Cashing In: How to Quickly Free Up Working Capital in Tight Times

All companies have assets on their balance sheets that can be converted into cash. Cash that can cover expenses when lines of credit are reduced. Cash that can be invested in new equipment when bank loans are difficult to come by. Cash that can help finance the inevitable acquisition opportunities that arise during every recession. Why tie up cash in static inventory, unprofitable SKUs, or excessively high receivables?

Credit is increasingly difficult to get for both businesses and consumers. Falling real estate values may or may not have bottomed out. Job losses and stock market volatility are putting a damper on consumer spending. Now is the time to target specific initiatives that will reduce working capital requirements and put your company in a financial position to successfully weather this economic storm. This article reveals some of the tactics that business managers can follow to permanently and quickly reduce working capital requirements and improve cash flow.

Working capital is the daily operating liquidity available to a business. In accounting terms, it's the product of a company's current assets (inventories, accounts receivable, cash) minus current liabilities (accounts payable, short-term loan payments). Having positive working capital ensures that a firm has the funds to make short-term debt payments and meet pending operational expenses. We're talking about important obligations, like payroll.

The steps required to reduce working capital requirements are not a mystery. Reduce inventory. Discontinue unprofitable products or services. Speed up accounts receivable. The challenge is to fix the underlying processes that are often overlooked during periods of strong sales growth, but which eat up excessive amounts of cash.

| Working Capital Reduction Potential | ||

| Company A (thousands) | Company B (thousands) | |

| Revenue | $150,000 | $500,000 |

| Gross Margin % | 25% | 25% |

| COGS | $112,500 | $375,000 |

| FG Inventory Reduction | ||

| FG Inventory Turns | 6 | 6 |

| FG Inventory $'s | $18,750 | $62,500 |

| Inventory Reduction Target | 10% | 8% |

| FG Inventory Reduction | $1,875 | $4,688 |

| RM Inventory Reduction | ||

| RM Inventory Turns | 10 | 10 |

| RM Inventory $'s | $11,250 | $37,500 |

| Inventory Reduction Target | 10% | 8% |

| RM Inventory Reduction | $1,125 | $2,813 |

| Days of Sales Outstanding (DSO) Reduction | 55 | 55 |

| Accounts Receivable Balance | $22,603 | $75,342 |

| Future DSO | 50 | 53 |

| Accounts Receivable Reduction | $2,055 | $2,740 |

| Total Potential | $5,055 | $10,240 |

This table shows the potential working capital reduction for a hypothetical $150-million company and a $500-million company. A targeted approach that combines ongoing project work and focused events can yield a very realistic 5% to 10% improvement in inventory turns and corresponding reduction of days of sales outstanding that frees up millions of dollars of working capital for more important purposes.

Time is of the Essence

The ability to align inventory levels with actual customer demand becomes more critical during periods of high volatility, which tend to drive up safety stock levels. It's easy to be caught with too much of the wrong product, and not enough of what's hot. Many executives like to talk about how their companies are "customer driven," and they may in fact behave that way within the customer service and sales areas of the organization. But most have not translated that customer focus to the operations and supply chain side of the business. Their planning and procurement processes are not flexible, they have limited demand visibility and they cannot react quickly to changing market conditions.

A focused project team with representatives from across the organization, which pulls in additional people to attack specific problem areas as required, can make dramatic reductions in working capital within a short, 8- to 10-week period. Modest 5-10% improvements in inventory turns and the order-to-payment cycle can free up millions of dollars. (See table, "Working Capital Reduction Potential.")

One of the primary duties of the working capital reduction team is to understand the different demand segments and the level of variability within those segments, then institute process changes that are more responsive to demand fluctuations. Such efforts start with demand segmentation.

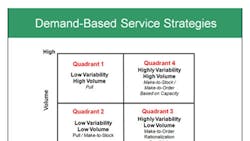

Most approaches to production planning and inventory management treat all products the same, applying rule-of-thumb stock levels across every segment. In fact, from a resource optimization standpoint, each demand segment may require a different service strategy. By analyzing order volume and frequency for each SKU the working capital team can determine, for example, what products could be made using a "pull" system, those that should only be produced on a made-to-order basis, and those that should not be produced at all. Converting any high volume, low variability products from make-to-stock to a pull replenishment system will reduce finished goods inventory and improve gross margins. It also provides retailers and distributors with the opportunity to save money by reducing inventory carrying costs at the point of sale.

On the chart above, product families that fall in Quadrant 1 exhibit steady, high volume demand, making them ideal candidates for a pull system. A low volume, highly variable product that falls in Quadrant 3 suggests a make-to-order strategy. It's also a candidate for discontinuation.

The working capital team must work to eliminate internal policies that contribute to volatility and drive up safety stock levels. This can include minimum order quantities that depress order as frequency or quarter-end price discounts that cause customers to delay purchases. Such practices can contribute to wild demand fluctuations. Rolling forecasts linked to current market conditions and other collaborative sales and operations planning methods can further align production with demand. On the inbound side, bulk purchasing policies and infrequent deliveries can increase raw material inventories and cash outlays.

In addition to demand segmentation, a simultaneous review of the company's product portfolio will reveal those SKUs that are barely breaking even and those that have negative margins. This analysis will reveal price adjustments that need to be made or products that should be discontinued. Not only will such SKU rationalization efforts free up cash, they can lower operating costs and improve earnings.

Speed up the Invoice-to-cash Cycle

One of the first signs that a company is struggling, no matter what the state of the overall economy, is an increase in the number of days that it takes to pay suppliers. On the other side of the cash-flow equation, periods of market uncertainty will often trigger a push to tighten payment terms, from net 45 days to net 30 days, for example. Everyone wants to hold onto cash longer, and get paid quicker.

A common tactic for improving cash flow in a hurry is to negotiate price discounts in exchange for faster payment terms. Such tactics sacrifice profit in exchange for an immediate boost in liquidity. There are other initiatives however, entirely within a company's internal control, that can streamline the accounts receivable process and reduce the order-to-cash cycle.

Raising the visibility of cash-related metrics outside of the finance department, such as days of sales outstanding, can increase everyone's awareness of business practices that impact working capital. The faster that the billing department generates invoices and sends them to the customer after a product or service is delivered the sooner payment will be received. As obvious as this may be, too many companies will perform such work in batches and it may take them a week or more to invoice their customers. Electronic invoicing and payment tools can further speed up the payment process.

Invoicing errors are a frequent contributor to long payment cycles. Quoted prices might not match up with master data, which leads to an incorrect invoice that is disputed by the customer. Root cause analysis of such errors can uncover the process failures that are driving such mistakes. Simplifying payment terms and controlling other sources of complexity can limit the opportunities for error. In addition, speeding up the invoice dispute resolution process itself, and rapidly communicating any collection issues, can further reduce the total value of past due invoices. Of course, if the client or customer is not paying, that's a completely different issue.

The working capital reduction team won't be able to eliminate all billing disputes, but reducing the number of errors and improving the resolution process will have both an immediate and a long-term impact on cash flow. Likewise, changes in inventory management policies and the elimination of unprofitable products will free up cash that can help a company survive turbulent times and invest for next growth period.

Ken Koenemann is Managing Director, Lean Value Chain Practice of TBM Consulting Group, Inc which provides Lean Sigma Consulting and Training Services. TBM Consulting Group's Lean Sigma approach integrates Lean principles for market agility and responsiveness and Six Sigma's focus on quality. www.tbmcg.com