The future state of U.S. manufacturing depends substantially on our success in reducing, rather than further increasing, our approximately $700 billion goods trade deficit, excluding petroleum. That deficit, after adjustment for price differences, equals about 40% of actual U.S. manufacturing output, about 5 million manufacturing jobs at current U.S. productivity levels. Success will depend on government actions that increase the price competitiveness of U.S. manufacturing and on corporations implementing more rapid automation and skilled workforce training and greater use of TCO (Total Cost of Ownership) for sourcing and siting decisions. The resulting reshoring and FDI (Foreign Direct Investment) will provide the high capacity utilization that will fund and motivate the needed automation and workforce recruitment.

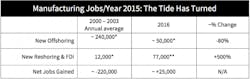

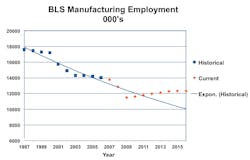

Manufacturing job flow to and from offshore has gone from net annual U.S. losses of about 220,000 (2000 to 2003) to a 25,000 net gain (2016).

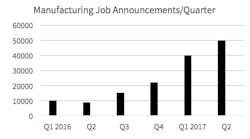

The trend was further accelerated by a lower USD and President Trump’s promises on trade, taxes, and regulations, with reshoring plus FDI manufacturing job announcements doubling in November 2016 and further accelerating at least thru the second quarter.

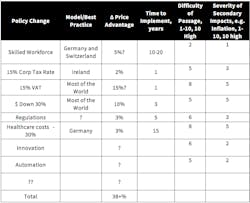

The recent acceleration is in anticipation of policy changes and will dissipate if changes are not implemented. Dozens of groups have proposed policies to grow manufacturing. Few of these groups have quantified their proposals’ impact. The Reshoring Initiative is developing a Competitiveness Toolkit for selecting the optimal mix of national policies to achieve a desired increase in output and employment. The Toolkit has the following elements:

- The size and distribution of the price and TCO gaps between the U.S. and other countries, especially China, by industry.

- The dollar value of imports by country and industry and thus the number of jobs that would be created by substituting U.S. production for X% of imports.

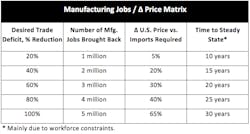

The administration can target a desired reduction in the trade deficit/increase in manufacturing jobs and identify the required percentage change in price competitiveness. For example, we estimate that a million jobs would require a 5 percentage point improvement in U.S. pricing and 10 years to achieve. We recommend the changes be committed for the long term but phased in over 5 or more years so companies have time to increase physical capacity and, even more critically, to recruit and train the needed skilled workforce. The estimates assume that all companies make their sourcing and siting decisions on the basis of TCO, instead of ex-works price. Otherwise, the required price reductions would be 15 percentage points higher.

We believe the estimates are conservative. Improved competitiveness will also increase our exports, producing approximately $1 export increase for every $3 of import reduction. Thus, a 20 percentage point improvement in U.S. price would increase manufacturing jobs by closer to 2.6 million. Also, the percentage price differences were calculated vs. China, which provides about 30% of our goods imports and half of our trade deficit. The elasticity with Europe and Canada will be substantially higher since the price differences are much smaller.

From the list of national policy changes, the administration and Congress can pick the mix and magnitude of changes that will achieve the required increase in price competitiveness.

We call on companies, trade associations, academia and government to partner with us on the Toolkit so we can include your recommended policy changes and your analysis of impacts on the price gap. You can reach me at [email protected]. Let’s jointly develop the tools for the government to make the optimal decisions for U.S. manufacturing and for the country.

About the Author

Harry Moser

Founder

Harry Moser, founder of the Reshoring Initiative, grew up experiencing the glory of U.S. manufacturing. With more than 45 years of manufacturing experience (most recently 25 years as president, chairman and then chairman emeritus of GF AgieCharmilles), Moser is a leading industry spokesman for reshoring and for developing the skilled manufacturing workforce required by reshoring.

The not-for-profit Reshoring Initiative ‘s Mission is to bring back U.S., and more generally North American, manufacturing jobs by helping companies see that, increasingly, they will be more profitable if they produce and source in or near their market.