I was recently on a conference call with a group of managers from one of the world’s most well respected freight brokers. During the call one manager stated that the ocean freight market was the softest he has seen in approximately nine years. He went on to say that any purchaser of ocean freight who has not recently spoken with their ocean freight service provider is probably paying too much. A cursory review of recent industry data supports both statements.

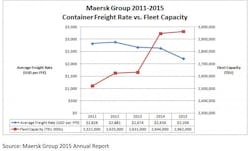

In their 2015 annual report, the Maersk Group reported that their average 40-foot container freight rate has decreased 22% since 2011, while their fleet capacity during this same time frame has increased by 17%. Adding to this bearish environment, the cost of bunker fuel has decreased 49% from 2011 to 2015.

Maersk is a well-run company, so you can be certain they are not alone in this regard. While lower fuel prices have provided some cost relief to the industry, downward price pressure on ocean container freight has become an industry-wide problem. The China Export Containerized Freight Index is down 20% from 12 months ago on the China to U.S. (West Coast) trade lane. The same index is down 28% and 38%, respectively, on the China to U.S. (East Coast) and China to Europe trade lanes. This dynamic has been caused by excess vessel capacity (i.e., from ships brought online during more optimistic times), the economic deceleration in China and the subsequent ripple effect to other emerging markets.

Material Handling & Logistics is an IndustryWeek companion site within Penton's Manufacturing & Supply Chain Group.