Supplier Scorecards: Choose These Metrics to Improve Your Partners' Performance

This is the last of a three-part series on purchasing. It is intended to blow up long-standing paradigms, to challenge purchasing leaders to think and act more boldly, as well as to think and act more purposefully on the journey to excellence. The first article dealt with the mindset that is necessary to lead the effort; to change how the purchasing team thinks about the function, which ultimately changes the culture. Bold. Process-improvement oriented. Data-driven problem solvers reaching out to supplier and in-house engineering support.

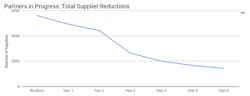

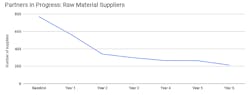

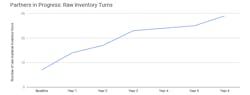

The second article, Busting Purchasing Paradigms, expounded on a proven process of how to make order-of-magnitude improvements that can position purchasing organizations in the world-class category of excellence. (See the graphs throughout this article.) Without such a CI process in place, how can any company achieve these kinds of results?

In this final article, I’ll summarize the scorecard that we used to measure suppliers, along with other expectations, that ultimately would earn qualified or certified supplier status. The two best scoring suppliers per commodity group would harvest the market share for each category with approximately a 70% and 30% split.

The original column suggested our readers consult with their customer service people to learn what the key expectations were for the company’s customers. Chances are good that the same metrics will serve you well with what to expect from your suppliers. First on the list is quality.

Quality

There were two measurements: Monthly DPMO (defective parts per million opportunities) and a rolling three-month DPMO to track trending.

The two calculations are simple:

- Monthly Quantity Rejected ÷ Monthly Quantity Received x 1,000,000

- Rolling 3-month Quantity Rejected ÷ Rolling 3-month Quantity Received x 1,000,000

The minimum quality requirement to compete to become one of the top two suppliers was 3 sigma, with points reported as follows:

3 sigma = 10 points

4 sigma = 20 points

6 sigma = 25 points

Be sure to use your engineering partners to recognize that some products don’t require the investment to achieve six sigma. But on critical specification requirements that affect form, fit or function of your customers’ products, work toward six sigma control on the CTQ (Critical To Quality) characteristics. Commit to the improvement within three calendar years. [See Is There a Role for Six Sigma in a Lean Transformation?]

Delivery Performance

There were two measurements: Monthly on-time delivery and a rolling three-month on-time delivery to track trending.

The two calculations are:

- Monthly Deliveries - Monthly Late Deliveries ÷ Total Monthly Deliveries

- Rolling Quarter Deliveries – Rolling Quarter Late Deliveries ÷ Total Rolling Quarter Deliveries

Our requirements were:

“A” items tolerance is 0 days early and 0 days late. Objective is as close to JIT as possible.

“B” items tolerance is 2 days early and 0 days late

“C” items are negotiated by commodity and plant location based on smaller demand and less frequent requirements.

Delivery performance scoring was recorded as follows:

| 98%-100% = 25 points | Level required to be the certified supplier |

| 95%-97% = 20 points | Minimum required to be qualified supplier |

| 93%-94% = 10 points | After three consecutive months at this level, the buyer would request the supplier present an improvement plan to recover within 30 days. |

| 90%-92% = 5 points | After two consecutive months at this level, the buyer would require the supplier to present an action plan to improve to 95%-plus within 30 days. |

| Less than 90% = zero points | Immediate probation with a workout plan required within 15 days. Qualified supplier status at risk. |

Both quality and delivery are of huge importance, but it’s worth a reminder here that over the first one to three years, you’re weeding out the suppliers who are unable to meet your minimum requirements to earn a top two position. These two suppliers who rise to the top are where the true partnership must be developed to maturity. All suppliers will at some point stub their toe. So be prepared to unemotionally work through the issues with them as a partner, not as an adversary. Penetrate their organizations to meet their engineering and production people, sales service, etc. And reciprocate with their counterparts into your company as well.

