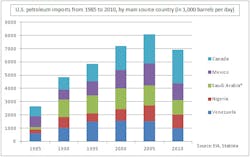

A recently released report from the U.S. Energy Information Administration provided good news about the future of US energy dependence. Net imports of energy now account for just 22% of US energy consumption. This number stands in stark contrast to the 30.8% share that imports held in 2005.

As political controversy continues to embroil the Middle East, it is an encouraging sign that the US economy is relying on less on foreign sources of energy. The foreign sources that do still provide significant imports are more "neighborly" and less likely to involve US energy consumption in political turmoil.

Since oil is a globally traded commodity, the US will still be exposed to some foreign supply price risk, but the farther our energy demands move toward natural gas and domestic oil supply, the further we protect ourselves from that risk and provide the fuel we need for continued economic growth.

About the Author

Alan Beaulieu Blog

President

One of the country’s most informed economists, Alan Beaulieu is a principal of the ITR Economics where he serves as President. ITR predicts future economic trends with 94.7% accuracy rate and 60 years of correct calls. In his keynotes, Alan delivers clear, comprehensive action plans and tools for capitalizing on business cycle fluctuations and outperforming your competition--whether the economy is moving up, down, or in a recession.

Since 1990, he has been consulting with companies throughout the US, Europe, and Asia on how to forecast, plan, and increase their profits based on business cycle trend analysis. Alan is also the Senior Economic Advisor to NAW, Contributing Editor for INDUSTRYWEEK, and the Chief Economist for HARDI.

Alan is co-author, along with his brother Brian, of the book MAKE YOUR MOVE, and has written numerous articles on economic analysis. He makes up to 150 appearances each year, and his keynotes and seminars have helped thousands of business owners and executives capitalize on emerging trends.

Prior to joining ITR Economics, Alan was a principal in a steel fabrication company and also in a software development company.