GM Strike Impact: $857 Million Weekly in Lost Wages Across the US

Many estimates of the cost of the UAW strike focus on how much the work stoppage is costing GM, but few have estimated the broader costs of the strike to the U.S. economy or individual states. The Center for Automotive Research’s (CAR’s) estimates put the cost of the UAW-GM strike to the company at roughly $450 million a week and the strike pay costs to the UAW strike fund at as much as $12 million a week.

The costs of an automaker strike can be comparatively small if the work stoppage is short-lived. If the automaker has sufficient inventory, sales revenue impacts should be relatively minor, and the workers can both make up for lost production and partially replace lost wages with overtime once they return to work. When a strike lasts beyond a week, it becomes more challenging to make up lost production and costs begin to mount for both the company and the union. The longer a strike lasts, the more it impacts companies and workers in the supply chain as well as the broader economy.

CAR used a dynamic input-output model of the U.S. economy to estimate the impact of the UAW-GM strike. (The peer-reviewed dynamic econometric model CAR used was purchased from Regional Economic Models, Incorporated (REMI).

CAR adjusted UAW-GM workers’ compensation to reflect the $250 per week strike benefits and modified the effects of GM purchasing to take into account only the reduction in production parts, materials, and services that are not needed while GM’s U.S. plants are not producing a product.

- CAR estimates the U.S. employment multiplier for UAW-GM jobs is 11.5, which means that when UAW-GM workers are at work producing vehicles, engines, transmissions, stampings, parts, and components, every UAW-GM job supports 10.5 other jobs in the U.S. economy, with 3.2 of those jobs in the production-focused U.S. supplier sector. (GM also buys non-production-related goods and services that it continues to demand even while production is down. These purchases include engineering/legal/accounting/business services, finance & insurance products, research & development, and advertising. The multiplier is calculated using a factor of 10% GM salaried employment in manufacturing-related operations.)

- CAR’s results show that overall, U.S. weekly worker compensation is $857 million lower for each week that the strike lasts. That lower compensation is associated with a $108 million reduction in tax payments to support government social insurance programs (unemployment insurance, Medicare, Medicaid, and workers’ compensation insurance) and a $114 million reduction in personal income taxes paid to state and federal treasuries.

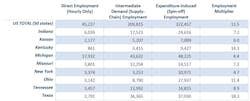

UAW-GM Employment Multipliers

Table 1 summarizes CAR’s estimated employment multipliers for UAW-GM jobs. The direct employment column represents the number of permanent UAW-GM jobs in the United States as well as in each of the nine states where GM has UAW-Represented manufacturing operations. The “intermediate demand” column includes jobs in the supply chain that are tied to production in UAW-represented GM plants (including goods and services such as materials, parts, components, and transportation and logistics). The “spin-off” or “expenditure-induced” column includes jobs that UAW-GM workers and production-related supplier workers sustain when they spend their earnings in the economy.

Source: Center for Automotive Research estimates

The state-by-state multipliers vary widely. The concentration of automotive and auto supplier manufacturing in each state, as well as the amount of in-state sourcing and cross-state purchases, influence the magnitude of each of these employment multipliers. Note that each state multiplier includes jobs supported by UAW-GM activity in other states. For example, Indiana’s 7.2 employment multiplier means that the 6.2 additional jobs in the state of Indiana are supported by every UAW-GM worker the United States—not just those who work at UAW-GM facilities in Indiana.

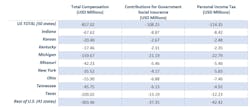

UAW-GM Compensation & Tax Effects

The compensation and tax revenue effects also vary by state, with the vast majority (nearly two-thirds) of the impacts occurring in the nine states in which GM has UAW-represented manufacturing operations. Just over 40% of the effects are concentrated in only three states—Michigan, Texas, and Indiana—the three states where GM builds full-size pickup trucks and SUVs, the company’s most profitable products.

- Michigan, with 40% of the UAW-GM workforce, is hardest hit by the strike.

- Weekly compensation in Michigan is estimated to decline by $160 million while the strike lasts,

- Weekly social insurance tax collections are expected to be $21 million lower, and

- Weekly personal income taxes are expected to be $23 million lower.

- Texas, with 8% of the UAW-GM workforce, has the second-largest economic strike impacts.

- Weekly compensation in Texas is estimated to fall $109 million while the strike lasts,

- Weekly social insurance tax collections are expected to be $13 million lower, and

- Weekly personal income taxes are expected to be $12 million lower.

- Indiana, with 13% of the UAW-GM workforce, has the third-largest economic strike impacts.

- Weekly compensation in Indiana is estimated to fall $68 million while the strike lasts,

- Weekly social insurance tax collections are expected to be $9 million lower, and

- Weekly personal income taxes are expected to be $8 million lower.

Table 2 details the weekly compensation and tax effects due to the UAW-GM strike.

Source: Center for Automotive Research estimates

Summation

Automotive manufacturing employment multipliers are among the highest of any sector of the U.S. economy. The UAW-GM strike is sufficiently large to not only affect many sectors of the U.S. economy but also to reach beyond the borders of the nine states that are hosts to UAW-represented GM manufacturing facilities. GM, the UAW, GM suppliers, federal, state, and local governments, and many other businesses incur losses each day the strike continues.

Kristin Dziczek is vice president, Industry, Labor & Economics group, for the nonprofit Center for Automotive Research. She has more than 25 years of experience as a researcher and policy analyst in automotive, union and government.

This article was originally published as a feature story on the Center for Automotive Research’s website. It is reprinted with permission.

About the Author

Kristin Dziczek

Vice President of the Industry, Labor, and Economics group

Kristin Dziczek is Vice President of Industry, Labor & Economics at the Center for Automotive Research (CAR). Dziczek joined CAR in 2005, and has more than 25 years of experience as a researcher and policy analyst. She is globally recognized as an expert on automotive labor, employment, and talent issues, especially on the topic of labor union relations and contracts, and she regularly presents at conferences and industry events throughout North America.

Kristin leads the ILE team—a group whose expertise includes economic analysis, forecasting & modeling, policy, and economic development. The ILE team’s research portfolio is focused on developing a better understanding of the connections between the automotive industry, technology, the economy, society, and public policy, and is home to CAR’s Automotive Communities Partnership program. Kristin’s research includes analyzing the competitive cost position of the U.S. automotive industry, and evaluating how different tax, trade, or industrial policies and incentives could impact overall automotive sales, production, and employment.

Prior to joining CAR, Kristin served as the associate director of the Michigan Manufacturing Technology Center, and has worked for the U.S. Congress, International Union UAW, and General Motors Corporation. She has published articles in the Monthly Labor Review, Industrial and Labor Relations Review, the Journal of Technology Transfer, and the Journal of Policy Analysis and Management, among others. She earned her B.A. in economics, M.P.P. in public policy, and M.S. in industrial and operations engineering, all from the University of Michigan.