Transportation budgets for manufacturers aren't likely to have much wiggle room for at least the rest of 2011, thanks to a number of trends that are keeping logistics costs high, with rising fuel costs being just the most obvious factor. The domestic transportation industry -- primarily trucking, rail and air freight carriers -- is attempting to deal with "diminished capacity, higher regulations, rising equipment costs, a graying workforce, and an economy that is moving back on track but not quite stable," says Chris Ferrell, director of the Tompkins Supply Chain Consortium, a benchmarking organization. And none of those trends points to any near-term pricing relief for manufacturers.

Sixty-four percent of the respondents to a recent Consortium survey say they've seen their transportation costs increase between 1% and 10% over the past year, and another 10% say their costs are up between 11% and 15%, largely due to rising fuel prices and the resultant fuel surcharges. As a result, manufacturers have become much smarter about how to manage their supply chains, particularly when it comes to shipping as much of their products as they can on the least expensive modes.

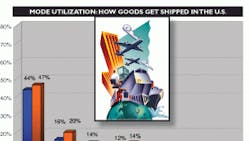

As the accompanying chart illustrates, companies are much more likely to use motor carriers or railroads to transport their goods than air-freight carriers. In fact, according to the Consortium, air carriers have seen a drop of 9% in utilization, as companies turn to less expensive modes of transportation; two years ago air accounted for 14% of all domestic transportation but now represents just 5%, based on the survey results.

Meanwhile, capacity within the trucking industry is tighter than it's been since 2005, according to the recent Freight Pulse 22 study conducted by equity research firm Morgan Stanley with IndustryWeek's sister publication, Material Handling & Logistics. In particular, companies are finding it more difficult to ship their freight via full truckload, the most economical mode for motor carriage, with fewer trucks and drivers on the road today than pre-recession.

• Rail doesn't support faster inventory turnover.

• Rail isn't competitive on price and service.

• Truckload price discounts have offset some of the rail cost differential.

• Companies are willing to pay more for truckload service.

• Changes in sourcing have reduced transportation costs.

Even so, when asked, "What have you done to reduce railroad spend?" the most prevalent answer was: "We have not made any changes and are paying the higher rail rates." The best choice manufacturers have is to optimize their supply chain networks to utilize the most efficient and economical transportation options.

About the Author

Dave Blanchard

Senior Director of Content

Focus: Supply Chain

Call: (941) 208-4370

Follow on Twitter @SupplyChainDave

During his career Dave Blanchard has led the editorial management of many of Endeavor Business Media's best-known brands, including IndustryWeek, EHS Today, Material Handling & Logistics, Logistics Today, Supply Chain Technology News, and Business Finance. He also serves as senior content director of the annual Safety Leadership Conference. With over 30 years of B2B media experience, Dave literally wrote the book on supply chain management, Supply Chain Management Best Practices (John Wiley & Sons, 2010), which has been translated into several languages and is currently in its second edition. He is a frequent speaker and moderator at major trade shows and conferences, and has won numerous awards for writing and editing. He is a voting member of the jury of the Logistics Hall of Fame, and is a graduate of Northern Illinois University.