Which Regions Are Most at Risk for Supply Chain Disruption?

Geopolitical disruptions are driving companies to reevaluate their supply chain priorities. COVID shutdowns, the wars in Ukraine and Gaza and increasing tension over Taiwan show that it is past time to evaluate reshoring and nearshoring as insurance against catastrophic disruptions.

In a recent CEO survey, geopolitical risk exposure was the highest-ranked driver of reshoring operations.

Companies grown accustomed to the convenience and efficiency of just-in-time (JIT) deliveries now have little patience for weeks or months of delay. These companies now have two choices: dramatically increase inventories and stick with offshore suppliers, or continue to benefit from JIT via the quick response of domestic suppliers.

The choice depends on the responsiveness of supply chains, the margin lost due to stocking-out, the difference in component pricing and the probability and likely duration of disruption. The challenge is to compare the dollars or pennies of marginal added cost of sourcing a component at home vs. the expected value of the thousands of dollars gained in margin and future business by being able to ship on time and retain happy customers.

Companies are, increasingly, seeing the moderately higher cost of domestic components as insurance against disruption, especially geopolitical disruption involving China and Taiwan. “I’m not saying we’ll go to 100% investment in your own country. But boy, the risk premium has significantly gone up,” Ken Moelis, chair and CEO of investment banking firm Moelis, told Bloomberg News in 2022. Paul Bingham, director of transportation consulting in the economics and country risk division of S&P Global, likens diversifying supply chains to buying insurance, “so that your business can survive if there is ever an enormous disruption in the relationship with China.”

We recommend that companies evaluate their supply chain exposure, through all tiers, to each higher-risk country/region. Many will conclude that the greatest dependence on a high-risk region is with China, Taiwan and neighboring countries. In the event of conflict, a disruption could last for years and be existential for some companies. Finding alternative suppliers would take months or years, since all U.S. buyers would be cut off at the same time.

In 2022 U.S. imports from China and Taiwan totaled $613 billion. Adjusted for price differences, those imports equal about one third of U.S. manufacturing output in aggregate. Often the U.S. has no or minimal capacity in key industries such as electronic components and assemblies, solar cells, pharmaceuticals and rare earth minerals.

Balancing the costs of insuring against disruption vs. the lower price of globalized supply chains can prove difficult. Geopolitical developments can occur suddenly with only subtle warning signs and carry ripple effects throughout whole regions. For these reasons, accurately factoring geopolitical risk into sourcing calculations is imperative if firms wish to maximize their efficiency while adequately insuring against circumstances that are difficult to foresee and avoid .

To aid in this decision-making process, the non-profit Reshoring Initiative has developed a Geopolitical Risk Report that includes profiles for eight major source countries and seven broader regions. This report provides a geopolitical risk probability and broad geopolitical risk analysis to help guide stakeholders in assessing their unique risk exposure.

Geopolitical risk (GPR) is the probability in one year of a major disruption in trade, resulting in the cessation of imports from that country to the U.S. as a result of an adverse geopolitical event.

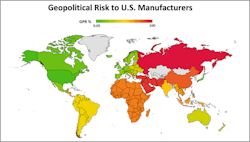

GPRs range from 0.1% for Canada, to 0.6% for Western Europe, to 3.5% for China. The report also includes an index of highly regarded and regularly updated resources to further support decision-making, as well as a color-coded map to gain more rapid insight into the global risk environment.

As the map shows, and the linked report details, there is a wide range of geopolitical risk throughout the world. High-risk areas can induce spillover effects in adjacent regions, further complicating the analysis.

For companies looking for the greatest reduction in geopolitical risk, the optimal solution is, of course, reshoring. Companies can use the Reshoring Initiative’s free online TCO Estimator to compare alternative sources. User data show that 20% or 30% of what is now imported from China can be sourced domestically, at equal or greater profitability. A forthcoming revised TCO version will include the Geopolitical Risk factor and should drive that percentage to well over 50%. The revised Estimator will use geopolitical risk to calculate the expected value of lost margin on revenue lost due to stocking out of a component or product. By including that cost in Total Cost, the user can determine whether it makes sense to “insure” their supply chain by reshoring.

Managing global supply chains is immensely challenging, made only more difficult when uncontrollable, potentially existential geopolitical events may take place. Mitigating or surviving international crises will be much more likely if the supply chain has been “insured” against risk of supply chain disruption by factoring in known risks. By utilizing the Reshoring Initiative’s free online tools, companies will be better prepared for the next crisis.

Harry Moser is the founder and president of the Reshoring Initiative. He holds engineering degrees from MIT and an MBA from University of Chicago, has 55 years manufacturing experience and is in the IndustryWeek and Association for Manufacturing Excellence (AME) halls of fame. Daniel O’Hara graduated from Pennsylvania State University in 2021 with a B.A. in International Politics. He is a Reshoring Initiative volunteer on projects related to geopolitical risk and U.S.-China issues while pursuing employment in the field of international relations and public policy.

About the Author

Harry Moser

Founder

Harry Moser, founder of the Reshoring Initiative, grew up experiencing the glory of U.S. manufacturing. With more than 45 years of manufacturing experience (most recently 25 years as president, chairman and then chairman emeritus of GF AgieCharmilles), Moser is a leading industry spokesman for reshoring and for developing the skilled manufacturing workforce required by reshoring.

The not-for-profit Reshoring Initiative ‘s Mission is to bring back U.S., and more generally North American, manufacturing jobs by helping companies see that, increasingly, they will be more profitable if they produce and source in or near their market.

Daniel O'Hara

Reshoring Initiative

Daniel O’Hara graduated from Pennsylvania State University in 2021 with a B.A. in International Politics. He is a Reshoring Initiative volunteer on projects related to geopolitical risk and U.S.-China issues while pursuing employment in the field of international relations and public policy.