NAM Survey Finds Manufacturing Optimism Wanes as Demand Dampens

Year-to-date economic growth has been disappointing, particularly when one looks at the optimistic outlook many business leaders had at the end of last year. A number of significant headwinds in the U.S. and global economy have challenged manufacturers so far this year. Indeed, a stronger U.S. dollar, the West Coast ports slowdown, lower crude oil prices and a cautious consumer have combined to dampen overall demand and output in the sector.

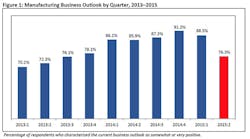

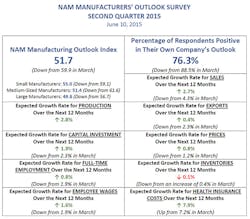

Just six months ago, for instance, 91.2% of manufacturers responding to the National Association of Manufacturers (NAM) quarterly survey said they were either somewhat or very positive about their own company’s outlook. It was only the fourth time since the survey’s inception in 1997 that we have achieved a reading exceeding 91%. Since then, that figure fell to 88.5% in March and 76.3% today, a significant decline in sentiment in such a short period of time. The June reading of this measure marks the lowest since the third quarter of 2013 (Figure 1).

Businesses face headwinds coming from Capitol Hill as well. The disappointing growth—especially within such a short period of time—reiterates the need to pass market-opening legislation like Trade Promotion Authority (TPA) and an Export-Import (Ex-Im) Bank Reauthorization.

To help make sense of this outlook measure, we are introducing a new index starting with this report: the NAM Manufacturing Outlook Index (Figure 2). Numbers greater than 50 suggest the manufacturing outlook is above average, coinciding with an expanding sector. We used data from previous surveys to see what the index would have been in those quarters. The index has fallen from 61.7 in December to 59.9 in March to 51.7 in this latest report. As such, we would continue to suggest that the manufacturing economy is growing, but at a much slower pace than the more-robust levels experienced just a few months ago.

Still, when you break this data down by firm size, it is clear that large manufacturers (e.g., those with 500 or more employees) stagnated in their outlooks in the second quarter, with their index dropping from 56.7 to 49.8. In contrast, the outlook for small manufacturers (down from 59.1 to 55.0) and medium-sized manufacturers (down from 61.6 to 51.4) remained above average, but with some significant easing, particularly for mid-sized companies (e.g., those with between 50 and 499 employees).

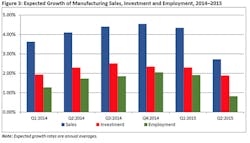

Small and medium-sized firms were also more optimistic about capital spending over the next 12 months, anticipating 2.1% growth. This compared to 1.3% growth for large manufacturers and 1.9% overall. Looking at all the responses, just over one-quarter said they see 5% growth in capital investments over the next year, down from 30.0% who said the same thing in March.

Likewise, firm size also played a factor in the hiring outlook. Large manufacturers are currently predicting a decline in employment of 0.2% over the next year, with small and medium-sized businesses anticipating 1.2% growth in their workforce. In total, hiring is expected to increase just 0.8% over the next 12 months, down from 2.0% and 1.9% in the last two surveys, respectively. Roughly half of all responses anticipate no change in employment.

Meanwhile, manufacturers expect their inventories to decrease by 0.1% over the next 12 months. Roughly half of those taking the survey predict inventory levels to remain unchanged, with 24.5% predicting increased inventories and 25.9% anticipating declines in the next 12 months.

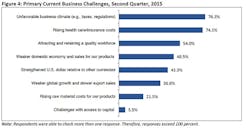

Health insurance costs were also a major concern, cited by 74.1% as a primary challenge. Manufacturers see health insurance costs increasing 7.9 percent over the next 12 months, up from 7.2 percent in the last report. More specifically, 40.9 percent of those completing the survey expect premiums to rise between 5.0 and 9.9 percent over the next year, with more than one-third predicting costs to rise by at least 10 percent. Small and medium-sized firms anticipate premiums to jump faster in the next year than large manufacturers do, at 8.5 percent and 6.8 percent respectively.

