NAM/IW Q2 Survey: Cautious Optimism Even as U.S., Global Uncertainties Mount

Manufacturers have played an important role in U.S. economic growth since the recession ended in 2009. Since then, the sector has added nearly 500,000 net new workers and provided an outsized role in its contributions to real gross domestic product. However, the stronger production activity experienced at the beginning of this year has slowed in recent months. While manufacturing production continues to expand, the pace of growth has eased. Challenges in Europe are one factor, with other uncertainties—including tax and regulatory policies facing businesses in 2013 and beyond—becoming a growing concern.

The most recent NAM/IndustryWeek Survey of Manufacturers backs up what we’ve been seeing in the data. Just more than 83% of respondents said that they were either somewhat or very positive about their company’s outlook (Figure 1). This is 5 percentage points lower than what the March survey showed, with the decline mostly the result of those shifting from “somewhat positive” to “somewhat negative.” Many of the selected comments echo some of these worries, with global market weaknesses and political stalemate frustrating manufacturing executives.

However, one in five manufacturers continue to say that they are very positive about their current outlook, which is essentially the same proportion as three months ago.

Manufacturers anticipate 4.3% gains in sales over the next year on average (see Figure 2). This is slightly below the 4.7% increase anticipated three months ago. It is notable that half of the respondents said that their company’s sales are expected to grow by 5% or more. This is more or less the level from the previous survey. The lower response was due to increases in those saying that sales were expected to stay the same or decline. Only 9% of manufacturers see their sales falling in the next year.

Other measures of manufacturing activity continue to expand. Capital spending and employment should increase by 2.5% and 1.9%, respectively, in the next 12 months. In both cases, this figure is only marginally lower than what was predicted earlier (down from 2.6% and 2.0%, respectively). In terms of investments, the split was between those who plan to increase capital spending (46.5%) versus those who plan to keep it the same (42.7%).

However, nearly 20% of those completing the survey plan to increase capital spending over the next year by 10% or more. Meanwhile, on the employment front, just more than one-third of manufacturers plan to hire up to 5% more workers, with another one-third staying put.

Inventories are expected to be virtually unchanged over the next year. Meanwhile, the prices for final goods are anticipated to go up by 1.5% over the next 12 months. This is below the 2.1% increase forecast three months ago. However, nearly half of all manufacturers plan to keep their prices about the same, with around 36% suggesting final price increases of up to 5%. For the most part, while businesses have been pressured by rising costs in the past year, their ability to pass along these costs has been hampered, with overall core inflation modest.

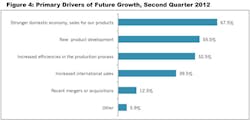

The manufacturing sector has benefitted tremendously from international trade, with almost 40% suggesting that overseas sales are one of their major drivers of future growth. Recent weaknesses in the global economy have slowed the growth of exports somewhat, but more than 18% of manufacturers still anticipate their exports to grow by more than 5%over the next year. This shows there are opportunities for growth, even as half of all respondents suggest that their export levels are not expected to change much. In fact, those suggesting that they were very positive in their current outlook were twice as likely to predict higher exports in the next year as those who expected either the same levels of exports or less.

Smaller manufacturers (e.g., those with fewer than 50 employees) were less positive than their larger counterparts. They anticipate sales growth of 2.75% over the next year, compared with 4.8% and 4.4% expected increases on average for medium-sized and large firms, respectively. In addition, fewer small manufacturing businesses were either somewhat or very positive about their current outlook, with 77.2% of smaller firms in that category. Medium-sized manufacturers (between 50 and 499 employees) were the most optimistic. This finding is mostly consistent with past surveys.

Figure 3 shows that 64% of respondents cite an unfavorable business climate as the top challenge for the second quarter in a row. In addition, many respondents frequently expressed tax and regulatory concerns, mostly at the federal level. However, at least one individual also remarked on the conditions in his or her state. Of those who volunteered answers, several focused on their frustrations with the political process, and they often discussed burdensome regulations and the need for a more competitive tax policy. A few even mentioned the impact of budget cuts on their businesses. A sampling of some of these comments appears later in this document.