Lead-Time Improvement

Lead-time improvement is the third metric. There are plenty of examples out there where supplier lead times on “A” materials are longer than the factory cycle times. Be sure your major suppliers have a plan to reduce cycle times in their plants. This is often the quickest way to reduce lead times. Volunteer one of your resources to assist/partner with a supplier engineer. If they don’t have the skills in house, purchasing should insist on corrective action within a reasonable time. Also, be sure to discuss “flex capacity” options. This is a test for how responsive a supplier can be if there is an increase in demand. Working with your key suppliers, set a timeline for lead-time improvement, which is scored as follows:

Improvement = Actual Lead Time – Starting Lead Time

Score 25 points > 50% improvement

Score 15 points 26%-49% improvement

Score 10 points 15%-25% improvement

Score 0 points < 15% improvement

Inventory Turnover Improvement

Inventory turnover improvement is the fourth metric. First, let’s eliminate consignment inventory in our factories. Our plants are not a warehouse for the suppliers’ raw materials because their lead times are too long. Allowing consignments provides a disincentive for suppliers to improve their factories. Most importantly, the cash required for inventory is the same so customers are likely paying whatever the carrying costs are for mountains of inventory (read: cash). Just say no to consignments. It’s a crutch. Force the process improvements necessary while the suppliers clutter their own building with inventory. They’re sitting on a one-time cash tsunami for their companies that isn’t being recognized.

Your best supplier lead times become the baseline others must strive for if they want to compete seriously for the business. (Separately, you can have discussions with your baseline company to begin thinking about what further improvements may be theoretically possible to achieve in coming years.) This often is helpful for deciding which suppliers are completely out of the game and which ones might be close to your initial expectations, assuming quality and delivery are competitive. Award points based on the percentage of improvement from the base line you agree to. Review progress regularly and tee up the next improvements at yearend. Within two to three years you should expect to enjoy the best lead times in the market by your sharply reduced number of suppliers.

Establish baseline turns from the prior year and expect improvement from there.

Points are awarded as follows:

50% improvement = 25 points

26%-49% = 15 points

15%-25% = 10 points

10%-14% = 5 points

A fifth option you may want to consider is a productivity measure where you can capture the overall cost and cash flow improvements, net of inflation. Tracking this will quiet the critics when they don’t tie the improvements that the operations people are talking about to the company’s balance sheet and income statement. Your controller can help if you ask.

In summary, this structure for metrics provides four important improvement initiatives, each worth 25% for a total of 100 points on the scoreboard. You will now have a monthly and quarterly “supplier report card” for the buyers to discuss with the supplier’s sales management. It’s not only a great way to get improvements started right away, it’s also a great way to begin moving volume to the better performers right away.

Please note that pricing negotiation is not on this scorecard. That’s with purpose. This agenda is about improving both the performance and the relationships with our much smaller group of suppliers. The benefits from the better performance will show up in the numbers and can be quantified. The price negotiation has external market conditions that affect the outcome and has no part in improving processes to excel.

Finally, there are other topics that should be addressed in this “Partners in Progress” approach to improvement. Here are some things to consider, taken from the table of contents of a Partners in Progress supplier manual.

- Purpose of Partners in Progress

- The Vital Role of Suppliers

- Adding new suppliers

- Supplier Information form

- Qualification Process

- Certification Process

- Certified Commitment Agreement

- Supplier Education

- Disqualification and Decertification

- Requalification and Recertification

- Supplier Dismissal

“A man of destiny knows that beyond this hill lies another and another. The journey is never complete.” -- F.W. De Klerk

“Without deviation from the norm, progress is not possible.” -- Frank Zappa

About the Author

Larry Fast

Retired

Larry Fast, IW's Ask the Expert: Lean Leadership author, was founder and president of Pathways to Manufacturing Excellence and a veteran of 35 years in the wire and cable industry. He is the author of "The 12 Principles of Manufacturing Excellence: A Leader's Guide to Achieving and Sustaining Excellence," which was released in 2011 by CRC Press, Taylor & Francis Group, as a Productivity Press book. It was a best seller in its category and a 2nd. Edition was published Sept. 24, 2015. It features a new Chapter 1 on leadership, various updates of anecdotes, and new electronic tools on the accompanying CD. At Belden, where he spent his first 25 years, Fast conceived and implemented a strategy for manufacturing excellence that substantially improved manufacturing quality, service and cost. He is retired from General Cable Corp., which he joined in 1997 to co-lead North American Operations. Fast later was named senior VP of North American Operations and a member of the corporate leadership team. By 2001 the first General Cable plant had won Top 25 recognition as one of the IndustryWeek Best Plants. By 2008, General Cable manufacturing plants had been recognized for 19 awards. Fast holds a bachelor of science degree in management and administration from Indiana University and is a graduate from Earlham College’s Institute for Executive Growth. He also completed the program for management development at the Harvard University School of Business in 1986.