A Cheat Sheet for Procurement Savings Tools

Purchasing has been underserved by technology in the last 10-15 years; however, there has been an explosion in software solutions that go far beyond ERP to address the unique and numerous use cases of procurement, sourcing, and supply chain.

While that is exciting, it has left CPOs wondering: How does solution A differ from B, C, D, etc.?

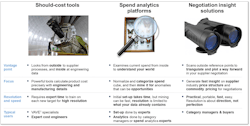

Here we will address the differences between traditional “should-cost” tools (around since the ‘70s); spend analytics (a big focus for that last 10-15 years); and new solutions in the last five years that focus directly on negotiation preparation and insight.

First, here is how these approaches and the software that serve them are similar:

- The main goal of each is the same: to save money

- All of them rely on data (albeit different types)

Understanding the differencesis a little trickier. At first glance, thsome of which are subtle, but when one actually uses these solutions, the differences become instantly apparent.

The figure below shows how different these three types of software are conceptually.

Should-Cost Tools (estimate perfection)

Should-cost tools are like a telescope in an observatory. There are a lot of adjustments that need to be made. Therefore, you need someone who is an expert to handle this tool. Their focus is using broad and deep data and assumptions from engineering (drawings, spec, 3D models) and from the suppliers (process speeds and feeds, routings, financial rates, etc.) to get a precise, to-the-cent, bottom-up calculation of what the cost (not, not necessarily price) of a part or service “should” be, based on the physical resources used (material, time, capital). This takes time, but once the telescope is targeted, amazing and beautiful views of the cost galaxy can be seen. That is, should-cost tools can give high resolution. Because of the skill needed to use them, these tools are mostly the purview of value-add / value engineering (VAVE) specialists or expert costing engineers. Some purchasing agents with engineering or manufacturing backgrounds do use them, but this type of software often is not really designed for the speed and flexibility the typical buyer or category manager needs.

Spend analytics platforms (arbitrage inspection)

These solutions take almost the exact opposite view of the should-cost tool. Think of these tools as a magnifying glass or even a microscope that is looking at your own data within your own organization.

Typically, this starts by assembling a “spend cube” where one categorizes all of the spend. Once this is done, the n-dimensional cube can be mined to find interesting opportunities. Although weeks or months are needed to set up the initial spend cube, cleanse the data, and normalize it, once this is done, the whole cube can be mined very quickly for any commodity. Therefore, the setup is typically done by experts (often by the services arm of the software provider of the spend analytics platform). However, day-to-day analytics of the finished cube can easily be done by spend analytics experts and category managers.

It is also important to understand that the magnifying glass of spend analytics is not trying to do bottoms-up calculation of cost of a part. Instead, spend analytics is trying to find arbitrage in the spend cube. That is, it is trying to find the same part made by different suppliers or in different orders with a different price. Additionally, it is looking for volume and supplier consolidation opportunities. Advanced versions of spend analytics may even look at performance attributes versus the cost (e.g., cost per weight of a casting). This is sometimes called Linear Performance Pricing (LPP).

Negotiation Insight Solutions (savings direction)

Negotiation insight platforms are, yet again, a different tool. They are more like a set of powerful pair of binoculars for the purchasing agent on the negotiation / savings hike. Their data focus is mostly outside of the organization on points of reference and triangulation to plot the course to savings. They focus on the actual pricing of raw materials and commodities, trends over time, and the price structure of your supplier and in certain geographies, compared to what one is paying today.

Their goal is not perfection like should-cost, or inspection like spend analytics, but direction; i.e., what arguments and facts the category manager can bring to the negotiation table to start a productive conversation with the supplier. As such, although negotiation insight solutions have cost calculation abilities, they are willing to sacrifice perfect resolution for speed, portability, and flexibility. Similar to your binoculars on a hike (or the battlefield!), you want the ability to train them very quickly from one benchmark or triangulation point to another. Because of this, negotiation insight solutions may not have the resolution demanded by cost engineers, but the people on the front line of the negotiation (e.g., buyers, category managers, CPOs, etc.) will find them a very useful addition.

Source-to-pay suites and individual solutions

A fourth category of helpful sourcing software is source-to-pay (S2P) solutions. In general, these solutions are not about finding savings, but running the business day-to-day. They focus on managing the processes of quoting / auctions, sourcing, contracts, risk, procurement, invoice, payment, etc.

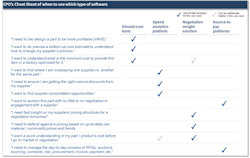

Which solution is right for my organization?

The short answer is: all of them! However, the more nuanced answer is, it depends on what you are currently doing in the procurement or sourcing process at the time. The table below shows some common needs that the CPO or others in the purchasing organization might have and which tool is best aligned to those needs.

As you can see, this is not an either/or question but a both/and. Like all toolboxes, it would be pretty limiting if there were only one tool. Different tools are needed for different jobs, and often multiple tools are used at the same time to accomplish a greater goal.

Eric Arno Hiller is the managing partner of Hiller Associates, a consulting firm specializing in Product Cost Management (PCM), should-cost, design-to-value and software product management. He is a former McKinsey & Company engagement manager and operations expert.