Sample Comments

Selected comments on the biggest challenges facing manufacturing right now:

• “Shortage of willing and qualified salespeople to fill openings.” (machinery)

• “Large reduction in U.S. military spending/purchases.” (textile mills or textile products)

• “Political gridlock in D.C. and the uncertainty it creates. Health care costs out of control.” (electrical equipment and appliances)

• “Weak international economy, sales of our products.” (miscellaneous manufacturing)

• “Economic uncertainty in Europe and its affects.” (primary metals or fabricated metal products)

• “Having available candidates to fill skilled machine positions for those who are retiring.” (primary metals or fabricated metal products)

• “Environmental regulations.” (nonmetallic mineral products)

• “Slowing European economy and less growth than expected in China economy. Still good, but not as expected.” (miscellaneous manufacturing)

• “Currency appreciation and rising labor costs (Brazil).” (primary metals or fabricated metal products)

• “Lack of confidence in our government and handling of national debt.” (paper and paper products)

• “Soft European markets.” (machinery)

• “Lack of progress with tort reform legislation.” (transportation equipment)

• “Implementation of Obamacare will force us to drop health insurance we have had for over 50 years.” (food manufacturing)

• “Weak sales forecast.” (furniture and related products)

• “Weakening developing market economies.” (primary metals or fabricated metal products)

• “Managing growth.” (miscellaneous manufacturing)

• “To develop and market new product in a timely fashion.” (wood products)

• “Lack of/having no faith that a return on investment is possible. What is the government going to do next? Certainly nothing to help.” (plastics and rubber products)

• “We are delaying any major capital investment until after the November 2012 elections.” (machinery)

• “Individual and corporate tax complexity is an impediment to hiring and growing.” (miscellaneous manufacturing)

Survey Responses

1. How would you characterize the business outlook for your firm right now?

a. Very positive – 20.5%

b. Somewhat positive – 62.6%

c. Somewhat negative – 15.8%

d. Very negative – 1.2%

2. Over the next year, what do you expect to happen with your company’s sales?

a. Increase more than 10 percent – 20.3%

b. Increase 5 to 10 percent – 30.0%

c. Increase up to 5 percent – 22.4%

d. Stay about the same – 18.4%

e. Decrease up to 5 percent – 4.5%

f. Decrease 5 to 10 percent – 1.9%

g. Decrease more than 10 percent – 2.6%

Average expected increase in sales consistent with these responses = 4.3%

3. Over the next year, what do you expect to happen with prices on your company’s overall product line?

a. Increase more than 10 percent – 1.9%

b. Increase 5 to 10 percent – 9.2%

c. Increase up to 5 percent – 35.8%

d. Stay about the same – 46.5%

e. Decrease up to 5 percent – 4.7%

f. Decrease 5 to 10 percent – 1.7%

g. Decrease more than 10 percent – 0.2%

Average expected increase in prices consistent with these responses = 1.5%

4. Over the next year, what are your company’s capital investment plans?

a. Increase more than 10 percent – 19.6%

b. Increase 5 to 10 percent – 13.2%

c. Increase up to 5 percent – 13.7%

d. Stay about the same – 42.7%

e. Decrease up to 5 percent – 3.1%

f. Decrease 5 to 10 percent – 3.3%

g. Decrease more than 10 percent – 4.5%

Average expected increase in investment consistent with these responses = 2.5%

5. Over the next year, what are your plans for inventories?

a. Increase more than 10 percent – 3.5%

b. Increase 5 to 10 percent – 7.4%

c. Increase up to 5 percent – 14.9%

d. Stay about the same – 48.6%

e. Decrease up to 5 percent – 16.6%

f. Decrease 5 to 10 percent – 5.7%

g. Decrease more than 10 percent – 3.3%

Average expected increase in inventories consistent with these responses = 0.1%

6. Over the next year, what do you expect in terms of full-time employment in your company?

a. Increase more than 10 percent – 4.9%

b. Increase 5 to 10 percent – 13.9%

c. Increase up to 5 percent – 33.9%

d. Stay about the same – 36.5%

e. Decrease up to 5 percent – 6.8%

f. Decrease 5 to 10 percent – 2.6%

g. Decrease more than 10 percent – 1.4%

Average expected increase in full-time employment consistent with these responses = 1.9%

7. Over the next year, what do you expect to happen to employee wages (excluding non-wage compensation such as benefits) in your company?

