How to Build an Anticipatory Supply Chain

Toyota got a wake-up call in March 2011, when an earthquake registering 9.0 hit northern Japan, unleashing a massive tsunami. The human toll was devastating and the rebuilding task a monumental challenge. Later, for Toyota, it became evident how dramatic and far reaching this natural disaster was for its global business.

The company had recently attained the position of best-selling automaker worldwide, in part because of its tightly managed supply chain. Over the course of many years, it had taken the slack out of its operations, using just-in-time delivery of parts to keep inventories to a minimum. But having pruned its supplier base severely, in some cases to single suppliers of certain parts, it now found itself more vulnerable than it imagined.

The disabling of a few parts makers in Japan meant that assembly lines ground to a halt as far away as China and North America. Globally, March production dropped by 29.9%. It took six months for suppliers to get back to delivering products in required volumes.

Stung by the experience, Toyota set out to revamp its supply chain in such a way that the time required to recover from large-scale disruption would be reduced to at most two weeks. It wasn’t possible to get to that goal simply by learning to mobilize better in the aftermath of disaster. Toyota’s supply system had to learn to anticipate problems—if not always the catastrophic event itself, then the knock-on effects it would have.

Management embarked on an initiative to expose vulnerabilities and rank them in terms of likelihood and potential impact. The company worked with more than 500 suppliers to create greater visibility throughout a multi-tier supply network and to either spread production across multiple locations or maintain larger inventory buffers. Most strikingly, the automaker decided to reengineer many of its 4,000–5,000 vehicle components so that across different models, common parts could be used. The point was to raise the order volumes of those parts to the point that suppliers could justify building additional manufacturing facilities, providing a hedge in case one went offline. Put the changes together, and Toyota now has a more forward-looking, adaptive and effective supply chain.

Toyota’s example offers an extreme form of a problem many others are experiencing, and a particularly rich version of a solution that other leading companies are pursuing.

In all kinds of product businesses, supply chains that were first formed accidentally, then optimized for efficiency, are now being reworked with an important goal: to make them anticipatory.

Learning to Count on the Unexpected

Increasingly, supply chains are being designed and built to anticipate disruptions and reconfigure themselves appropriately to mitigate their impacts. What’s behind this major trend in operations management? Certainly, advances in information and communications technology are making it more possible. At the same time, a volatile business environment is making it more necessary. Whether it’s a spike in demand for a particular product in a locale, act of war or terrorism, labor dispute, regulatory change, or supplier bankruptcy, companies are learning to count on the unexpected.

More than anything, the trend reflects a growing belief that operations management in the past has overemphasized certain themes. A decades-long focus on optimization, seeking ever-lower costs, has resulted in supply chains that are too lean and too brittle. Even the more recent emphasis on resilience, while important, casts companies in too much of a reactive mode.

Fast-forward to today, and leading global corporations are building supply networks not just to withstand but to expect shocks. They know that in order to succeed in the next wave of globalization, it is important to embrace this new era of operations management—the anticipatory supply chain.

Creating an Anticipatory Supply Chain

For many organizations, the implication is very clear: Competing successfully will likely depend on keeping pace with this trend. The details of how to create an anticipatory supply chain will vary from sector to sector and even company to company. However, a few principles will apply in general.

Regionalization

As multinational corporations embark on a new wave of globalization, it is interesting to see that the drive to make supply chains more nimble and adaptive is leading to greater regionalization.

In the new wave of globalization, the simple trade flows familiar to most managers—that is, low-cost producers in the East supplying products to rich consumers in the West—are giving way to far more complex patterns. In parts of the world that have been centers for low-cost manufacturing, new wealth has been created and consumption is rising rapidly. The trend is most evident in Asia, where powerful productive capacity now sits alongside growing market demand.

Corporations spotting revenue growth opportunities in these markets are scrambling to adapt supply arrangements. In general, they are redesigning supply networks to be able to match demand and supply within the same region. For that matter, as wage rates rise in Asia, more companies are backing away from the sourcing arrangements that made China the “workshop to the world.” The trend is toward nearshoring, tapping into production capacity closer to prime markets.

Even in markets not known for low-cost inputs to production, companies are reweighing the costs and benefits of more localized supply networks. Most of the suppliers for blender manufacturer Vitamix, for example, are within 100 miles of its headquarters in Olmsted Township, Ohio. The company sees the proximity as essential to maintaining dialogue with its suppliers about its growth plans and strategic issues. Mutual understanding and commitment are essential because, in some cases, Vitamix asks suppliers to make capital investments before the growth actually occurs.

A tighter connection with strategy

In the past, supply chain arrangements were kept separate from conversations about strategy. The supply chain team had to determine the best method for meeting a product strategy’s requirements once the business goals had been set—which, of course, gave rise to “accidental supply chains.” Driven by greater global complexity, supply chain considerations are becoming central to strategy-making. Leading companies acknowledge the critical connection between supply chain and strategy development and execution; less successful companies focus more on how the supply chain contributes to operational performance.

