BMW Counters Apple Threat with Self-Driving, Electric Car

BMW AG (IW 1000/31) plans for a self-driving, electric car to supplant the 7-Series sedan as its flagship model in the coming years, responding to the challenges posed by the likes of Apple Inc. and Uber Technologies Inc.

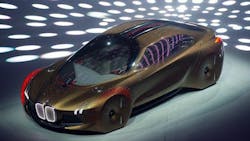

The BMW iNext, to be rolled out early next decade, embodies the company’s vision of the future. The electric car will drive itself, link to cloud computing services and interact with the driver beyond knobs and buttons. It marks a further shift from the Autobahn thrills that have made BMW the world’s largest maker of luxury vehicles.

The effort to keep ahead of traditional rivals and automotive newcomers with high-tech, clean-running vehicles will largely be funded by gas guzzlers. That includes rolling out more high-performance M models, new derivatives of the 7-Series as well as the X7 -- a big, new sport utility vehicle -- in 2018.

“We are taking advantage of the growth potential in the high-margin segments,” Chief Executive Officer Harald Krueger said at a press conference in Munich, his first major strategic statement since becoming CEO last May. “The evolution will continue to fund the revolution in the coming years.”

A decade after taking the top spot in the global luxury-car market, BMW is at a crossroads. Years of rolling out new models ranging from coupe-like SUVs to seven-seat wagons have left the company with few niches that could spur growth. While traditional rival Mercedes-Benz pushes to reclaim the crown, car-sharing service Uber and newcomers like Tesla Motors Inc. and possibly Apple add to the pressure.

“BMW’s strategy review touched on the topics that all carmakers are dealing with,” including connectivity, autonomous driving and vehicle emissions, said Sascha Gommel, a Frankfurt-based analyst at Commerzbank. “All of these technologies are costly.”

BMW is particularly exposed. Unlike Daimler AG’s Mercedes and Volkswagen AG’s Audi, the parent of the BMW, Rolls-Royce and Mini brands isn’t part of a broader group. That means its current lineup needs to fund the investment, while at the same time meet demands by regulators for cleaner cars. To offset the emissions of M performance models, BMW plans plug-in hybrid variants of its bread-and-butter models.

The company aims to find the balance to maintain its pretax profit margins at a minimum of 10% through 2020. The process will include weeding out poor-performing models like the Mini coupe, as it walks a fine line between profit, growth and investment.

The stark contrast between what regulators want and what customers are willing to pay for is evident in the sales of BMW’s M and i subbrands. Sales of high-performance M models surged 39 percent last year to more than 62,000, double the sales of the i3 and the i8 plug-in hybrid sports car.

‘Take Risks’

In the near term, growth will likely slow. BMW predicted earnings will rise only slightly in 2016, compared with a forecast of solid gains last year. Revenue from the automaking segment will also grow slightly, assuming the political and economic environment remains stable.

Krueger’s “Next” strategy marks the biggest shift since 2007, when then-CEO Norbert Reithofer pushed the upscale carmaker to invest billions to reduce fuel consumption, produce its first electric vehicle and pioneer the mass production of carbon fiber. The challenges now are much more diverse, and the payoff remains uncertain.

“We need to act swiftly in the digital world and be prepared to take risks,” including adding more services like ride-sharing, said Krueger. “Maximum flexibility is needed to stay our course in an uncertain environment.”

About the Author

Bloomberg

Licensed content from Bloomberg, copyright 2016.