a. Increase more than 5 percent – 2.4%

b. Increase 3 to 5 percent – 20.2%

c. Increase up to 3 percent – 59.9%

d. Stay about the same – 16.6%

e. Decrease up to 3 percent – 0.2%

f. Decrease 3 to 5 percent – 0.5%

g. Decrease more than 5 percent – 0.2%

Average expected increase in wages consistent with these responses = 1.8%

8. Over the next year, what do you expect to happen with the level of exports from your company?

a. Increase more than 5 percent – 18.3%

b. Increase 3 to 5 percent – 10.1%

c. Increase up to 3 percent – 14.4%

d. Stay about the same – 52.6%

e. Decrease up to 3 percent – 2.4%

f. Decrease 3 to 5 percent – 1.4%

g. Decrease more than 5 percent – 0.7%

Average expected increase in exports consistent with these responses = 1.4%

9. What are the primary drivers of your company’s future growth strategies?

(Respondents could check only one response; therefore, responses will exceed 100%.)

a. Increased efficiencies in the production process – 52.5%

b. Increased international sales – 39.5%

c. New product development – 55.5%

d. Recent mergers or acquisitions – 12.5%

e. Stronger domestic economy, sales of our products – 67.5%

f. Other – 5.9%

10. What are the biggest challenges you are facing right now?

(Respondents could check only one response.)

a. Attracting and retaining a quality workforce – 45.6%

b. Challenges with access to capital or other forms of financing – 7.8%

c. Increased international competition – 23.5%

d. Rising energy and raw material costs for our products – 46.4%

e. Rising insurance costs – 43.1%

f. Unfavorable business climate (e.g., taxes, regulation) – 64.0%

g. Weaker domestic economy, sales of our products – 46.1%

h. Other – 7.5%

11. What is your company’s primary industrial classification?

a. Apparel and allied products – 0.2%

b. Beverages and tobacco products – 0.2%

c. Chemicals – 4.5%

d. Computer and electronic products – 2.1%

e. Electrical equipment and appliances – 6.2%

f. Food manufacturing – 2.4%

g. Furniture and related products – 1.2%

h. Leather and allied products – 0.2%

i. Machinery – 10.6%

j. Miscellaneous manufacturing – 17.3%

k. Nonmetallic mineral products – 2.1%

l. Paper and paper products – 1.4%

m. Petroleum and coal products – 0.5%

n. Plastics and rubber products – 6.6%

o. Primary metals, or fabricated metal products – 32.9%

p. Printing and related activities – 1.9%

q. Textile mills or textile products – 1.4%

r. Transportation equipment – 5.0%

s. Wood products – 3.3%

12. What is the size of your firm (e.g., the parent company, not your establishment)?

a. Fewer than 50 employees – 18.4%

b. 50 to 499 employees – 54.6%

c. 500 or more employees – 27.1%

About the Author

Chad Moutray

Chief Economist, National Association of Manufacturers

Chad Moutray is chief economist for the National Association of Manufacturers, where he serves as the NAM’s economic forecaster and spokesperson on economic issues. He frequently comments on current economic conditions for manufacturers through professional presentations and media interviews and has appeared on various news outlets. In addition, he is the director of the Center for Manufacturing Research at The Manufacturing Institute, the workforce development and education partner of the NAM, where he leads efforts to produce thought leadership, data and analysis of relevance to business leaders in the sector.

Prior to joining the NAM, Mr. Moutray was the chief economist and director of economic research for the Office of Advocacy at the U.S. Small Business Administration from 2002 to 2010. In that role, he was responsible for researching the importance of entrepreneurship to the U.S. economy and highlighting various issues of importance to small business owners, policymakers and academics. In addition to discussing economic and policy trends, his personal research focused on the importance of educational attainment to both self-employment and economic growth.

Prior to working at the SBA, Mr. Moutray was the dean of the School of Business Administration at Robert Morris College in Chicago (now part of Roosevelt University). Under his leadership, the business school had rapid growth, both adding new programs and new campuses. He began the development of an M.B.A. program that began accepting students after his departure and created a business institute for students to work with local businesses on classroom projects and internships.

Mr. Moutray is the vice chair of the Conference of Business Economists, and he is a former board member of the National Association for Business Economics, where he is the co-chair of the Manufacturing Roundtable. He is also the former president and chairman of the National Economists Club, the local NABE chapter for Washington, D.C.

He holds a Ph.D. in economics from Southern Illinois University at Carbondale and bachelor’s and master’s degrees in economics from Eastern Illinois University. He is a Certified Business Economist™, where he was part of the initial graduating class in 2015.

In 2014, he received the Outstanding Graduate Alumni Award from EIU, and in 2015, he accepted the Alumnus Achievement Award from Lake Land College in Mattoon, Illinois, where he earned his associate degree in business administration. He serves on the external economics advisory board for the SIUC’s School of Analytics, Finance and Economics.