Businesses are Less Worried About Their Supply Chains in Q1, but Concerns Remain

Companies expect less risk to their supply chains at the beginning of 2025 when compared to Q4 2024, but not by much. The Lehigh Business Supply Chain Risk Management Index (LRMI) collects survey data each quarter to gauge whether businesses expect supply chain risks to increase (≥ 51), remain the same (50) or decrease (≤ 49) for 10 categories in the upcoming quarter. The average across the categories dropped from 67.48 in Q4 to 66.18 for Q1.

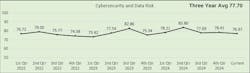

Companies say data and security breaches are the biggest threat they expect to affect their supply chains at the beginning of 2025, with one respondent noting that a cyber/data incident is not a matter of “if” but “when” for most businesses. Cybersecurity and Data Risk topped the list with an index of 76.97

“We anticipate that this area, for the foreseeable future, will be constantly increasing. We are in the midst of data and cyber warfare among nation states, corporations and other powerful entities. Securing data and building strong relationships with partners is key right now,” writes another respondent.

Despite this risk claiming the top spot for early 2025, supply chain professionals are less worried than they were in early 2024, following a number of high-profile cyberattacks at companies like Clorox and Boeing.

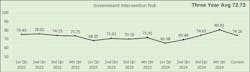

With a reading of 74.16, changing government policies is also a primary concern surrounding supply chains. However, much like cybersecurity risks, the Q1 index for Government Intervention Risk is lower than what was reported in the second half of 2024.

Interestingly, survey comments cite the incoming administration and its tariff proposals as a reason for optimism and pessimism.

“Risk will decrease due to expected deregulation under the new administration,” writes one respondent, while another writes, “We expect an increase in risk as the impact of promised tariff policy changes could be significant. Potential deportation and immigration policy changes could further impact the overall labor shortage.”

Speaking of tariffs, they seem to have caused an uptick in Supplier Risk concerns, which jumped two spots from the previous quarter and moved from 67.05 to 74.16 in Q1 2025. One respondent says tariffs with stretch supplier capabilities as companies adjust to new conditions.

Supplier diversification and good relationships with suppliers are mentioned as important mitigating factors to a volatile environment, and respondents who tout these advantages say they expect no change in risk.

Still, businesses are skeptical that consumers will be open to accepting substitutes for products or components no longer available.

“Some raw materials are sourced outside the U.S. and may be subject to unknown tariff decisions. I don't feel there will be checks and balances to rein in hasty decisions,” writes one respondent.

The impact of the presidential election cannot be overstated, which is clearly demonstrated by number four risk this quarter, Economic Risk. Before November, fear for the national and global economies was the highest it has been since early 2023, but the Q4 2024 index of 77.91 dropped sharply to 67.98 for this quarter.

Another reason for the dramatic decline could be attributed to significant interest rate cuts from late last year, which were largely celebrated by manufacturers at the time.

However, we’re not out of the woods yet, as many unknowns still signal potential areas of concern. Respondents largely echo the circumstances listed in the previous risks, mentioning labor shortages, promised tariffs and mass deportation as possible reasons for worry.

The following are the 10 risk types in order from highest to lowest risk index score for Q1 2025:

- Cybersecurity and Data Risk: 76.97

- Government Intervention Risk: 74.16

- Supplier Risk: 74.16

- Economic Risk: 67.98

- Technological or Competitive Risk: 66.29

- Transportation Disruption Risk: 64.04

- Environmental Risk: 61.80

- Customer Risk: 61.24

- Operational Risk: 57.87

- Quality Risk: 57.30

Editor's Note: IndustryWeek has partnered with Lehigh University to promote its supply chain survey by encouraging our readers to participate in the survey. The Q4 report was the first to include responses from several IW readers.

About the Author

Anna Smith

News Editor

News Editor

LinkedIn: https://www.linkedin.com/in/anna-m-smith/

Bio: Anna Smith joined IndustryWeek in 2021. She handles IW’s daily newsletters and breaking news of interest to the manufacturing industry. Anna was previously an editorial assistant at New Equipment Digest, Material Handling & Logistics and other publications.