Fiscal Responsibility

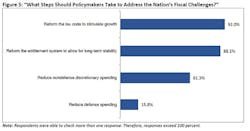

As manufacturers strategize for the long term, they must consider structural barriers that could plague the economy down the line. As such, it is not surprising that 95.5% of respondents to this latest survey said it was important for policymakers to address the nation’s fiscal challenges. Moreover, 7 out of 10 manufacturing leaders completing the survey felt that addressing these challenges was extremely important. In terms of the steps that policymakers need to take to reduce the deficit and to tackle the nation’s debt (Figure 5), respondents overwhelming suggested reforming the tax code (92.0%), pursuing entitlement reform for long-term stability (88.1%) and reducing nondefense discretionary spending (61.3%).

The survey also asked for other ideas that might help the country restore its fiscal position. Respondents offered a number of suggestions, including a desire for elected officials to worry less about their next election, a balanced budget amendment, health care reform, term limits and reducing the size of the federal bureaucracy. As one individual put it, there should be no “sacred cows.” Several manufacturers cited concerns about the impact of increased interest rates on the federal debt.

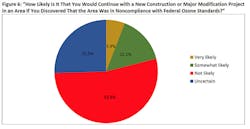

Proposed Ozone Regulations

The Environmental Protection Agency (EPA) has proposed new federal regulations on ozone, which an NAM study estimates could cost as much as $140 billion annually, or $1.7 trillion from 2017 to 2040. Beyond the cost of complying with the regulation, manufacturers could also face difficulty when seeking to expand their operations if the local area is deemed out of compliance with federal ozone standards. Almost two-thirds (66.3%) of respondents said they were concerned about the impact that these new EPA regulations might have on their businesses, with 16.9% uncertain.

Note

This survey has been conducted quarterly since 1997, with the NAM membership submitting this quarter’s responses between May 14 and 29, 2015. Three hundred sixty-seven manufacturers from all parts of the country, in a wide variety of manufacturing sectors and in varying size classifications, responded this quarter. The next survey is expected to be released Wednesday, Sept. 9, 2015.

About the Author

Chad Moutray

Chief Economist

Chad Moutray is chief economist for the National Association of Manufacturers (NAM), where he serves as the NAM’s economic forecaster and spokesperson on economic issues. He frequently comments on current economic conditions for manufacturers through professional presentations and media interviews. He has appeared on Bloomberg, CNN, C-SPAN, Fox Business, Fox News, and Reuters television.

Prior to joining the NAM, Dr. Moutray was the chief economist and director of economic research for the Office of Advocacy at the U.S. Small Business Administration (SBA) from 2002 to 2010. In that role, he was responsible for researching the importance of entrepreneurship to the U.S. economy and highlighting various issues of importance to small business owners, policymakers and academics. In addition to discussing economic and policy trends, his personal research focused on the importance of educational attainment to both self-employment and economic growth.

Prior to working at the SBA, Dr. Moutray was the dean of the School of Business Administration at Robert Morris College in Chicago, Ill. (now Robert Morris University of Illinois). Under his leadership, the business school had rapid growth, both adding new programs and new campuses. He began the development of an MBA program that began accepting students after his departure and created a Business Institute for students to work with local businesses on classroom projects and internships.

Dr. Moutray is a former board member of the National Association for Business Economics (NABE). He is also the former president and chairman of the National Economists Club, the local NABE chapter for Washington, D.C. He holds a Ph.D. in economics from Southern Illinois University at Carbondale and bachelor’s and master’s degrees in economics from Eastern Illinois University. In 2007, he was named a distinguished alumnus by Lake Land College in Mattoon, Ill., where he earned his associate’s degree in business administration, and in 2014, he received an Outstanding Graduate Alumni Award from Eastern Illinois University.