MAPI: Manufacturing Has 'Reason for Optimism for All of 2014'

Manufacturers continue to report a steady improvement in business, according to the Manufacturers Alliance for Productivity and Innovation (MAPI) quarterly business outlook survey released today.

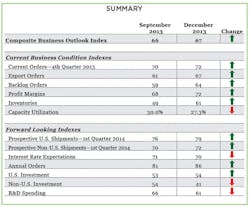

The survey’s composite index, a leading indicator for the manufacturing sector, improved from 66 to 67, the highest level since September 2011. This marks 17 quarters of the survey reading above 50, the dividing line for growth in the sector.

“The increase in the composite index and the continued improvement in most individual indexes signal that there is momentum pushing manufacturing activity and that activity is expected to increase over the next three to six months,” said Donald A. Norman, MAPI senior economist and survey coordinator. “The results suggest the sector has reason for optimism for all of 2014.”

Among the current indexes in the survey, the inventory index rose to 61 in December from 49 in September, MAPI reported, consistent with recent national income data and indicating an inventory buildup. The profit margin index showed good news for manufacturers, rising from 68 in September to 72 in December.

The capacity utilization index, which measures the percentage of firms operating above 85% of capacity, was the sole current index to drop, down to 27.3% in December from 30% in September.

The annual orders index, which is based on a comparison of expected orders for all of 2014 with orders in 2013, was a “bright spot,” MAPI noted, increasing to 86 in December from 81 in September.

Indexes for prospective U.S. shipments and for non-U.S. shipments both advanced. However, U.S. manufacturers showed a preference for capital investment at home. The U.S. investment index rose to 54 in December from 53 in September but the non-U.S. investment index took a sharp turn down, from 54 in September to 41 in December.

“The sharp drop in the non-U.S. investment index likely reflects concerns about economic conditions in parts of the Eurozone and Latin America, as well as the rising cost of operations in China,” Norman explained.

Fewer manufacturers registered concerns that longer-term interest rates will rise by the end of March. Manufacturers also indicated they would be pulling back on research and development spending, as that index fell to 61 in December from 66 in September.

In a supplemental survey, MAPI also asked manufacturing executives about their staffing of the finance function. While 41% indicated they will lose 5% or less of their finance staff over the next three years, 30% anticipate that 11% or more of their finance staff will depart or retire over that period.

Seventy-one percent said it will be moderately difficult to replace departing financial personnel, and 76% said they use search firms in their recruiting. Financial analysts and tax specialists are the most difficult positions to fill.

About the Author

Steve Minter

Steve Minter, Executive Editor

Focus: Leadership, Global Economy, Energy

Call: 216-931-9281

Follow on Twitter: @SgMinterIW

An award-winning editor, Executive Editor Steve Minter covers leadership, global economic and trade issues and energy, tackling subject matter ranging from CEO profiles and leadership theories to economic trends and energy policy. As well, he supervises content development for editorial products including the magazine, IndustryWeek.com, research and information products, and conferences.

Before joining the IW staff, Steve was publisher and editorial director of Penton Media’s EHS Today, where he was instrumental in the development of the Champions of Safety and America’s Safest Companies recognition programs.

Steve received his B.A. in English from Oberlin College. He is married and has two adult children.