Manufacturing leaders expressed net disapproval of President Donald Trump’s performance in office so far, especially the threat of tariffs that could disrupt businesses.

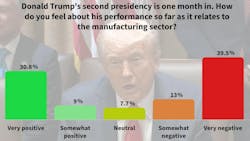

And those who dislike the president’s actions are very vocal about it. In a poll conducted by IndustryWeek following Trump’s first month in office, nearly 53% of 1,100+ responses were "negative" or "very negative." And those holding poor views of the president had more to say than those applauding his performance.

Poll Results

| Very Positive | 30.7% |

| Somewhat Positive | 9.0% |

| Neutral | 7.8% |

| Somewhat Negative | 13.0% |

| Very Negative | 39.6% |

“The key to great manufacturing is the ability to plan investments, supply chains and employment. The current chaos around tariffs and education for workforce training makes planning impossible.”—Respondent in the machining industry, “somewhat negative” on Trump.

Trump and company are all over the board with a lot of policies that will affect manufacturing and especially consumer behavior—which directly affects manufacturing. Without a consistent direction it is hard to forecast production goals and leads to inaction. Nature hates a void and lack of direction on manufacturing is no different. Further, tariffs in particular, as well as labor uncertainties, contribute to inaction. It would be helpful if the President and his team would take a hands-off approach to the economy.—Respondent in plastics manufacturing, “somewhat negative” on Trump.

While tariffs make “Tariffying” headlines, the fact is that the Team is actually identifying sacred cows of wasteful and contrary to our national purpose spending. Wish the Congress would get off their (redacted) and restore the manufacturing tax cuts from this president’s last term, but that is on Congress not the White House.—Respondent adjacent to the machining industry, “somewhat positive” on Trump.

Other buzzwords that cropped up repeatedly (though much less frequently) in comments:

- 7 respondents mentioned immigration. 5 responses were positive, 2 negative.

- 8 respondents mentioned Elon Musk. 1 response was positive, 7 negative.

- 10 respondents mentioned DOGE. 7 responses were positive, 3 negative.

Here’s a further sampling of responses, ranked by category.

Very Negative (39.5% of responses)

President, electronics equipment manufacturer: The random, haphazard approach to tariffs, bad-mouthing friendly countries, knee-jerk federal spending cuts and layoffs create a more-than-unpredictable future. No major capital equipment or facility improvements will be made at my business until [Trump] is either gone or some level of stability returns. Post-COVID. Post supply-chain turmoil. Post inflation and interest-rate hikes. How could it be any different? I hope to be in business by year’s end.

VP, equipment: The tariff plans are actually doing the opposite of what [Trump] states he wants to accomplish. We are exploring moving manufacturing from the U.S. to Asia in order to ship our products to Canada and Mexico, due to potential retaliatory tariffs from those countries. Not to mention our cost increases from the tariffs, which will be difficult to pass on to our customers. They would most likely delay purchases rather than pay increases.

Sales manager, industrial equipment: Huge concerns about Trump pissing off our closest partners, Canada and Mexico. We do significant business in both countries and have a plant in Canada. This is already negatively impacting our business. We also do significant business in the automotive sector, which is now a big question mark. After stabilizing late last year, inflationary pressures are back on.

Very Positive (30.8% of responses)

Technologist, welding machines and consumables: I support the war on "Illegal" immigration. I support ending the Russia-Ukraine War, with or without the involvement of Ukraine in negotiations. I support the tariffs.

Operations manager, oil refining: Appreciate that the administration is interested in the importance of the oil industry and its importance to the economy. Appreciate that they are interested in more thoughtful review of new regulations. Appreciate that they are reviewing government spending vs. tax burden.

President/owner, plastic packaging containers: Economically this will be the best administrative solution in my lifetime for American Manufacturing. I have waited 24 years for this to happen!

Somewhat Negative (13% of responses)

Project manager, fabricated metals: No clear plan on tariffs. On again/off again. NOBODY works like that in manufacturing.

CEO, plastics and composites: We need consistent and reliable trade policies with Canada and Mexico. We rely on trade with them. We would like more R&D tax credits and accelerated depreciation.

Respondent, aerospace: There does not seem to be a clear, thoughtful plan that this administration is taking, outside of destroying every system. They have not thought out the consequences of their actions and how that impacts every system. What they have done is create a environment of apprehension and fear.

Somewhat Positive (9% of responses)

Engineering consultant: I am currently unemployed. I feel that much of the EV hype and hiring of the previous years created jobs, the reasons those jobs existed were not due to organic market demand for EVs. We have to address our overall energy supply and delivery infrastructure, and we need to be honest about the true cost of switching to BEV; otherwise, the EV craze is just another bubble in our economy. Also, as long as China “plays by different rules” when it comes to energy and EV production, our policies since 2020 have hurt our domestic position.

General manager, packaging company: While many of the recent actions have been disruptive, in many areas the disruption is causing government workers to face the same challenges private industry faces daily. Despite the damage that may be caused in some areas, the good outweighs the bad by an order of magnitude.

Project manager, automotive: Way too soon to tell. They came in with a plan and appear to be doing what they said they'd do. Tariff outcome & immigration impact on MFG depends on what country you are in, and what country's perspective you are talking about. I’m expecting supply chain realignment to continue/accelerate; not sure about labor situation & reshoring. Never have I seen this level of transparency. DOGE has exposed a lot of the very stupid and irresponsible spending that we always suspected happens.

Neutral (7% of responses)

Chief human resource officer, plastics injection molding: I am very concerned about the increased cost of raw materials. As a small business that contract-manufactures medical and industrial products, that could hamstring us. Especially as our employees are feeling an increased crunch on their personal finances and need greater overall compensation, further burdening small businesses.

Production manager, plastic machining: I’m hopeful that the administration will do more to help mid- to small businesses.

Respondent, consumer electronics: I am not crazy about the shotgun approach nor the authoritarian bent. I do like the change aspect.

About the Author

Laura Putre

Senior Editor, IndustryWeek

As senior editor, Laura Putre works with IndustryWeek's editorial contributors and reports on leadership and the automotive industry as they relate to manufacturing. She joined IndustryWeek in 2015 as a staff writer covering workforce issues.

Prior to IndustryWeek, Laura reported on the healthcare industry and covered local news. She was the editor of the Chicago Journal and a staff writer for Cleveland Scene. Her national bylines include The Guardian, Slate, Pacific-Standard and The Root.

Laura was a National Press Foundation fellow in 2022.

Got a story idea? Reach out to Laura at [email protected]