In Deloitte Consulting LLP’s recent supply chain survey, 98 percent of “supply chain leaders” said that achieving global growth objectives was an extremely or very important objective of the supply chain. Organizations that recognize the huge role that the supply chain plays in advancing strategic growth goals, and that proactively engage the supply chain are more successful in achieving both top-line and bottom-line results.

Particularly given their focus on risks, anticipatory supply chains should be thoroughly integrated with the formulation of business strategy. An interesting implication of this is that executives at the highest levels of an organization may likely expect and demand greater leadership of supply chain functions.

New kinds of talent

A new type of leader, and new types of talent, may be required in many companies’ supply chain organizations. In the recent past, an executive could make a brilliant career out of managing supply networks and heroically responding to periodic supply disruptions. Not much deeper into the past, supply chain leaders tended to be veteran managers steeped in industry and institutional knowledge and interested in mentoring junior staff in the long-established ways of doing things. No more was needed when supply chains confronted a limited number of repeatable risks that could be managed through annual risk mitigation processes.

But the age of the anticipatory supply chain will require a more integrated background—executives who combine global experience with creative problem-solving and analytical skills—true innovators who are also disciplined operators. Already, many companies are giving more authority and responsibility to supply chain executives because they are recognizing that supply chains are vital to the future of the organization. Increasingly, top supply chain executives have gained that coveted “seat at the table” in strategy development.

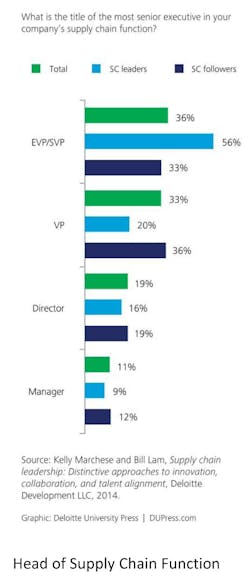

The results of Deloitte’s recent supply chain survey underscores this phenomenon. Fifty-six percent of supply chain leaders’ companies are headed by a supply chain EVP or SVP, versus only 33 percent among supply chain followers (see graphic, “Head of supply chain function”). Career paths like Marillyn Hewson’s may become more common. In 30 years with the aerospace company Lockheed Martin, she has held a variety of roles, including vice president of global supply chain management. In January 2013, Hewson was named president and CEO.

Technology Will Continue to Reshape the Supply Chain

We expect that the vision of the anticipatory supply chain will take years to realize fully. At every step, the most effective organizations will be those applying cutting-edge technology to enhance their real-time understanding of activity in complex supply networks, and to improve the economics of having production capacity closer to consumption locales.

As the Internet of Things expands and companies’ analytics become more sophisticated, predictive supply decision-making will increasingly become automated. Sensors signaling disruptions or unexpected activity in remote corners of the world will trigger appropriate adjustments in the flows of materials and energy.

Other technologies will reshape global supply chains. The evolution of additive manufacturing, or 3-D printing, has the potential not only to transform the manufacturing process for some goods, but to greatly reduce or even eliminate the need for shipping them across long distances. Much of the excitement about the technology is based on the prospect of being able to manufacture replacement parts rather than having to stock large varieties of them “just in case”—or else incur delays while they are shipped from centralized warehouses. According to our supply chain survey, supply chain leaders are more likely to be early adopters of disruptive technologies such as 3-D-printing, with 48 percent of leaders using 3-D printing “extensively” (vs. only 13 percent of supply chain followers).

Ever more sophisticated robotics will also allow for manufacturing schedules to turn on a dime. This is why Apple is investing a reported $10.5 billion in advanced production automation. The company is striking deals that will give it exclusive access to technologies for all kinds of tasks, from polishing the colored plastic of iPhone 5c mobile device cases to laser-cutting the aluminum bodies of MacBook computers.

In late 2013, Jeff Bezos, Amazon’s CEO, used the opportunity of a “60 Minutes” interview to unveil what he see as an inevitable development in package delivery technology: unmanned aerial vehicles, akin to those employed by the U.S. military for targeted strikes on enemies, used to drop parcels at consumers’ doorsteps. Given Amazon’s dozens of huge fulfillment centers scattered across the United States, the drones could enable a customer placing an online order to have it in hand within half an hour.

New innovations like these—and this is only a sampling—can guarantee that supply chains grow ever more anticipatory, and that the ideal way to buy, make and move a given product will perennially need rethinking. Innovation in the supply chain will likely continue to be a differentiating factor between the leaders and followers.

Kelly Marchese is a principal with Deloitte Consulting LLP and leader of the Supply Chain Strategy practice. She has over 20 years of experience leading projects in complex manufacturing industry sectors. Marchese leads the Global Supply Chain Risk service offering. She is a Master Black Belt in Lean/Six Sigma and is a thought leader in engineering effectiveness through manufacturing operations excellence.

Bill Lam is a senior manager with Deloitte Consulting LLP in the Supply Chain Strategy practice with over 12 years of experience leading large, complex supply chain strategy and operational improvement projects cutting across multiple industries and geographies. He focuses on supply chain transformation, organizational redesign, inventory optimization, integrated business planning, material requirements planning, cost-to-serve analytics, strategic sourcing, and reverse logistics.