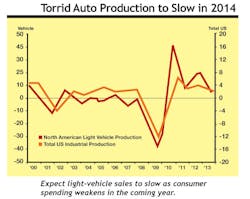

There is good news to celebrate as we begin the New Year. We at ITR Economics encourage businesses to plan on increasing activity in 2014, but we are also cautioning against linear projections. There are some headwinds.

At the moment, the Affordable Care Act is a huge unknown in terms of end costs to consumers in 2014. The early returns seem to suggest premiums and out-of-pocket expenses will rise for a good portion of American workers. Along with limited well-paying, full-time employment opportunities, the consumer will likely be squeezed in 2014.

On the bright side, the leading indicators, which measure broad swaths of the U.S. economy, are well-positioned in positive territory. Further expansion is expected through the first half of 2014. Consumer spending reflected in retail sales (deflated) ended 2013 in positive territory, and business-to-business activity, as measured by nondefense capital goods (excluding aircraft), is also positive as we begin the new year. Interest rates remain stimulative. Inflation is benign and banks are easing lending restrictions.

Mexico Gains Auto Production

Mexico continues to attract auto assembly and parts manufacturing with its combination of low costs, free trade agreements and favorable Western Hemisphere location. Mexico's trade agreement with Brazil allows automakers to export vehicles to Brazil at a lower cost than plants in the United States or Europe. Japanese automotive companies are adding assembly-line capacity and expanding operations.

| Stay up-to-date with economic news and trends on Alan Beaulieu's Make Your Move blog at iw.com/blog/make-your-move. |

Don't focus on the mild weakness that we foresee later this year. Use this year to put in place processes and employees that will help you gain market share and profits in the years to come. Also, tune out Washington and the press. They will only distract you. Stay focused on what you do best.