quarter earnings conference call, is poised to deliver a strong finish to 2022 despite a more uncertain economic picture. But he would not, along with many other CEOs and CFOs reporting their Q3 numbers, be drawn into giving analysts much in the way of definitive guidance of 2023. Not enough stability or comfort.

And yet, this is the time of year when thoughts begin to turn in earnest to the upcoming year. “How much will you spend on raw materials?” those analysts want to know. “What are you hearing from customers?” “Can you find workers?”

To try to get at those questions in a more strategic way, we combed through the conference call transcripts of a 50-member cross-section of our IndustryWeek U.S. 500 list of publicly traded companies. It’s the same cohort we analyzed early last month before earnings season kicked off and it comprises the five largest companies in 10 subsectors (with the slight change of American Axle & Manufacturing Inc. replacing Tenneco Inc. because the latter is no longer hosting calls pending its sale to Apollo Global Management Inc.).

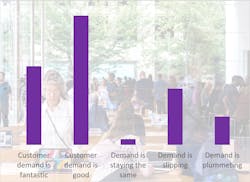

We surveyed those call transcripts for forward-looking sentiments—by now, we know how the third quarter went—about four key factors: inflation, labor, supply chains and demand. We classified executives’ comments into one of five buckets: fully positive, slightly positive, neutral, slightly negative and fully negative. Some of those comments centered on fourth-quarter dynamics while some provided first glimpses into 2023.

Not all 50 companies discussed each of our four topics during their calls so we don’t have the nice round number of 200 data points to analyze. And in a few cases, leadership teams voiced somewhat conflicting comments—demand was strong in this segment but definitely weakening in another—that were distinct enough to have us put two notches in a single category.

In the end, we had 164 expressions of confidence, frustration, fear or pessimism to categorize. We weighted each ‘fully positive’ or ‘fully negative’ response at 100% and each ‘slightly’ comment at 50%, then calculated the average. That methodology means that every single company responding ‘fully positive’ would produce a score of 1 while 50 ‘slightly negative’ responses would result in a -0.5 score. A perfectly evenly distributed set of responses ends up with score of zero.

Here’s how the numbers broke down, accompanied by more executives’ quotes for representative context:

Inflation: -0.42

“Cost inflation just remains stubbornly high. We're obviously offsetting that with price and operating efficiencies or some of it,” Vulcan Materials Co. Chairman, President and CEO Thomas Hill said. “The parts and service costs are and will probably stay high. I would think that will be for sure in the fourth quarter, and I would expect it into 2023.”

Another reason inflation looks to remain sticky is that many executive teams facing ongoing input cost pressures are confident they can pass along more price increases late this year and early next. As Ward Nye, Hill’s peer at Martin Marietta Materials Inc., summed up: “If past is prologue—and we believe that it is—inflation supports a constructive pricing environment for upstream materials, the benefits of which endure long after inflationary pressures abate.”

Labor: -0.14

To say there’s resignation about the longer-term dynamics of the labor market would be too strong. It might be more apt to label many executive teams’ attitudes toward workforce questions as one of acceptance: The strains we face today look to be structural and thus call for a response with a lengthy time horizon.

“We continue to invest heavily in automating our manufacturing facilities. We think that's the right long-term play,” Builders FirstSource Inc. President and CEO Dave Flitman told analysts. “We think labor is going to be constrained in this industry—and particularly skilled labor, which we need in our manufacturing facilities—for a long time to come.”

Supply chains: -0.17

“Portions of the supply chain, I would say, are pretty much back to normal,” said D.G. Macpherson, chairman and CEO of distribution giant W.W. Grainger Inc. “A year ago, we had labor challenges and all kinds of challenges. Those have pretty much gone away in terms of our own supply chain. And then the outbound transportation is also pretty strong at this point and less of a problem.”

Still, as the tight labor market spurs investments in technology such as those at Builders FirstSource, so Deere & Co. has been investing in machinery capacity for some of its suppliers. The problems of this quarter won’t be gone in a few months and they require greater commitment and involvement.

Demand: +0.29

Sustaining the optimism of many are longer-term tailwinds such as the passage of the Inflation Reduction Act and the infrastructure spending it will catalyze. Martin Marietta executives said they expect “a step change in the public-sector investment” next year will help drive their business “for years to come.” Also in play is the big shift toward near- and reshoring manufacturing capacity.

“The demand drivers today in several markets are not that GDP-sensitive,” O-I Glass Inc. CEO Andres Lopez told analysts on his team’s call. “And let me give you one example: localization of global brands, which is happening across markets. That's not sensitive to GDP.”

As many observers have noted, investments in a shorter supply chain and new production centers also are not going to help bring down inflation. The days of “transitory” talk have long passed us by.

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has been in business journalism since the mid-1990s and writes about public companies, markets and economic trends for Endeavor Business Media publications, focusing on IndustryWeek, FleetOwner, Oil & Gas Journal, T&D World and Healthcare Innovation. He also curates the twice-monthly Market Moves Strategy newsletter that showcases Endeavor stories on strategy, leadership and investment and contributes to other Market Moves newsletters.

With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati in 1997, initially covering retail and the courts before shifting to banking, insurance and investing. He later was managing editor and editor of the Nashville Business Journal before being named editor of the Nashville Post in early 2008. He led a team that helped grow the Post's online traffic more than fivefold before joining Endeavor in September 2021.