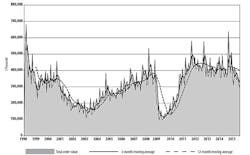

New orders for machine tools and related products rose to $329.76 million in November 2015, up 2.2% from October but still 13.8% less than the November 2014 total. AMT — the Association for Manufacturing Technology, which presented the figures in its latest U.S. Manufacturing Technology Orders report, noted the monthly increase in the value of new orders was offset by the fact that the number of units sold declined 16.31% from the previous month.

The November totals brought year-to-date U.S. manufacturing technology orders to $3.78 billion, a 17.2% decline versus the 11-month total ($4.56 billion) recorded from January-November 2014.

The monthly USMTO results are based on actual machine tool orders reported by participating companies that produce and distribute metal cutting and metal-forming and

–fabricating equipment, including domestically manufactured and imported machinery and equipment. The USMTO is an indicator of capital investment (not manufacturing activity) and represents manufacturers’ confidence in current and developing economic conditions.

“A significant portion of global manufacturing is experiencing slower growth, especially China,” observed AMT president Douglas K. Woods. “Investing in productivity and automation technologies is one way that manufacturers look to stay competitive in a softer market, especially as pricing moderates for finished manufactured goods.”

The Association listed the automotive, appliance, HVAC, and computers/electronics as industries “that made the most investment in equipment measured by USMTO.” It also pointed to regulatory developments at the end of 2015 that it suggested would promote further increases in U.S. manufacturing technology investments: Congress approved a two-year budget agreement that will end the mandatory sequestration (which in recent federal budgets have automatically eliminated significant amounts of spending on defense programs) and restore tax incentives for capital equipment purchases that expired at the end of 2014.

“In addition to the benefits that come from these tax incentives — specifically 50% bonus depreciation and permanent Section 179 expensing — we are hopeful that this will accelerate the replacement cycle for equipment that we are expecting in 2017 and 2018,” Woods stated. “The prolonged decline in orders we saw through 2015 is anticipated to give way to an upturn at the end of 2016.”

Regional Results Illustrate Range of Demand

In addition to the nationwide totals for new orders, the USMTO report includes monthly summaries of orders in six regions of the U.S. The relative strength of capital investment activity in different regions — e.g., automotive demand in the North Central-East and –West regions, oil-and-gas industry demand in the South Central region — portrays more dramatically the difficulty of sustaining growth across the manufacturing industries.

In the Northeast, November’s new orders for rose 37.6% from October, to $73.3 million. The 11-month total for new orders in the region is up 3.1% compared to 2014, to $733.8 million.

In the Southeast region, November’s new orders for metal-cutting equipment declined 12.0% versus October, to $31.48 million. The region’s year-to-date orders for all manufacturing technology amounted to $400.86 million, a decline of 8.4% compared to January-November 2014.

The North Central-East region’s manufacturing technology orders during November amounted to $98.23 million, down 8.6% from October. Through the first 11 months of 2015, the North Central-East region reported $1.08 billion worth of new orders, a decline of 8.4% versus the comparable period of 2014.

The North Central-West region had metal-cutting equipment orders amounting to $51.81 million during November, an improvement of 8.7% from October. Year-to-date manufacturing technology orders in the region amounted to $692.3 million, a 14.0% decline versus the January-November 2014 total.

The South Central region reported metal-cutting equipment orders of $30.65 million, which is 63.9% more than the October order volume. However, for the year-to-date total manufacturing technology orders in the South Central region stood at $291.25 million at the end of November, down 59.2% compared to the previous year’s comparable figure.

In the West region, November’s metal-cutting equipment orders fell 25.3% from October. Total manufacturing technology orders in the West region were reported at $581.01 million for the January-November period, down 15.2% compared to the 2014 figure.

American Machinist is an IndustryWeek companion site within Penton's Manufacturing & Supply Chain Group.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries. His work has covered a wide range of topics, including process technology, resource development, material selection, product design, workforce development, and industrial market strategies, among others. Currently, he specializes in subjects related to metal component and product design, development, and manufacturing — including castings, forgings, machined parts, and fabrications.

Brooks is a graduate of Kenyon College (B.A. English, Political Science) and Emory University (M.A. English.)