As the world has embraced everything smart it has become strikingly clear that semiconductors are a crucial component. And, as the pandemic intensify the need and desire for more smart devices, unfortunately, the fragility of the semiconductor supply chains surfaced. Unfortunately, the issue is sure to continue as the demand for 5G phones, smart automobiles and even seemingly simple consumer goods like air fryers continues to escalate.

As supply chains ground to a halt globally, the entire chip manufacturing industry was among the affected. There are adjustments existing chip producers can make to ease the pain and get essential production environments back up and running. However, as Intel’s CEO explained recently, a true solution to the current supply constraint is going to take time. Specifically, 2-3 years. The reason is simple. Sustainably addressing the demand surge dictates more capacity including facilities, talent and an array of custom capital equipment.

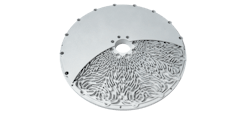

Understandably, semiconductor capital equipment is the key enabler to deliver highly complex chips needed to power a variety of technologies that have become integral to our society. And, as chips continue to decrease in size while processing power increases, capital equipment manufacturers are innovating their equipment to help semiconductor fabrication plants (fabs) meet these demands. However, these tools are complex and expensive with a long product development cycle.

Having worked within the semiconductor capital equipment sector for over a decade producing metal parts for lithography, deposition and stripping machines, 3D Systems understands the role additive can play. “These complex machines have compromises in a lot of places, and additive manufacturing serves as a relatively new manufacturing method to help optimize components and subsystems for function and performance over manufacturability,” says 3D Systems Principal Solutions Leader Scott Green. “In many ways additive is helping systems perform much closer to the expected, theoretical way of working. And, when systems do that, they produce higher quality output faster.”

As with any industry, there are some early adopters who are clearly leading the charge, printing relatively straightforward parts, with the uniqueness often being the need for very clean parts. However, as maturity starts to set in, Green is already starting to see increasingly complex requirements as additive starts to infiltrate the different design areas.

When combining the most important qualities for semiconductor equipment (high strength, high conductivity, resistant to highly corrosive material or abrasion), nickel alloy, titanium and aluminum alloy surface as the most straightforward materials to produce the desired parts. “As additive proliferates into other parts of the machine, we may see some expansion into tungsten,” he says.

According to Green, as companies invest in bringing foundries online, it's the perfect time for equipment manufacturers to consider the benefits of performance and supply chain benefits additive can add to the equation. “Additive provides a very unique economic and technological mix of circumstances for semiconductor equipment manufacturers. Additive has the potential to help unlock the performance gains inside systems, subsystems or total capital equipment systems -- all of which are really critical right now,” says Green. “It's also important to simplify the supply chain and streamline operations to move faster and get machines into the market faster.”

About the Author

Peter Fretty

Technology Editor

As a highly experienced journalist, Peter Fretty regularly covers advances in manufacturing, information technology, and software. He has written thousands of feature articles, cover stories, and white papers for an assortment of trade journals, business publications, and consumer magazines.